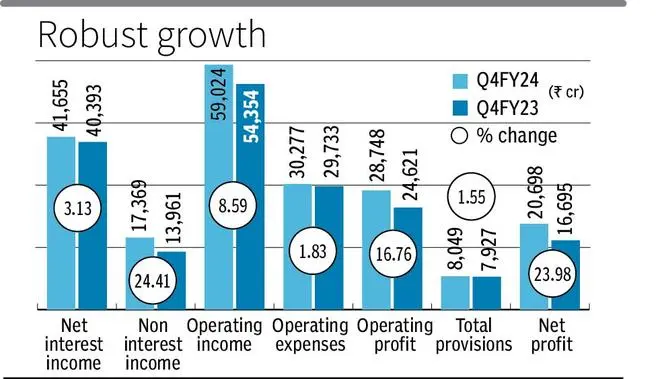

State Bank of India (SBI) reported its highest standalone quarterly net profit at ₹20,698 crore in the fourth quarter due to robust growth in non-interest income, including treasury income, tight rein on operating expenses and write-back in standard asset provisions and other provisions.

India’s largest bank had reported a net profit of ₹16,695 crore in the year-ago quarter. Net profit in the reporting quarter is up about 24 per cent year-on-year (y-o-y) and about 126 per cent sequentially.

The bank’s central board, at its meeting on Thursday, declared a dividend of ₹13.70 per equity share of ₹1 each fully paid up for FY24.

Net interest income/NII (difference between interest earned and interest expended) was up 3.13 per cent y-o-y at ₹41,655 crore (₹40,393 crore).

Total non-interest income, comprising fee income (loan processing charges, miscellaneous fee income, etc), forex income, profit or loss on sale/revaluation of investments, etc, rose about 24 per cent at ₹17,369 crore (₹13,961 crore).

Operating income (NII plus non-interest income) growth of 8.59 per cent y-o-y (₹59,024 crore), outpaced operating expenses (employee cost and other operating expense) growth of 1.83 per cent y-o-y (₹30,277 crore), resulting in the operating profit going up 17 per cent to ₹28,747 crore.

Loan growth and NPAs

SBI Chairman Dinesh Kumar Khara expects FY24’s loan growth to be sustained in FY25 and net interest margin maintained at the current level. In FY25, the lender expects 14-16 per cent growth in loans (15.24 per cent in FY24) and 12-13 per cent in deposits (11.13 per cent).

He observed that the bank has a sanctions pipeline of ₹4-lakh crore, with private sector entities accounting for 75 per cent of these sanctions and public sector accounting for the rest. Surplus holding of statutory liquidity ratio securities stood at ₹3.5-lakh crore.

While the current capital adequacy ratio (14.28 per cent as at March-end 2024) is adequate to support up to ₹7-lakh crore of balance sheet growth, the bank is open to raise equity capital, Khara said.

Net interest margin (whole bank) declined to 3.28 per cent in the reporting quarter from 3.37 per cent a year ago.

Provisions for employees declined about 28 per cent y-o-y in the reporting quarter to ₹5,225 crore.

While loan loss provisions shot up 156 per cent to ₹3,294 crore, the bank received write-back from standard assets provisions (₹370 crore) as well as from other provisions (₹1,306 crore).

Asset quality improved, with gross non-performing assets (NPAs) declining to 2.24 per cent of gross advances as at March-end 2024 against 2.42 per cent as at December-end 2023. NNPAs nudged lower to 0.57 per cent of net advances from 0.64 per cent.

As on March-end 2024, gross advances increased by 15.24 per cent y-o-y to ₹37,67,535 crore, with robust growth across all segments. RAM (retail, agriculture and MSME) and corporate advances crossed ₹20-lakh crore and ₹11-lakh crore, respectively.

Total deposits rose 11.13 per cent to ₹49,16,077 crore. Low cost current account, savings account (CASA) deposits declined to 41.11 per cent of domestic deposits against 43.80 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.