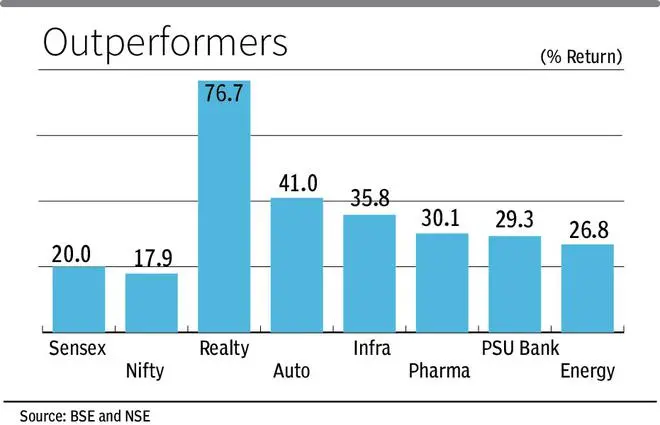

Notwithstanding the new heights scaled by key indices Nifty and Sensex, most key sectoral indices have beaten them on the back of robust economic activity across sectors.

The realty index has registered the highest growth of 77 per cent last year against the negative return of 10 per cent in 2022 while auto index was up 41 per cent (15 per cent).

However, the bellwether Nifty and Sensex have delivered 18 per cent and 20 per cent last year despite record-breaking rally. The performance of these indices paled in front of others largely due to their high base affect.

Infrastructure and pharma indices have delivered a return of 36 per cent and 30 per cent last year compared with 6 per cent and negative 11 per cent in 2022.

Leading sectors

Alok Agarwal, Head-Quant and Portfolio Manager, Alchemy Capital Management said bulk of the gains in the broader markets were led by sectors that have very little representation in the Nifty or Sensex.

For instance, the real estate sector, which registered the highest gain last year has no representation in Nifty. Similarly, defence and railway stocks have turned multibaggers in the last one year, with no presence in Nifty, he said.

Led by the government’s capex, the industrials were doing very well, but have only 6 per cent presence on Nifty, said Agarwal.

Kaushik Dani Fund Manager (PMS), Abans Investment Managers, said, sectoral investments are usually for investors with higher-risk appetite while others should have a balanced approach to this space.

The key index returns may look softer compared with previous year on account of high base. However, there are ample opportunities at stock and sector level including in pharma, metals and IT.

Vaibhav Shah, Fund Manager at Torus Oro PMS, said, sectoral indices outperformed mainline indices on the back of macro tailwinds which benefited most domestic economy-focused sectors.

2024 Outlook

In 2024, he added financial services sector is expected to perform relatively better on account of uptick in credit cycle, capex boost, better fundamentals and increase in penetration.

Manish Chowdhury, Head of Research, StoxBox, said, the real-estate sector should continue to do well on the back of sectoral tailwinds such as strong demand across various housing categories, good execution from builders, easy availability of credit, rise of nuclear families and influx of people to urban work centres.

The pricing pressure on pharmaceutical sector has eased and should see improved financial performance in coming days, he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.