The market share of retail investors in India’s stock market has reduced in the past few months and so have their direct flows into the secondary markets since May.

As per data from the National Stock Exchange, retail participation in the cash market segment contracted in May by 440 basis points on a month-on-month basis in May and the same contracted by 770 basis points on year on year. The share of individual investors on the NSE for financial year 2023 came in at 37 per cent, which is the lowest since FY2018. In FY2022, the same was 40.7 per cent, NSE data show. Experts say it indicates decline in market interest by retail investors and is likely to continue for the next few months.

In May, direct investment by retail clients on the NSE platform halved to net ₹10,000 crore compared to ₹21,900 crore in April. Notably, the inflows came off in May and June, NSE said. Direct investments by retail investors in equities were stronger in the previous fiscal with net inflows in FY 2021-22 amounting to ₹1,64,900 crore, nearly 2.5 times the net inflows during FY2020-21.

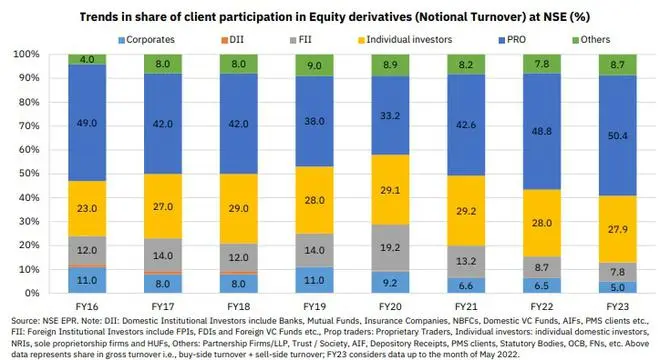

One of the reasons for a fall in market share of retail investors on NSE can be attributed to heightened selling by foreign portfolio investors, which caused their overall turnover and share to rise. Another key reason for less participation of retail investors could be the stricter margin norms announced by the Securities and Exchange Board of India recently that come into effect from May, experts say.

Derivative trading falls

Since India’s benchmark stock indices came off by around 15 per cent from the lifetime high levels, derivatives trading on NSE too fell. Average daily turnover (ADT) in equity derivatives declined by 4.1 per cent MoM in May as trading in single stock derivatives and BANKNIFTY futures moderated. The overall ADT touched ₹1,64,600 crore versus ₹1,71,700 crore in April. The ADT of stock derivatives declined by 9.3 percent year on year in May, even as trading in index derivatives expanded by 5.7 per cent 78.4 per cent year on year.

Equity turnover on NSE declined by 6.3 per cent month-on-month and 22.7 percent on a year-on-year basis in May followed by 6.7 per cent MoM and -2.9 per cent YoY decline in April, despite having more number trading days. NSE’s turnover in the cash segment fell to ₹12.1 lakh crore in May versus ₹12.9 lakh crore in April.

The average daily turnover also registered a decline of 15.2 per cent MoM and -26.4 per cent YoY in May touching ₹57,600 crore as compared to ₹68,000 crorein April. The decrease in ADT can be attributed to decrease in trading activity by retail investors as valuations moderated in May, NSE said. Still, turnover in equity derivatives saw a growth of 5.9 per cent MoM and 26.4 per cent YoY to touch ₹35 lakh crore trillion in May as compared to ₹32.6 lakh crore trillion in the previous month. While growth in turnover of equity futures was marginal on a MoM basis 1.4 per cent in turnover of equity options was significant at 21.2 per cent.

The NSE says that while overall registration for FY-22 touched more than 19 million new investors – nearly 81 per cent higher than previous fiscal - the investor registrations have been falling since its peak in November 2021. Experts say, this could be due to the temporary slowdown in the markets on the back of high inflation in the past few months and also a virtual halt to the primary market offerings. In FY-21, growing registrations witnessed an addition of nearly 10.5 million new investors on NSE. With more than Rs 2 lakh crore worth of investments into stock markets in the past couple of years, retail investors had emerged as a counter force to the selling spree of the foreign portfolio investors.

In the past two years out of seven, retail investors were net buyers of stocks. During this period, they have invested nearly ₹2.3 lakh crore directly through secondary markets, of which ₹1.6 lakh crore was invested during the last financial year. Consequently, retail investors’ holdings in NSE-listed companies as on March 31, 2022 rose to a 15-year high of 9.7 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.