The Reserve Bank of India’s central board of directors, on Wednesday, declared a bonanza to the Central Government, approving a massive, all-time high surplus transfer of ₹2,10,874 crore for FY24.

This bumper surplus transfer could help the government either borrow less in FY25 or step up capital expenditure. If the government borrows less, government security (G-Sec) yields could soften, thereby lowering its borrowing cost.

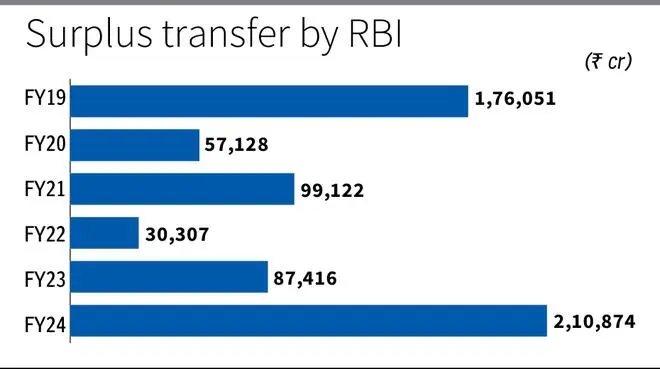

The previous highest surplus transfer was ₹1,76,051 crore in 2018-19. The surplus transfer in FY24 is 2.41 times the previous year’s ₹87,416 crore. It is also much higher than both the budgeted and street estimates of ₹1-lakh crore surplus.

Following this announcement, the yield of the new 10-year benchmark G-Sec (coupon rate: 7.10 per cent) closed below 7 per cent on Wednesday at 6.9919 per cent, softening about 4 basis points (bps) compared with the previous close of 7.0351 per cent. The price of this security rose by about 30 paise to close at ₹100.75 (previous close: ₹100.445).

‘Positive impact’

Bank of Baroda (BoB) economists Dipanwita Mazumdar and Aditi Gupta attributed the higher-than-anticipated surplus to higher interest income, led by an increase in both global and domestic yields. There were also revaluation gains on forex reserves.

“The higher surplus will have a positive impact on government finances. This is positive in terms of maintaining the targeted fiscal deficit. Thus, the additional ₹1-lakh crore gives the government the headroom to either cut back on its gross borrowing from the market, putting less pressure on domestic yields, or increase its thrust towards capex,” they said.

With bond-index-related FPI inflows also expected to surge in Q2FY25, the benchmark 10-year yield could thaw to as low as 6.75 per cent, assuming the RBI invokes rate cuts in the second half, per the BoB economists’ assessment.

In a statement, the RBI said that during accounting years 2018-19 to 2021-22, owing to the prevailing macroeconomic conditions and the onslaught of the Covid-19 pandemic, the Board had decided to maintain the risk provisioning under the Contingent Risk Buffer (CRB) at 5.50 per cent of the Reserve Bank’s Balance Sheet size to support growth and overall economic activity.

With the revival in economic growth in FY23, the CRB was increased to 6 per cent. As the economy remains robust and resilient, the Board has decided to increase the CRB to 6.50 per cent for FY24.

The Board thereafter approved the transfer of ₹2,10,874 crore as surplus to the Central Government for the accounting year 2023-24.

Surplus Evaluation

Record surplus transfer from the Reserve Bank of India is estimated to have an impact of up to 30 basis points of GDP on government finances, Finance Secretary TV Somanathan said.

Meanwhile, another official said that the impact on government finances cannot be directly translated into fiscal deficit numbers.

“Transfer of ₹2.10-lakh crore likely to have an impact ranging between 0.2 to 0.3 per cent of GDP on government finances,” Somanathan said..

“This (surplus transfer) is an unexpected bonanza for the government. It will have a positive impact on the government’s finances and liquidity. But we need to see how the new government at the centre uses this windfall,” said V Rama Chandra Reddy, Head of Treasury, Karur Vysya Bank.

Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India, said, “The development is an ode to the RBI managing volatility deftly while leveraging the turbulence in global markets to its advantage. “The provisional RBI balance sheet components show that the RBI domestic assets increased marginally while the foreign assets grew sharply. With higher domestic and foreign interest rates and possible contracting payable under LAF, the RBI surplus swelled in FY24. The increase in the price of gold also added to the overall expansion of the RBI balance sheet.”

With inputs from Shishir Sinha in New Delhi

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.