“Home is where the heart is” goes the song. But sentiment aside, are there smart ways to buy property at a reasonable price? What about, for example, foreclosed properties via bank auctions?

As one might recall, Punjab National Bank recently announced a mega auction of properties where borrowers had failed to pay their dues. This is not a unique exercise, of course. Many banks periodically conduct e-auctions of residential and commercial properties when there are loan defaults. Specifically on residential properties such as apartments, independent villas and bungalows, for instance, banks use the SARFAESI Act 2002 when borrowers default beyond 90 days. First a notice is served, and if repayments don’t follow, banks eventually proceed with auctioning the properties.

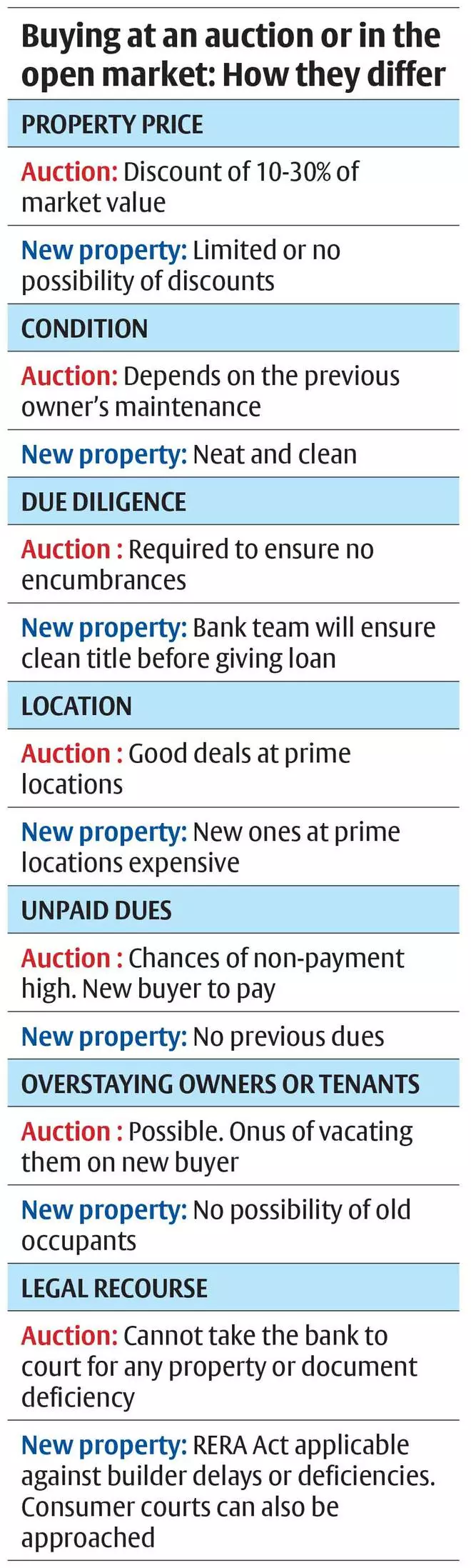

Many home buyers are drawn to such auctioned properties as they become available at attractive prices — often at 10-30 per cent discount to the prevailing market rates.

But is a steep discount alone good enough to make that all-important buying decision?

If you are a buyer, where must you look for all the information? What are the steps involved in participating in the auction? What are the factors — financial, legal and procedural — that you must deal with before venturing into buying a bank-auctioned property? What are the risks?

Here’s all you need to know about buying foreclosed properties.

Info about auction

Banks typically advertise auction of properties through newspapers, their own websites, and through third-party aggregators as well

A key portal where a lot of information is available on properties up for auction is the IBAPI (Indian Banks Auctions Mortgaged Properties Information). It is a collective initiative of the Indian Banks Association. There are 11 participating public sector banks and as many as 11,698 properties that are up for auction are part of the portal.

The IBAPI portal has details of properties in a fairly user-friendly manner. It is quite easily manoeuvrable. You can search for properties across categories — residential, commercial, agricultural and industrial. Search options allow you to navigate State-wise, city-wise and even pin code-wise. Filters are also available by nature and size — bungalows, villas, apartments (one, two, three BHK and so on) and farmhouses. Registration is free of cost.

You can zero in on a property of your choice by using the search options available. The details of the auction date, reserve price set by the specific bank and the EMD (earnest money deposit) are also available.

Apart from IBAPI, there are many private third-party aggregators as well. Foreclosureindia.com, eauctionindia.com, findauction.in and bankeauctions.com, for instance, give details of foreclosed property auctions in easily navigable and user-friendly ways.

Most of these sites as well as IBAPI provide a photograph of the property and also basic details pertaining to the defaulting owner, whether the residence is in leasehold or in freehold without any encumbrances.

Registering and bidding

The flow chart below explains the process to register in the IBAPI. You need to start the procedure 2-3 months before the auction date so that you get a chance to visit the site physically, if allowed by the bank. Plus, you may need time to get loan approvals for the property you wish to bid for. If possible, taking sanction of a pre-approved loan before making the bid may be useful.

The registration is simple. You need to give details of your mobile number, email, PAN and Aadhaar, among other information. You will be asked to upload the documents and once approved by IBAPI, your registration would be complete.

After you select a property, you can bid for the same via the MSTCecommerce site. You can pay the EMD for the property, which is usually 10 per cent of the bid amount, via NEFT alone presently.

On the auction day, you can place your bid starting at the reserve price. If you are the highest bidder or if there are no other bidders, you will be notified via an email about the winning bid. You can also check the final details of the highest bidder.

There is an option to pay the final amount, too, via the portal.

In case there is a sudden court order or a legal development due to any interested party having reservations about the auction, and you wish to withdraw from the bidding process, you may be able to do so.

Readying the finances and taxes involved

Every property up for auction has a reserve price attached to it by the bank, based on its valuation metrics.

Because the property would eventually be second-hand and also the fact that banks generally look to recover as much of the dues as possible, such apartments or houses are made available at a discount. This could range from 10 to 30 per cent below the market value.

As a prospective buyer, you need to cough up 10 per cent of the reserve price as earnest money before participating in the auction, as pointed out earlier

If you make the winning bid, the remaining amount has to be paid within strict timelines. Banks generally look for the entire payment to be made within a month of the completion of the auction.

In case you are looking to buy the property via a loan, you must ensure that you have a pre-approved loan, so that disbursals can be done at short notice. More so if the auctioning bank and your own bank are different entities.

If you win the auction, but are unable to make the balance payment, you may have to forfeit the EMD paid at the start. That can prove very costly.

The other key aspect to note is the deduction of tax at source. In case the property you wish to purchase is valued at more than ₹50 lakh, you need to pay 1 per cent of the property price as TDS.

This must be done at each stage of payment, so that 1 per cent is deducted on the entire transaction amount.

Key legal and operation factors

Title deed and documents

When properties are purchased from a bank via an auction, you would expect the title deeds of the property to be perfect and without any defect or encumbrances. In the best-case scenario, a clean title deed would be transferred to your name from the bank, with no encumbrances.

While this may be so generally, there can be instances where things may not go smoothly.

For example, there could be encumbrances associated with the property. There could be other legal claimants to the property, who may challenge the auction process or stop the transfer of title to you.

Then there are cases where other lenders could have given loans to the defaulter and may lay claim to the auction proceeds.

Apart from these, there could be situations where banks may have lent to borrowers despite the title being unclear or defective. Or there may be illegality where a builder may have constructed with deviations or put up more than the sanctioned number of floors or limits after a bank lent the money.

Therefore, you must make your own enquiries, take the help of a property lawyer to ensure that the documents are clean and that there are no legal hurdles later on.

You cannot take the bank to court over any such issue that crops up.

Vacating tenants or existing owners

Banks often take ‘symbolic possession’ of a property once there is a default from the loan borrower. This means the bank has legal rights over the property, but has not taken physical possession, so the present owner may be living in the apartment or house even as the auction process is on. The other possibility is that there may be tenants living in the property of the loan defaulter.

In both cases, the onus of getting the occupants vacated falls on you, the auction winner. That can be quite problematic.

Unpaid municipal taxes, bills and society dues

The bank auctions the property on an ‘as is where is’ basis and absolves itself of any future costs related to the property.

Given that the previous owner has defaulted on the loan, there is a strong possibility that there may be several statutory dues as well.

So, there may be unpaid property and water taxes and electricity bills too. Additionally, if it is an apartment, maintenance and other society dues must be factored in.

Such dues have to be settled by you – the new buyer of the property.

Physical condition of the property

As defaults on loans happen due to insufficient cashflows or job losses, it is quite possible that the previous owner may not have had enough money to maintain the property well.

There may be considerable repair and maintenance works required to make the apartment or the independent house liveable again.

This would necessitate additional expense and legwork on your part. If these costs are added up to the reserve price and the overall value still makes sense, you can go ahead and purchase the property via an auction.

Who should buy repossessed properties?

The most important factor to note is that you should ideally not be buying your first house via an auction process. More so if it is for self-occupation.

If there are legal hurdles, you don’t want to shell out all the money only to find that the title is faulty or that there any other court-related issues.

Buying a property via the auction may be a good idea if you purchase it for renting it out again. That way, you would be able to get regular cashflows.

If the house is in a posh locality or in a much sought-after area, it may make good investment sense. You can sell the property bought at a discount at a much better price once market conditions improve.

In the case of fairly wealthy homebuyers, villas or farmhouses may make sense as the discount would make the purchase attractive. They can complete the required maintenance and repair works and use it for themselves or lease them out.

The ability to raise finances quickly is another key requirement.

Finally, any buyer via an auction must be prepared for considerable legal and physical groundwork. Therefore, you must be willing to engage a lawyer for all the paperwork, get all the relevant documents from the bank and various other government agencies for verification, make enquiries about any claims of relatives or lenders and so on. Paying past statutory dues and engaging with workers to repair the property are other tasks.

If you are confident about handling these issues and can spare considerable time, you can go ahead and buy property via an auction.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.