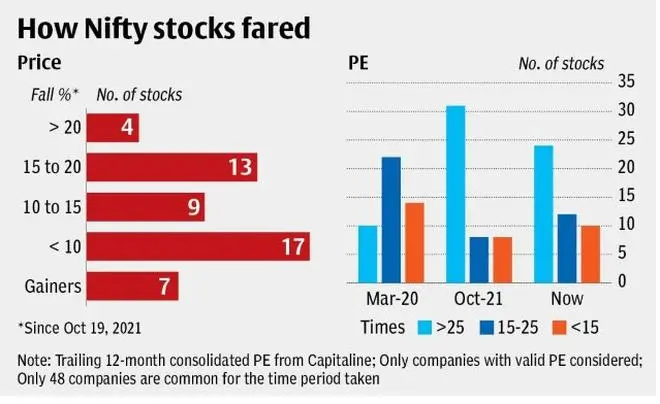

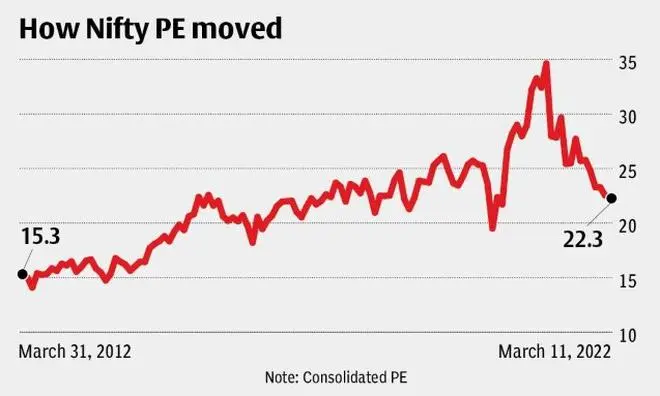

While there has been a rebound in the market in the last week, the bellwether Nifty index is still about 10 per cent down from the October 2021 peak. From a valuation perspective, the Nifty now trades at a trailing twelve-month PE (consolidated) of about 22 times, as against the 25-26 times in October last year and over 30 times in the beginning of 2021. The current valuation is slightly above the 10-year average trailing valuation of 21 times, as per Bloomberg.

The foremost question on investor minds today is, is the correction a good buying opportunity or is there more downside left? While no one can predict the markets, here are a few factors that can put the risk – reward present in today’s context, in perspective.

Earnings outlook

Since the Covid disruption, earnings rebound has been a key driving factor for the markets. Before the pandemic, Nifty earnings for FY19 dropped by about 5 per cent over FY18. With the first wave kicking in, FY20 earnings saw a further 4 per cent compression over FY19. However, after further fall in the first quarter of FY21, earnings for the full fiscal (FY21) bounced back, growing by 19 per cent year-on-year to ₹525. Currently, Bloomberg estimates FY22 consolidated EPS for Nifty companies at ₹732 (of which actuals of three quarters are already available), implying, yet again, a solid y-o-y growth of 39 per cent.

Nifty EPS estimates for FY23 stand at ₹850, pointing to a 16 per cent growth over FY22 estimates. A disruption in the ongoing March 2022 quarter from the Russia-Ukraine crisis can bring down the actual earnings growth for FY22 as well as mark down the expectation for FY23, if the war prolongs.

It is the extent of the impact of the Russia-Ukraine conflict on earnings that is difficult to gauge at this point. Four players in the commodities space – Tata Steel, Hindalco, JSW Steel, ONGC - alone are expected to contribute to about one-fifth of the expected Nifty PAT of FY23. These stocks account for about 4 per cent of the Nifty weight. While their earnings may receive a boost if commodity prices continue to rule high and act as a tailwind for Nifty earnings, most manufacturing companies may face high input costs from the rise in metal as well as crude oil prices, apart from additional power/fuel costs due to high crude prices.

How inflation and interest rates move from hereon and how this will impact demand and bottom lines is also a key monitorable in this scenario. Given that there are many moving parts, trying to second-guess the market trajectory from hereon is easier said than done.

For a perspective, it is worth noting that Nifty earnings in the last ten calendar years have grown at a CAGR of about 8.5 per cent as per Bloomberg.

What investors can do now

Instead of crystal-gazing, investors can make use of what they now have in hand - the market correction as well as the almost in-line valuation - in two ways.

One, focus on pockets of opportunities outside the manufacturing space. Financial services and IT are the top two sectors by weight in the Nifty 50. While many companies in the IT space remain expensive, opportunities can emerge as volatility plays out. Sharp corrections in banking stocks and defensivepharma segment can also provide entry points for long-term investors. As travel opens up more convincingly post the third Covid wave, select travel and hospitality stocks can be options as well. Even in manufacturing, take Automotive, for instance; betting on EV (electric vehicle) focused players whose prices and valuations have corrected can pay off, as it is a long-term story based on structural shift. These stocks will not be bogged down by immediate threats from a prolonging of the slowdown in vehicle sales or high input costs or fuel prices.

Two, look at bottom-up opportunities. The just 10 per cent fall in the Nifty 50 masks the massive correction in the broader market. Sample this: Of the Nifty 500 constituents, 100 stocks have lost in the range of 10-20 per cent and another 100, 20-30 per cent since October 2021; 50 stocks have lost between 30 and 50 per cent. This can be your chance to pick up quality mid and small-cap companies - importantly less leveraged ones, those that can cushion margins in an inflationary environment - at better valuations for the long term.

Alternatively, you can also consider index investing for the mid-cap segment. In our earlier article we said why index funds for the mid-cap segment are a better choice than actively managed ones. We have recommended one such fund – Motilal Oswal Nifty Midcap 150 Index Fund.

Investors though need not go all in at this point in time and can keep powder dry for further volatility or corrections, considering that the uncertainties still remain.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.