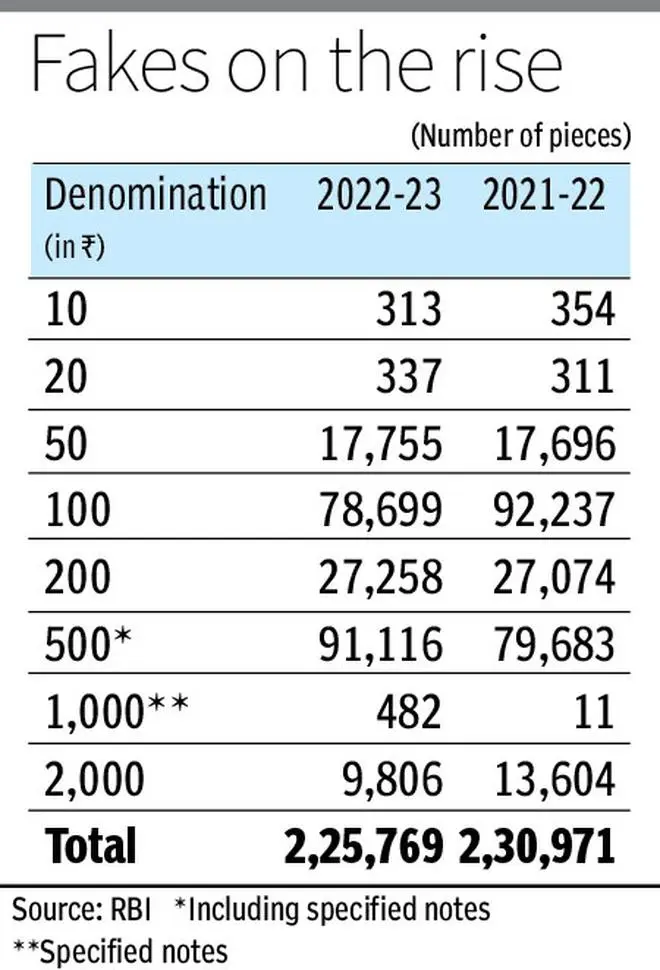

Counterfeit currency notes of ₹500 denomination detected in the banking system rose by 14.4 per cent in FY23, while those of ₹20 denomination saw an increase of 8.4 per cent the Reserve Bank of India said in its annual report for 2022-23.

Of the total fake currency notes detected, 4.6 per cent were detected at the RBI and 95.4 per cent at other banks.

Counterfeit notes of ₹10 denomination declined by 11.6 per cent, ₹100 declined by 14.7 per cent and ₹2,000 by 27.9 per cent.

In terms of value, the share of ₹500 and ₹2,000 banknotes rose to 87.9 per cent of the total value of notes in circulation as of March 31, from 87.1 per cent a year ago. In terms of volume, ₹500 banknotes had the highest share at 37.9 per cent, followed by ₹10 denomination notes at 19.2 per cent.

The disposal of soiled banknotes increased by 22.1 per cent to 2,293 crore pieces during the year compared with 1,878 crore pieces in FY22. Total expenditure incurred on printing of securities was ₹4,683 crore against ₹4,985 crore in the previous year.

- Also read:Who moved my ₹2000 note?

System frauds

RBI said that while private banks reported the maximum number of frauds in FY23, public sector banks contributed more to the fraud amount.

In terms of the number, digital payments frauds—including cards and internet—were the highest whereas in terms of value, frauds were the highest in loan portfolios.

“Small value card/internet frauds contributed maximum to the number of frauds reported by the private sector banks, the frauds in public sector banks were mainly in loan portfolio,” the report said.

Fraud reporting has increased in recent years due to education by RBI, banks, and payment system operators on fraud reporting and alert mechanisms, industry players said.

- Also read: GST: How to find a fake GST invoice?

As a whole, total frauds reported in FY23 fell 49 per cent on year, prior to which frauds had declined by 55 per cent in FY22.

RBI said there continues to be a significant lag between the date of occurrence of a fraud and its detection. As a result, frauds that occurred in previous financial years formed 95 per cent of the total value of frauds in FY23 and 94 per cent in FY22.

“Maximum number of frauds have been in digital transactions through various payment methods and channels. Preference of internet for major transaction volumes continues to grow but some online payments do not meet security standards, which poses potential risks to customers,” said Rahul Jain, CFO at NTT DATA Payment Services India.

Moreover, digital payment methods are more susceptible to being targeted by fraudsters through phishing and vishing methods, while unmanned ATMs are more prone to skimming and other malicious activities, he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.