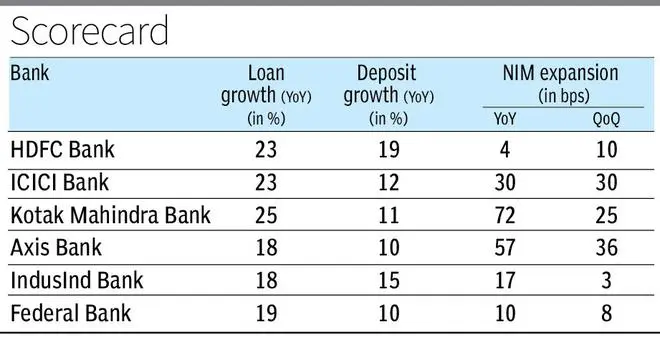

Most private banks saw an expansion in their Net Interest Margins (NIM) in Q2 FY23, led by the widening gap between lending and deposit rates and strong loan growth, which outpaced deposit growth across the sector.

Led by the series of consecutive rate hikes by the Reserve Bank of India (RBI) to combat elevated inflationary pressures, lending rates have been on the rise, also owing to the fact that 60-70 per cent of banks’ incremental consumer loans are floating or linked to external benchmarks.

Including the 50 bps rate hike in September, the MPC has raised the repo rate by 190 bps since May to 5.9 per cent. While much of this has been passed through in lending rates, the transmission on deposit rates has been slower.

NIM expansion

The widening gap has been beneficial for private banks, with most major lenders reporting an improvement in margins in Q2, also supported by robust growth in Net Interest Income (NII) on the back of loan growth.

“NIM boost for Axis Bank was driven by better loan yields that was a function of higher repo-linked pool, increased retail share, focus on rupee loans and shedding of RIDF (Rural Infrastructure Development Fund) bonds,” said Prabhudas Lilladher, in a note.

For Kotak Bank, expansion in the loan to deposit ratio to 90 per cent from 86 per cent in Q1 FY23, and a lower net delinquency rate, also added to the margins, said Systematix. It added that 78 per cent of the bank’s loans are likely to repriced within 12 months, which should further help margin expansion in H2 FY23 and FY24.

HDFC Bank, however, was the outlier with margins steady and around the bank’s long-term average. Analysts said that margin expansion for the bank will be dependent on asset repricing as well as the change in product mix towards retail loans.

In addition to the floating nature of most loans, transmission in loan rates has also been higher due to high demand for credit, especially consumer credit, despite higher rates.

On the other hand, lenders have been raising deposit rates with a lag, or only in their fixed deposits, as most are sitting on surplus liquidity which has so far been sufficient to fund credit demand.

In their Q2 FY23 earnings calls, however, most private banks said that they will start making greater efforts, including hiking deposit rates, for deposit mobilisation and accretion.

“ICICI Bank reiterated its strategy to grow its franchise in a granular manner, sustainably with a risk-calibrated approach,”Sharekhan Securities said, adding that there will be further impact of the rate hikes on loan yields whereas repricing of deposits will also be seen in the coming quarters.

Going forward, factors such as better digital capabilities, healthy loan growth outlook, stable asset quality with higher-rated corporate book and continued focus to increase retail mix with higher-yielding businesses such as commercial vehicles, credit cards, and microcredit are expected to augur well for private banks, said analysts.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.