Railway stocks have been in the limelight over the last year, with some prominent PSU players more than doubling. Much like the uptick in capital expenditure in other infrastructure segments, the railways has seen government spending move up this year. The allocation to railways in Budget 2023-24 rose 48 per cent, to ₹2.41 lakh crore, over last year.

Besides, Indian Railways is in the process of setting up more than 3,000 km of dedicated freight corridor (DFC) to attract more freight traffic.

Simultaneously, the National Railway Plan (NRP) Vision 2030 has been formulated to create a ‘future ready’ railways by 2030. This Plan is aimed at developing capabilities to increase modal share of the Railways in freight to 45 per cent. The NRP states that the average speed is inversely proportional to the transportation cost. It is estimated that if the average speed of freight train is increased to 50 kmph, from 37.8 kmph (as of FY22), then the share of select commodities transport through railways will rise to 40 per cent from the current 28 per cent.

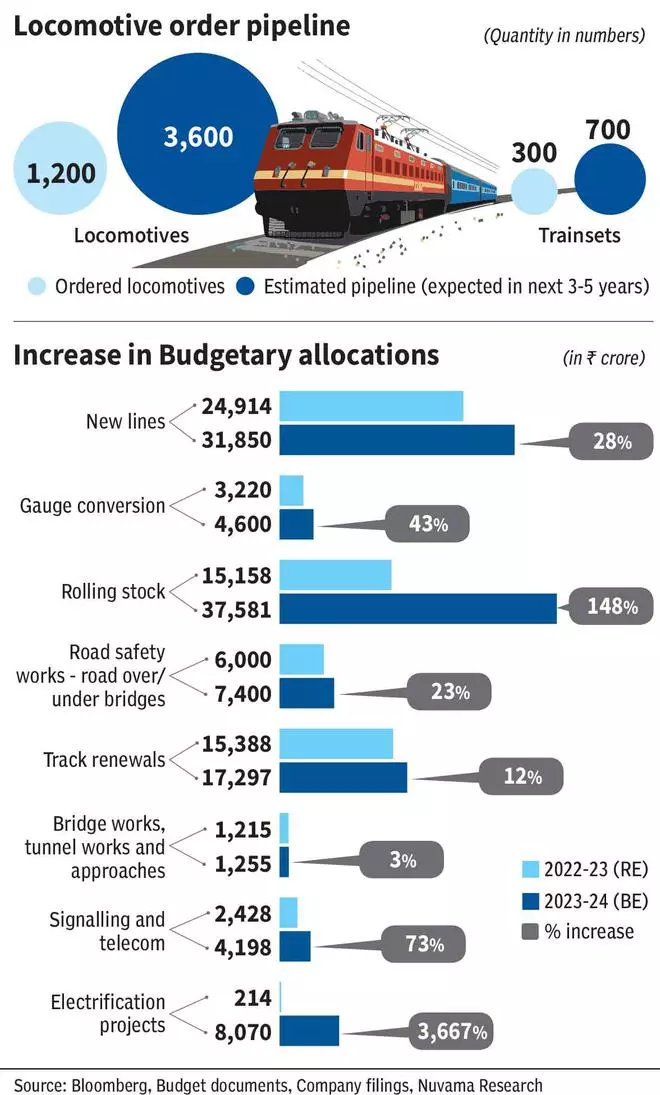

This would require significant investment by Indian Railways in modernisation of technology, high-powered locos, modern coaches, and better tracks. In Budget 2023-24, the allocation for new lines, gauge conversion, doubling and track renewals has increased by 28 per cent, 43 per cent, 28 per cent and 12 per cent, respectively.

Just a few days ago, the Cabinet Committee on Economic Affairs approved seven projects that will enhance the railway capacity to operate passenger and freight trains. These projects, worth ₹32,500 crore, are expected to expand the existing network by 2,939 km.

Considering all the action happening in this space, here is a lowdown on the opportunities and how key players are faring.

Rolling stock

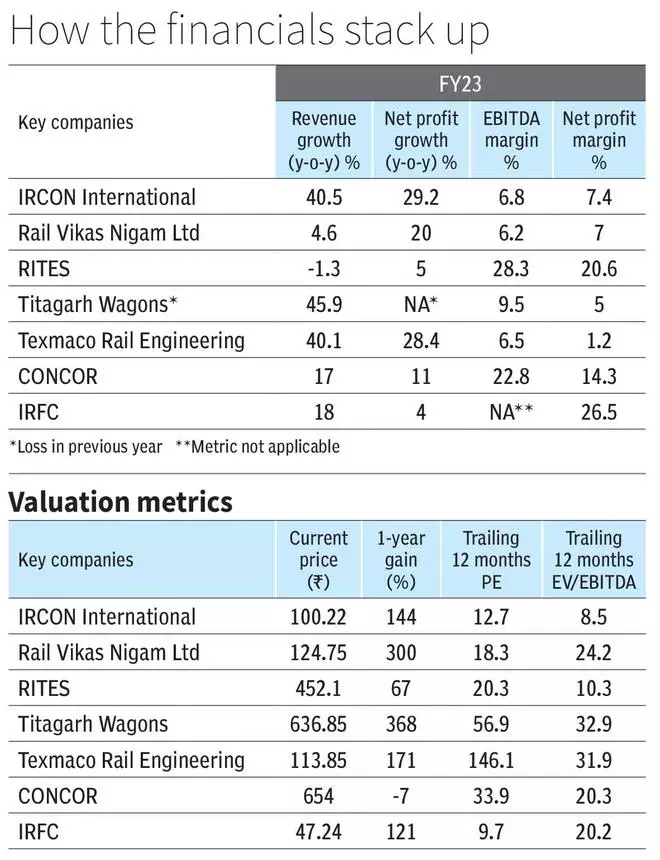

Budget 2023-24 has an allocation of ₹37,581 crore for rolling stock, which is 148 per cent higher than the previous Budget. Rolling stock includes locomotives, wagons, coaches, or any other vehicle(s) used by the Railways. According to a, April 2023 Nuvama report, “Transmission and Railways: Decadal thrust”, the future tender pipeline of Railways includes 600-700 Vande Bharat train sets over 4-5 years, 1,100-1,200 electric loco tenders annualy over next 3 years ,new RRTS (Rapid regional transport service) corridors and metro expansions across urban and tier-2/3 cities.

This suggests enormous potential for the manufacturers of rolling stock and its value chain partners. The main players in this segment are Siemens, Alstom and Medha Servo; out of these, Siemens is listed on Indian bourses. In January 2023, Siemens received an order to manufacture 1,200 electric locomotives and to provide service and maintenance for 35 years. The total value of the project is ₹26,000 crore.

Among the other prominent listed players in this space are Titagarh Wagons, Texmaco Rail & Engineering, Rail Vikas Nigam Ltd (RVNL), Bharat Earth Movers (BEML) and Bharat Heavy Electricals (BHEL). BHEL, Siemens and Alstom have the capacity to manufacture certain locomotives on their own whereas other companies enter into joint ventures with Indian or foreign manufacturers.

In recent times, Indian Railways called for tender to award project worth ₹58,000 crore for manufacturing and maintenance of 200 Vande Bharat train sets. The joint venture of RVNL and Russian manufacturer Metrowagonmash secured the contract to manufacture and maintain 120 Vande Bharat trains. The order for the remaining 80 trains was bagged by the JV of BHEL and Titagarh Wagons.

Railway Infrastructure development

In Budget 2023-24, the allocation to gauge conversion works was ₹4,600 crore, 43 per cent higher YoY; new lines works was allotted ₹31,850 crore, which is 28 per cent higher YoY; track doubling has been provided ₹30,749 crore and road over/underbridges was allocated ₹7,400 crore, which is 23 per cent higher YoY. This is positive for EPC companies that carry out railway works. Railway projects are mostly awarded on EPC basis and do not have variants like BOT (Build operate transfer) or HAM (Hybrid Annuity model) unlike road projects. The notable companies operating in this space are RVNL, Ircon International, L&T Construction, ARSS Infrastructure Projects, and K&R Rail Engineering.

RVNL and Ircon international are two PSUs of Indian Railways that specialise in the construction of transport infrastructure. Being railway enterprises, both have projects such as tunnelling, track works and electrification, as their core competency but they also undertake other projects, such as roads and bridges. Ircon International, as the name suggests, operates in foreign markets also — mainly in central Asia, Africa, South-East Asia and Australia.

Being PSUs, these companies have an advantage, i.e., they may sometimes receive orders from government on a nomination basis. Ircon international has 55 per cent of order book (Q1FY24) on nomination basis and RVNL nearly 65 per cent of its FY23 order book. Ircon has received contract for two packages in Ahmedabad-Mumbai high speed rail, for around ₹6,857.2 crore, RVNL has received a contract for tunnel design and construction along with track and electrical works for ₹1,088 crore from Haryana Rail Infrastructure Development Corporation.

Rail India Technical and Economic Service (RITES), an engineering and consultancy firm, is an Indian Railways enterprise. It provides a comprehensive range of services — from concept to commissioning — in all facets of transport infrastructure and related technologies. The company derives 53 per cent of revenue from consultancy; 33 per cent revenue flows from turnkey projects and 6 per cent and 8 per cent, respectively, from leasing and exports. In Q1FY24, RITES secured new projects and extensions worth ₹306 crore.

IRFC is an NBFC owned by Indian Railways, whose mandate is to finance the expansion plans of the latter. The funds raised by this company are extra budgetary resources i.e., off Budget. The company raises funds in order to acquire rolling stock assets and then leases to Railways in lieu of lease payments, which is 38.87 per cent of its AUM (Assets under management) as on June 30, 2023. The second component is leasing of railway infrastructure assets and national projects of the government, which is 59.86 per cent of its AUM. The company has a fixed markup on the lease payments which is 0.4 per cent for rolling stock leases and 0.35 per cent for project assets. In addition to this it also gives loans and advances to PSUs like IRCON and RVNL. Since 98.73 per cent of its AUM is to railways and balace to Railway PSUs the default risk is low.

Metro Rail

Besides the traditional segments ofRailways, i.e. freight and passenger trains, new segments in passenger trains, such as high-speed railways and RRTS (Rapid regional transport services), are being added. To enhance urban infrastructure, new metros are being established in tier 2 cities and existing metros are being expanded. This opens up opportunities for both locomotives and train sets manufacturers as also EPC contractors.

In June 2023, RVNL got orders worth ₹11,256 crore from Chennai Metro to construct five underground metro stations. In April 2023, the joint venture of RVNL and Siemens secured two major contracts from Gujarat Metro Rail Corporation, worth ₹1,057.46 crore, for supply and electrification systems for Ahmedabad Metro phase 2. French locomotive manufacturer Alstom, in March 2023, started the production of Movia metro passenger trains for the Bhopal and Indore Metro projects. The company was awarded the contract in July 2022, for manufacturing 156 trains with 15 years of comprehensive maintenance.

A major player having end-to-end capability in developing metro network in India is Larsen & Toubro (L&T). L&T has presence in both India and foreign countries, in developing metro stations and lines. Through its Heavy Civil Infrastructure business vertical, L&T can build elevated rail corridors, station buildings; the track laying can be accomplished through its Transportation Infrastructure & Railways businesses; track electrification through Power Transmission & Distribution businesses and total mechanisation through its Railways business and expansive depots.

L&T has developed Hyderabad Metro, Chennai Metro, Delhi Metro, Ahmedabad Metro and Lucknow Metro in India and Riyadh Metro, Doha Metro and Dhaka Metro globally. In June 2023, L&T was awarded two track-work contracts with a total value of ₹500.94 crore for Bengaluru Metro’s 56-km Line-5.

Signalling, track management systems and power transmission

Railways requires a comprehensive and reliable signalling and track management system. In Budget 2023-24, the allocation for signalling and telecom was ₹4,198 crore — 73 per cent higher YoY. The signalling and telecom of Indian Railways is taken care of by its Signal and Telecommunication department.

There are also private companies that supply Signalling, Train Collision Avoidance system and Train Management system. The major companies providing these systems are KEC, Kernex Microsystems and HBL Power Systems. These companies may get direct orders from Railways or subcontracts from the original EPC contractors of Indian Railways. Kernex Microsystems secured orders worth ₹563 crore during the fiscal year 2022–23. The company has also received orders from Integral Coach Factory (ICF) Chennai worth ₹26.7 crore for supply, installation, and commissioning of a Train Collision Avoidance System (TCAS) (also known as Kavach) for 39 units, with a targeted completion date of July 31, 2023. In June 2023, HBL Power Systems won an order from Ashoka Buildcon worth ₹135 crore.

KEC is an infrastructure developer and EPC contractor with diverse expertise. Its railways segment is involved in overhead electrification, signalling and telecommunication, traction substations, doubling of tracks, etc. The company, in June 2023, received two orders worth ₹600 crore for Train Collision Avoidance System. Kalpataru Projects International is also into similar business lwhere it undertakes civil works like bridges, tunnels, stations, etc, alongside track maintenance and power transmission. In February 2023, the company bagged orders worth ₹299 from Railways.

These are the broad avenues within the Railways and the key companies participating in the ongoing infrastructure building/capex theme. Do note, only a few companies mentioned above have either their complete business or a major part of their business coming from the Railways. Therefore, investors need to check the proportion of railways in the overall business of a player to get the right perspective.

Dedicated Freight Corridors

According to a Jefferies report released last year, transportation above 330 km is cheaper on railways than roadways. However, while only 36 per cent of the total cargo in India has a lead distance of less than 300 km, roadways carry nearly 60 per cent of total freight in the country. Railways move a mere 31 per cent of total freight. Though freight traffic generates higher revenues for the Railways, passenger trains and freight trains share the same infrastructure and hence, there has been a limitation on usage of this mode.

Therefore, the government has come up with Dedicated Freight Corridors or DFCs.

DFC will cater to the rising freight transportation demand and help tackle capacity constraints. Currently two DFCs are being developed; Western DFC connecting Dadri in Uttar Pradesh to Jawaharlal Nehru Port in Mumbai, which will be 1,506 route kilometres (Rkms) and Eastern DFC connecting Ludhiana in Punjab to Dankuni in West Bengal, of 1,875 Rkms.

Around 1,046 Rkms of Western DFC has been commissioned, which is 69 per cent of the total route, and the balance is work in progress. In case of Eastern DFC, 1,150 Rkms have been commissioned, constituting 61 per cent of the total route.

Dedicated Freight Corridors are expected to bring efficiency to freight transportation by rail. The major benefit is the reduced operating cost. For e.g., the double stacking of containers and longer trains can reduce the per unit operating cost; the use of electric locomotives may reduce the overall energy cost. DFCs are expected to enable trains to travel at speeds as high as 100 kmph, which will reduce the transit time of the cargo being carried. They will benefit logistics companies like CONCOR, Gateway distriparks and Allcargo logistics.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.