Tata Sons may fetch a market valuation of of ₹7-8-lakh crore in an initial public offering, according to Mumbai-based investment banking firm Spark PWM Pvt Ltd. If it commands a market-cap of ₹8-lakh crore, then it would be among the top four listed companies.

The investment advisory firm expects the IPO to happen in the next 18 months, as Tata Sons was classified as an “upper-layer” non-banking financial company by the central bank in September 2022. Any upper-layer non-banking financial company must list its shares within three years. This requirement indicates that Tata Sons is expected to enter the capital market by September 2025.

“We believe that this event could likely lead to the simplification of the complicated group holding structure of the Tata Group and enable some of the listed holding companies to liquidate its holding within the giant parent conglomerate,” Spark added.

There are multiple levers of value available from the unlisted investments as the group is entering into new age segments such as semiconductors (by Tata Electronics). Thus, we believe that the group could derive another ~Rs 1-1.5 lakh crores of value from unlisted investments and step-down subsidiaries (such as Tata Technologies, Tata Metalliks and Rallis), it added.

The market value of Tata Sons’ listed investments is estimated at around ₹16-lakh crore and the book value of the unlisted investments is around ₹0.6-lakh crore, Vidit Shah, Research Analyst, said in the report. “We believe that about 80 per cent of Tata Sons’ holdings might not be monetisable but the process of restructuring could trigger a re-rating,” Shah said.

Tata Chem to benefit

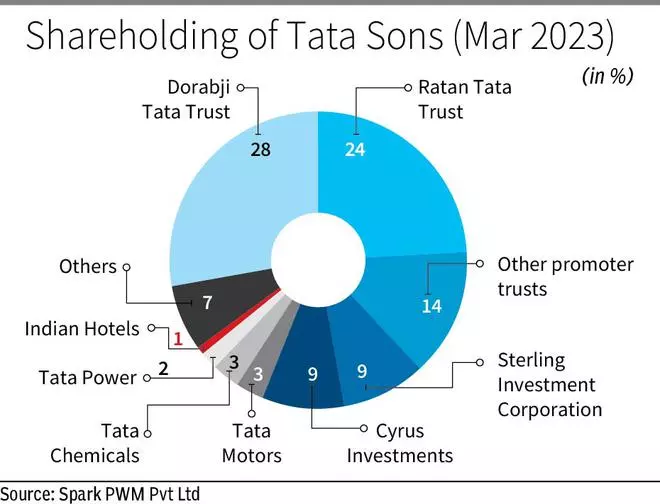

Four (Tata Motors, Tata Chemicals, Tata Power and Indian Hotels) companies within the Tata Group hold ownership in Tata Sons. However, the only realistic way to get exposure to the potential value unlocking (of Tata Sons stake) is via Tata Chemicals wherein the ownership of Tata Sons potentially amounts to about 80 per cent of the company’s market capitalisation. The stake is worth about 16-21 per cent of the market capitalisation for the other three companies.

“We calculate the intrinsic valuation of Tata Chemicals to be about 11x FY25 PE (calculated using Bloomberg earnings estimates). Given the cyclical nature of the commodity Soda Ash and the potential headwinds faced by the industry due to falling realisations, the valuations have been supressed. We also note that should the street assign a ₹10-11-lakh crore valuations to Tata Sons, the intrinsic valuation of the listed Tata Chemicals business is 5-7x FY25 PE, which could potentially re-rate should the investment be liquidated at/or post IPO.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.