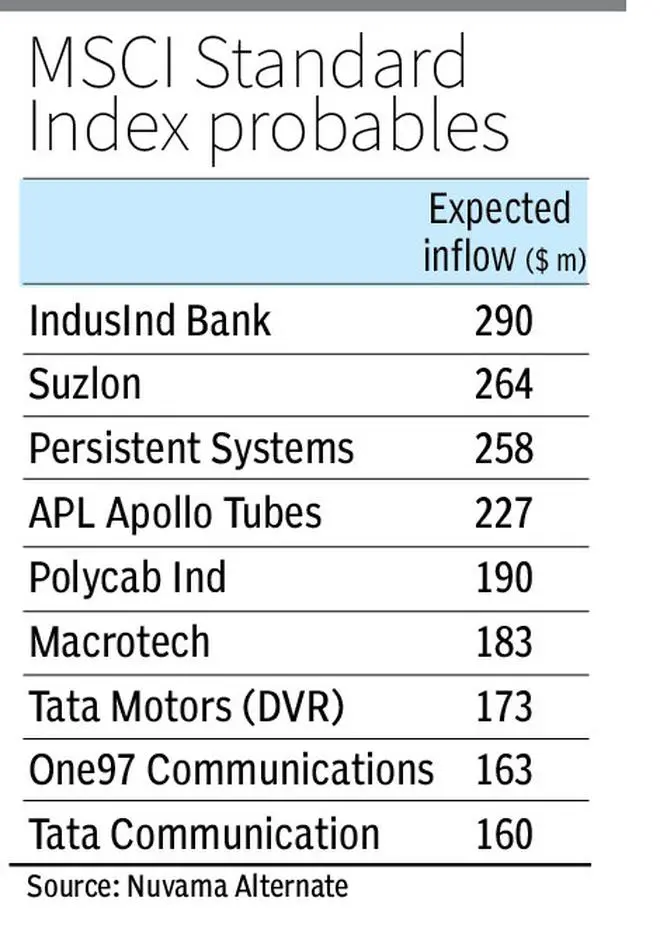

Nuvama Alternative and Quantitative Reserach expects IndusInd Bank, Suzlon Energy, Persistent Systems, APL Apollo, Polycab Industries, Macrotech Developers, Tata Motors DVR, PayTV (One 97 Communications) and Tata Communications to be included in the MSCI Global Standard Index, that will be announced by the global index major on November 15.

According to Nuvama Alternate, this will ensure an inflow of $1.9 billion into these equities. According to it, IndusInd Bank is likely to see $290 million inflow and Suzlon $264 million.

Similarly, JM Financial’s high probable candidates are IndusInd Bank, Persistent Systems, APL Apollo Tubes, Suzlon, Polycab India, Paytm and Tata Communications. While there is marginal probability of Macrotech entering the MSCI Standard Index, AU Small Finance Bank has a low probability of exiting from the index, it added.

Nuvama Alternate has identified 24 stocks as high probable stocks to enter MSCI SmallCap index — Gokaldas Exports, SJVN, HCC, PTC India, Gateway Distriparks, Arvind, Electrosteel Castings, DB Realty, Orient Cement, Gabriel India, Astra Microwave, Lloyds Engineering, Jai Balaji Industries, AGI Greenpac, Tilaknagar Industries, Redtape, PG Electroplast, IFCI, Man Infraconstruction, Force Motors, Texmaco Rail, Pricol, Wonderla and PDS.

Suzlon Energy, Persistent Systems, APL Apollo, Jindal Stainless, Dalmia Bharat, Vodafone Idea, BHEL, Linde India, Thermax, ACC, Indian Bank and Escorts Kubota are high probable candidates to be excluded from MSCI Small-cap Index, it added.

Similarly, Polycab and Macrotech Developers are likely to enter AMFI’s large-cap category in January 2024 re-jig. Suzlon, Mazagon Dock, Kalyan Jewellers and KEI Industries are likely to migrate to mid-cap from small-cap, Nuvama said in a recent report.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.