After hitting the nadir in FY21, courtesy the Covid pandemic, the hotel industry in India has rebounded like the mythical Phoenix bird that comes to life by rising from the ashes.

While initially hotels were seen benefiting from ‘temporary’ revenge travel, pretty soon it became clear that India’s hotel industry is on a strong wicket, thanks to robust turnaround in demand after the pandemic, led by the rising discretionary spending on tours and travels, improving economic environment, revival of wedding-related demand and other events. These strengthened the business case for hotels.

The overall sentiment in the industry is quite positive as witnessed by the results in the past few quarters. In fact, FY2022-23 was a record year for many listed hotel companies in terms of revenues, margins and profits, allowing companies to sharply cut debt.

The industry is witnessing renewed growth and is understood to be in an upcycle, which is expected to last for the next few years as demand outstrips supply. Hotel stocks, enthused by robust performance and potential for sustained growth, have moved to a different orbit. The three-year compounded annual growth rate (CAGR) for prominent hotel stocks such as Indian Hotels Co. (71 per cent), EIH (49 per cent), Chalet (51 per cent), Lemon Tree (56 per cent) and Royal Orchid (76 per cent is 2-3 times of bluechip Sensex’s 21.7 per cent run in the same period. Investors, like customers, are eager to check-in. . Here are four key factors you should monitor before you enter hotel stocks.

Hotel positioning

Not all fingers of our hand are alike. Ditto for hotels. Hotels are positioned to cater to needs such as luxury, premium, budget and value travellers. While some listed hotel companies cater to a wide range, others are extremely focussed. For instance, Indian Hotels Co Ltd (IHCL) features hotels under the iconic Taj brand, upscale offering Vivanta, premium properties under SeleQtions and the budget range under Ginger, thus offering rooms across price points. EIH Ltd has hotel brands such as Oberoi (luxury), Trident (5-star) and Maidens (heritage).

In comparison, Lemon Tree is focussed on mid-priced hotels through various brands such as Aurika, Lemon Tree Premier, Lemon Tree Hotels, Red Fox, Keys (Prima, Select and Lite). Royal Orchid operates 5-star, 4-star (Royal Orchid Central & Regenta Suites), resorts and budget hotels (Royal Place & Regenta Inn), focussing on business and leisure travellers. Chalet Hotels operates high-end hotels and is also a hotel-led, mixed-use developer in a few key cities.

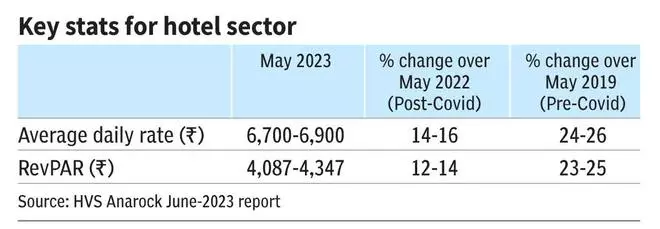

As per HVS Anarock data for May 2023, the India average daily rate (ADR) was ₹6,700-6,900, with occupancy of 61-63 per cent. The way the hotel business is positioned has a bearing on room rates, although there will be monthly swings. But companies with luxury rooms/properties fetch higher room rates, backed by the promise of better experience.

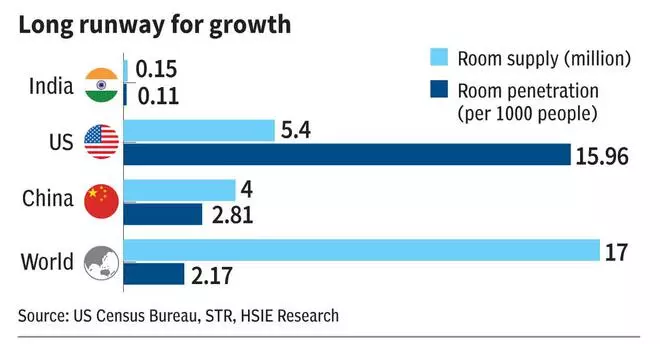

The room rate is ₹18,200 for EIH (including managed hotels), around ₹11,220 for IHCL (all domestic hotels including Ginger), ₹11,300 for Chalet, ₹5,600 for Lemon Tree, and ₹5,400 for Royal Orchid, etc. Given the high demand for rooms, monthly/quarterly occupancy rates ranged at 68-78 per cent for these hotel companies, much ahead of the national average. While globally the entry of travel/hotel aggregators has intensified the competitive landscape, this risk has so far not played out in India due to the much bigger market opportunity and low penetration of hotels (53K hotels in India vs 1.66 lakh in the US).

However, higher room rates don’t always translate to higher EBITDA margins. It is likely that higher room rates will entail higher costs too. For example, in FY23, the consolidated adjusted EBITDA margins for Chalet (40.1 per cent) and Lemon Tree (51 per cent) are higher than for IHCL (31.1 per cent) and EIH (29.7 per cent), which are comparable to Royal Orchid (31.1 per cent) despite the latter’s room rates being less than half of the hotel giants.

Another factor that could probably work in favour of India-focussed hotel chains such as Lemon Tree is the absence of relative drag from international properties. For instance, average room rates ($274 vs $236) and occupancy (58 per cent vs 55 per cent) of international hotels of IHCL have just inched up in Q4 of FY23 vs Q4 of FY20 (pre-Covid period). Hence, the portfolio mix of domestic and international hotels is a monitorable.

Expansion plans

Prominent hotel stocks in India, among themselves, offer investors revenue and profit potential from 42,000+ rooms. For instance, IHCL gives exposure to 21,600+ rooms. Lemon Tree (8,300+) and Royal Orchid (5,400+) are next in pecking order in number of rooms. EIH, though being the second-largest in terms of m-cap, has a room portfolio of about 4,300 (including 11 per cent abroad). Chalet is at 2,600+. There are also smaller listed companies in this space such as HLV, Sayaji Hotels, Kamat Hotels, Advani Hotels, Sinclairs Hotels, Asian Hotels (N) and Asian Hotels (E).

Existing rooms offer only limited leverage to boost revenues at a time when tourism in India seems to be at inflection point. While F&B revenue (usually 40-50 per cent of room nights sales), better daily room rates (with arrival of international tourists), higher occupancy and cost reductions can be used as levers, expansion holds the key to future earnings growth. Hoteliers have already undertaken various cost-reducing initiatives during the pandemic, such as multitasking workforce, reducing staff/room ratio, lowering overhead expenses, etc.

Substantial additions to rooms and properties over the next few years and sustained operating margin improvements can pay rich dividends, amid immediate triggers — such as Government’s intent to leverage the G20 Summit to boost inbound tourism, the men’s cricket ODI World Cup in October 2023 and the recovering international tourist footfalls, post-Covid. Given the upcycle in the hotel industry, players that expand operations simultaneously hold an edge. IHCL is set to add about 9,900 rooms (45 per cent of existing room count) by FY27. EIH plans to add about 750 rooms (17 per cent) by FY27, but that supply is poised to start from FY25. Lemon Tree plans to add 2,540 rooms (approximately 30 per cent) by FY27, while Chalet aims to add 1,100 rooms (43 per cent) by FY26. Some players such as Royal Orchid disclose pipelines for short term, for instance, 1,100+ rooms by 2023.

The route adopted for expansion is also crucial. There are typically four ways to add hotels/rooms: Owned, Leased, JV and Managed/Franchise. These days, management contracts or asset-light strategy are the preferred route for expansion, given 5 main advantages. One, they facilitate expansion plans and ramping up presence. Two, they create brand visibility at a faster rate. Three, there is no upfront requirement of capex, which is positive for the debt profile of the hotel company. Four, minimal maintenance capex is required (no major shutdowns for renovation). Fifth, breakeven at operating profit level in 12-15 months.

This route is finding takers as three key risks of hotel companies are addressed — viz. regulatory (delays in getting approvals and licences, leading to increasing project cost), infrastructure (limited land availability at the desired location and rising property prices) and funding (medium to small-size hotels not favourable to PE, VC funding). But do note, occupancy rates and room rates may be lower in case of managed hotels since newer properties come up in tier-2 & 3 locations. Players such as Royal Orchid have over 70 per cent in management/franchise contracted properties. Lemon Tree has 40 per cent rooms via this route. Top players such as IHCL are aiming to add 70+ per cent fresh room supply to their inventory through management contracts.

Monetisation plans

For hotel companies, rooms are the main cash cows. Asset sales do sometimes fetch money. For instance, Kamat Hotels early this year said it has signed an agreement to sell the Mumbai-based VITS unit for up to ₹125 crore. Lemon Tree, for instance, has a plan to dilute ownership in the owned portfolio (while retaining majority shareholding) through public markets/strategic investors in a bid to monetise/unlock cash. One example of this plan is possible listing (IPO/REIT/InvIT) of subsidiary Fleur Hotels to which shall be transferred all 100 per cent owned assets of Lemon Tree.

Bigger players have also entered into hotel/hospitality allied areas in terms of new business. If these businesses/units become large enough, there is scope for value unlocking and monetisation through various routes. For example, IHCL’s budget hotel chain Ginger has become a ₹300-crore annual business with 39 per cent margins.

Air catering is also another side business. IHCL operates TajSATS (₹640 crore sales). EIH has a flight catering and airport lounges business. EIH also has exposure to Mercury Car Rentals, a JV with Avis. F&B outlets such as food delivery ‘Qmin’ (IHCL) and casual dining ‘Cou Cou’ (EIH), once they scale up, also hold promise.

The fourth factor for investors to track is valuations (elaborated below).

Valuations and financials

Given the upcycle in hotel stocks, expansion plans and improved profitability, historical financials as well as valuations need to be taken with a pinch of salt if current trends sustain.

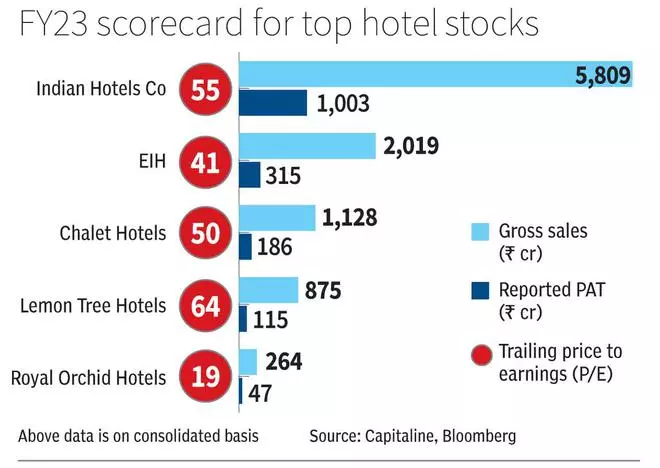

For instance, IHCL’s FY23 reported PAT of all-time high ₹1,003 crore comes after losses of ₹960 crore in previous two years (FY22 and FY21). In the pre-Covid era (before FY21), IHCL clocked losses each successive year during FY14-FY17. Adjusted net profit margins of IHCL, EIH, Chalet, Lemon Tree and Royal Orchid are now in the 13-18 per cent range compared to negative margins (average) in the previous five-year period.

The record profits have helped some hotel stocks cut debt. According to Capitaline, debt to equity ratio of IHCL has declined from 1.25 in FY21 to 0.47 in FY23. Data for other stocks for FY23 is not available but numbers for FY19 to FY22 also indicate a similar trend for Chalet (2.12 to 1.43) while EIH has maintained the trend (0.18 to 0.16). Lemon Tree (1.3 in FY19 to 2.45 in FY22) and Royal Orchid (0.6 in FY19 to 1.17 in FY22) have seen debt to equity ratio expand in this period.

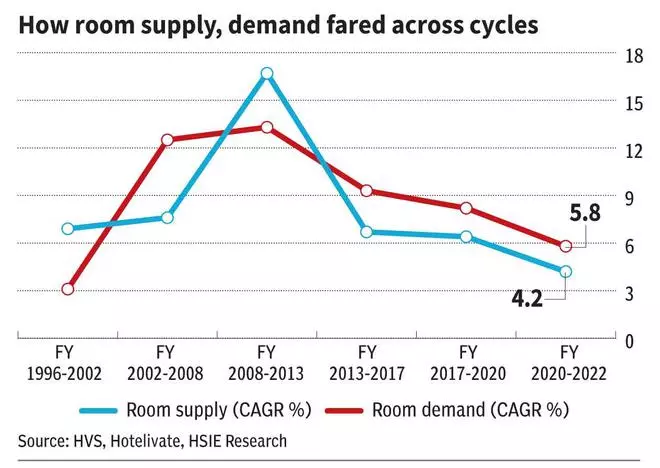

While companies may be taking on debt to fuel expansion, it remains to be seen how they handle the finances. In the last upcycle the sector witnessed from 2004 to 2008, hotel stocks improved margins and valuation multiples but subsequent slowdown left them with excess room inventory. For a prolonged period between FY06 and FY16, hotels in India added capacity at a CAGR of over 10 per cent, outpacing demand. This impacted the occupancy and room rates across the industry, especially from the onset of the global financial crisis in 2008 to 2013 when demand was lower than supply

In terms of future expectations, consensus estimates indicate annual revenue growth in early teens for larger players such as IHCL and EIH. The year-on-year annual sales growth expectations are 15-30 per cent for Chalet, Lemon Tree and Royal Orchid for FY24 and FY25. Earnings per share (EPS) growth estimates are higher in each case for FY24 and FY25.For instance, bigger players such as IHCL and EIH trade at 37 times and 27 times their estimated FY25 EPS (Bloomberg consensus). Chalet (26 times) and Lemon Tree (27 times) trade at similar levels, but Royal Orchid trades at 10 times FY25 EPS. We have a ‘buy’ rating on IHCL given its position as the biggest proxy to the rosy long-term prospects for global travel and tourism.

The major risk that investors in hotel stocks need to contend with is the cyclical nature of the hotel business. Operating performance of the companies remains vulnerable to industry cyclicality/seasonality and macro-economic cycles; more so, given the discretionary spending element.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.