So far this year, US benchmark indices are down 12-24 per cent, but India’s Nifty 50 is up one per cent. Can this outperformance sustain? History shows that it may not.

The US is facing unprecedented inflationary pressures taking a toll on the cost of living. Europe is besieged by inflation on one front and an energy crisis on the other, further fuelling the risk of an inflationary spiral. As if this wasn’t enough, both the US and European central banks are on a rate hiking spree in an attempt to drain excess liquidity from the system, but increasing the cost of capital, which reduces the attractiveness of equity as an asset class.

Not to mention the fact that one of the powerful engines of global growth in the last two decades, China, is now mired in problems of its own with the economy slowing due to multiple factors (property bubble, zero-Covid policy, regulatory crackdown on technology companies, etc).

India’s macro fundamentals are undeniably in better shape than most global markets. This has given rise to views in recent times that the Indian economy/markets can be decoupled from rest of the world.

However, a chain is only as strong as its weakest link. If you have any doubts, just turn to 2007-08 when an entirely US domestic housing bust rattled global economies and markets including India’s. Not to forget the European sovereign debt crisis of 2010-12, which too gave traders, investors and policy-makers in India many a sleepless night.

Highly correlated

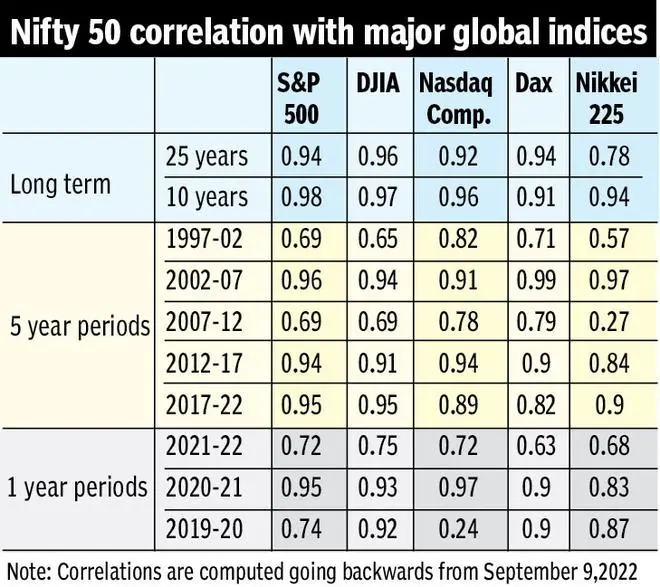

Analysed on the basis of change in index values (not adjusted for currency movements), data show that global markets are highly correlated. The Nifty 50’s correlation with the Dow Jones Industrial Average is as high as 0.96 over the last 25 years, and 0.97 over the last 10 years. Similarly, Nifty 50’s correlation with S&P 500 and Nasdaq Composite is at 0.94/0.92 over a 25-year period, and 0.98/0.96 over 10 years. Thus, irrespective of time periods and structural changes in economies/markets over the years, the correlation remains strong.

Further, this correlation is also strong across other global markets as well. For example, the correlation of Nifty 50 with Germany’s Dax index is 0.91 in the last 10 years, although the two markets do not necessarily move in tandem. The correlation of the S&P 500 with Dax in the last 10 years is also at 0.94. This underscores the importance of positive global fundamentals and sentiment for good returns to sustain in the long-term, even when domestic fundamentals are good. Sustained decline in a few major markets will most likely pressure domestic markets sooner or later.

Looking at the data granularly, correlations have reduced a bit off and on in the last 25 years. For example, the lowest correlation of Nifty 50 with S&P 500 was 0.69 in the 1997-2002 and 2007-12 time periods. But this is still high and both periods included a couple of years of overlapping bull and bear markets in India and the US.

On a yearly basis, there were a few rare instances when the correlation turned marginally negative as it did between Nifty 50 and S&P 500/Nasdaq in 2010-11 (-0.17). Even then, there were overlapping periods of turmoil in global markets due to the Europe sovereign debt crisis as well as inflation breaking out of the comfort zone in India.

Cautious outlook

If history were to repeat itself, as it often does in markets, investors will be better off if they choose caution over the decoupling theory. India did outperform global indices in1999 and 2007, but bears caught up in the post 2000 and 2008 crises. So, the current outperformance should be taken with a pinch of salt.

Another factor that investors need to guard against is that, even with underlying fundamentals remaining good in India, global investors at some point in time may be forced to book profits in India to make up for losses elsewhere.

As it is said, ‘if you can’t sell what you want, you sell what you can’.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.