Silver’s total demand hit through the roof in 2021 as global economic activity improved post the Covid pangs. Silver ETFs (Exchange Traded Funds) were launched in India in early 2022 to provide retail investors an opportunity to take exposure to this precious metal. What are the factors driving sliver prices and what’s in store? And what should investors take note of when it comes to putting money on this white metal? Here’s answering these questions.

Shining fundamentals

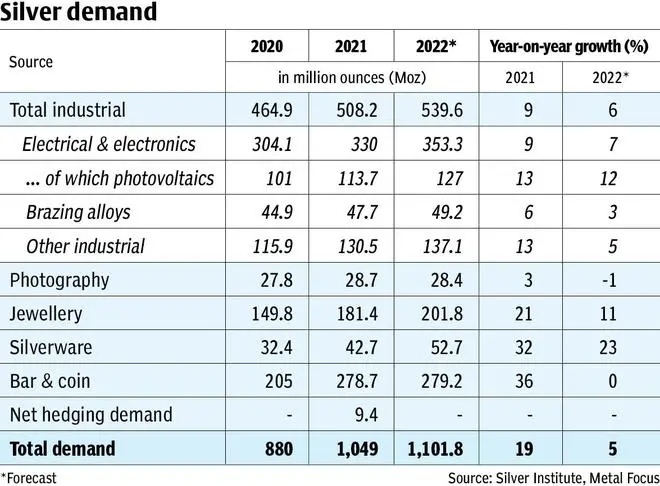

Fundamentals of silver look solid at this juncture. Total demand was up by 19 per cent year-on-year (y-o-y) to 1,049 million ounces (Moz) in 2021, according to data by the Silver Institute (compiled by Metal Focus). Demand for the metal has come from across the board with the largest contributor being electrical and electronics segment with nearly half of the total i.e., 508 Moz, up by 9 per cent for the year. Bar and coin segment saw the sharpest rise as the consumption in this form increased by 36 per cent for the year to 279 Moz. These factors have led to a supply deficit (first time since 2015) of nearly 52 Moz in 2021.

In 2022, the demand is projected to be solid where the industrial usage is expected to go up by 6 per cent to nearly 540 Moz. Apart from the global GDP growth, application in green technologies in auto and renewable energy sectors are likely to be a boost. Interestingly, electric vehicles have higher silver loadings than the internal combustion engine equivalents and there has been steady demand for photovoltaics (PVs) in recent years. PVs are nothing but solar cells used to construct solar panels. Consumption for PVs stood at nearly 114 Moz, up by 13 per cent y-oy. It was at 93 Moz in 2018.

Jewellery demand, another key driver, is anticipated to rise by 11 per cent to 202 Moz on the back of lower prices and further recovery from Covid. Although net physical demand by bars and coins are likely to stay flat in 2022.

Overall, the Silver Institute projects the demand to outpace supply in 2022 as well, potentially increasing the deficit to 72 Moz. So, the requirement for the white metal is set to stay strong this year. Even the long-term prospect remains intact as electrification of vehicles and investments in green energy can keep the demand healthy. Also, there are new and emerging uses like in nanotechnology where silver nanoparticles play an important role because of its physical and chemical properties.

Challenges threatening the sparkle

However, silver prices haven’t been reflecting the strong fundamentals. After gaining 47 per cent in 2020, silver lost 11 per cent in 2021. By closing at $22.36 last Friday, it has dropped 3.9 per cent year-to-date.

To combat the coronavirus crisis, central banks pumped in liquidity and cut interest rates drastically. The US Federal Reserve cut the policy rate to zero and announced massive amount of QE (quantitative easing). Talks of the eventual interest rate hike in the US gained traction when the US Federal Reserve turned hawkish in their June 2021 meeting, weakening silver prices. Apart from this, treasury yields began rising from August, increasing investor preference for interest-yielding bonds over non-interest-yielding assets like precious metals. These factors outweighed the positive impact of rising inflation on the precious metals. As a result, silver, which possess dual characteristics - as both a precious metal which is considered a safe haven, and as an industrial metal which does well on the back of economic growth - depreciated. It remained suppressed for the rest of 2021 along with gold.

While the Ukraine war did give silver some impetus in February 2022 due to its precious metal tag, the rally was short-lived because the war triggered fresh growth concerns which could potentially dent the industrial demand. The IMF (International Monetary Fund), in its World Economic Outlook in April, projects the global growth to be at 3.6 per cent in both 2022 and 2023, down 0.8 and 0.2 per cent from January projections, due to uncertainties unravelled by the Ukraine war.

Moreover, headlines regarding the Fed and the rate hike continued to dominate throughout. Last week, the monetary authority of the US raised policy rate by 50 basis points, following a 25-basis point hike in March. This trend is likely to go on through the year and this may not be good news as the opportunity cost of holding silver goes further up. Silver buying, as an inflation hedge, too, is not expected to pick up, as the upcycle in rates can bring down the inflation worries over time.

Thus, multiple factors can come into play in deciding the direction of price movement. Perhaps, silver’s strong fundamentals can be key in turning the tide in its favour slowly, if not immediately. Even if the demand falters and the recessionary concerns take centre stage because of the Fed tightening too aggressively, as some fear, the safe-haven demand can shoot up and, in this case, silver can be a beneficiary along with gold. Simply put, silver is now in a position where it can leverage the benefits of being dual-natured.

So in the near-term — in next four-six months, the price might probably stay in a range or come under some pressure. But beyond that it can start a fresh uptrend and could touch $35-37 range, the highest in the last decade, in the next one year or so (see Technical Analysis).

Silver Vs Gold

Silver has similarities with gold. In fact, it is called the poor man’s gold. Like gold, the white metal can be a go-to asset during distress and it also offers dollar exposure. Generally, precious metals tend to perform better against rupee compared to dollar, because the rupee is an eternally-losing currency against the greenback.

A notable difference between these two metals is how they are mined. One peculiar aspect for silver is that, unlike gold, or unlike any other metal for that matter, only about one-fourth of silver comes from its primary mines. The remaining three-fourth comes from mines of other metals such as copper, lead and zinc, where silver is the by-product. So the production is not likely to respond either way to the prevailing market prices at any given time.

But does closeness to gold mean that silver‘s behaviour mimics gold? Not at all. Here are three reasons why silver works best as a tactical investment.

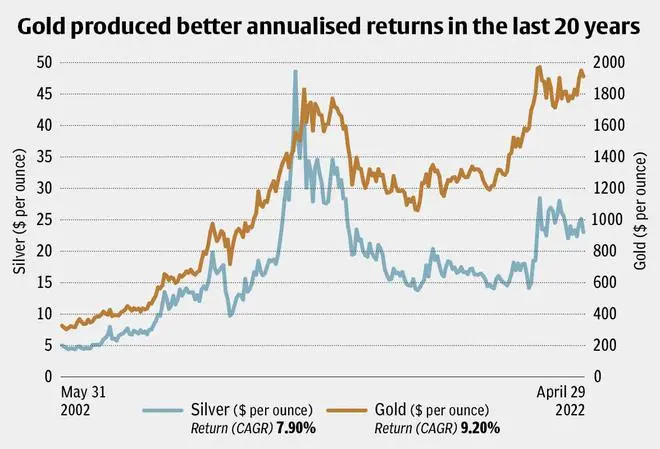

More volatility: For investors who look for long-term investments, gold can be better. The last 20-year annualised return of gold and silver is 9.2 and 7.9 per cent, respectively. A recent analysis of 10-year rolling returns of gold and silver by BusinessLine Portfolioshows that sliver has higher probability of negative returns even over longer periods of seven years. Gold is also more stable than silver — the latter is nearly 1.5 times more volatile that the former, considering the last 20 years’ price movement. Gold is less correlated to stocks as well, making it a better diversifier. The correlation between gold and S&P 500 over the last 20 years is 0.05, meaning both are practically uncorrelated assets. In comparison, the correlation between silver and S&P 500 is 0.23, indicating a small positive correlation. Similar trend is exhibited with the Nifty too (see table). So, gold can add more stability with lower risk. But higher volatility in silver means greater opportunities.

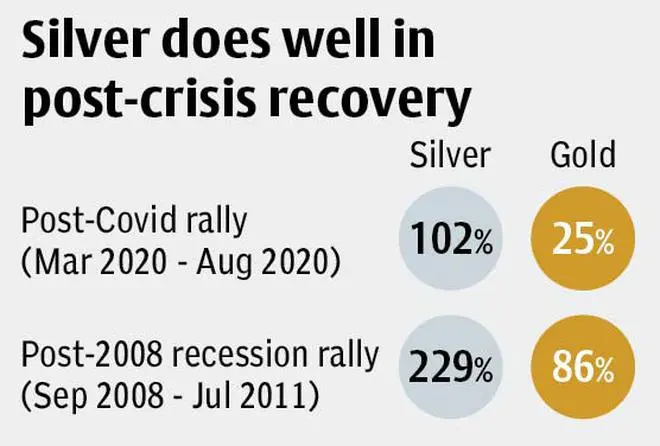

Linkage with economic expansion: When the global economy is in expansion phase, the demand for silver can accelerate, as 60 per cent of what is produced goes into industries. So, although silver is widely seen as a precious metal, when the economy is growing, it can outperform gold, which thrives mainly on uncertainties and crises. For instance, as the economic activities improved across the globe following easing of Covid restrictions, silver produced an absolute return of 63 per cent between April 2020 and April 2022, even though silver failed to hit fresh highs like gold. Whereas the yellow metal gained 21 per cent in the corresponding period.

Similarly, post the 2008 financial crisis, silver price more than tripled between September 2008 and August 2011, whereas gold price doubled during this period. Therefore, going into an expansion cycle, silver is likely to do better than gold. In contrast, gold can be the default choice when there is a crisis. For example, return of gold is flat since the beginning of Russia-Ukraine crisis, whereas silver has lost nearly 7 per cent. So, investors should approach silver more as a tactical asset to improve the overall performance of the portfolio by deploying money during certain periods. Of course, this requires the understanding of financial market nuances.. Yet, there is a metric that can simplify things to some extent which is the gold-silver ratio.

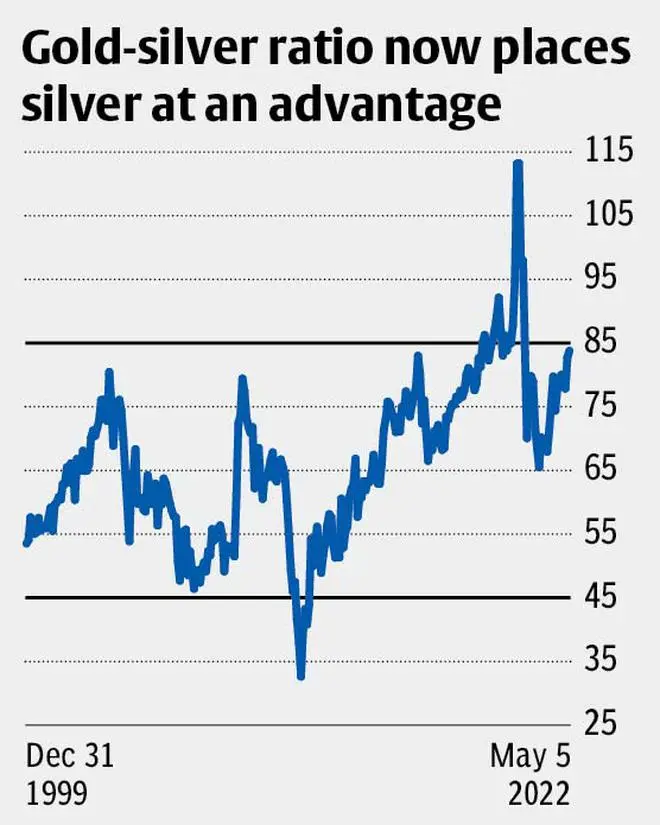

Gold-silver ratio: Also known as mint ratio, it basically denotes the number of ounces of silver required to buy one ounce of gold. It is derived by dividing the price of one ounce of gold by the price of one ounce of silver. The ratio goes up if gold outperforms silver and vice-versa. So, this can be used as one of the tools in assessing the future relative performance of gold and silver.

The ratio is currently at 84. Looking at the ratio since the year 2000, it has for most of the time, remained within 45 and 84. So, now at the upper end of the band, the ratio suggests that going ahead silver is likely to outshine gold.

Technical Analysis

The covid rally in silver, which began in April 2020 from about $12, exhausted in August 2020 after hitting the resistance at $28. Since then, the price of the metal has been fluctuating in the broad range of $21.50-28.50. So, typically, the next leg of short-term movement will be based on the direction of break of this range. Nevertheless, the recent price action suggests that the price is likely to slip below $21.50. However, the downside can be limited to the price band of $18-18.80, which is a strong base.

That said, considering the trend over medium to long-term, silver could either start the rally by rebounding from the support at $21.50 or drop to $18-18.80 range in the short term and then start moving northwards. The rally will face a hurdle at the upper end of the current range — at $28.50. Nevertheless, over the next one year, this resistance is expected to be invalidated where silver prices can appreciate and touch $35. Beyond this, it could even surge to $42. On the other hand, note that below $18, the price area of $13-14 is very critical. A breach of these levels could shackle silver between $10 and $14 for a long time.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.