Does good karma lead to better investing experiences?

Historically, financial return has been the predominant driver for the investing decisions taken by investors. But, of late, some investors across the world have been looking at target investee companies through the ESG lens — where E stands for Environment, S for Social, and G for governance. ESG investing, they say, is built on how the investee company treats the planet, how the company cares about people, and how the firm is being governed/run.

The answers form the crux of all ESG investing, where assets globally surpassed the $35-trillion mark already in 2020. Yet, ESG investing on its own is nothing novel because it has been around in different forms such as green investing, socially responsible investing, sustainable investing, ethical investing or impact investing.. Call it perhaps one of the luxuries of a prolonged bull market, or a skilful way to direct capital to the do-gooders of the corporate terra firma. Not surprisingly, ESG investing, like every other issue, has split the investing hoi polloi into pro-ESG and anti-ESG camp.

Decoding ESG not easy

Traditionally, investing has involved distributing our monetary resources across financial products to generate income or gain profits. ESG investing goes beyond that and is focussed on how companies make money, rather than just how much money they make.

In about two decades since academic literature first started using ESG references, the ESG movement has grown from merely a corporate social responsibility (CSR) initiative to a global investing phenomenon. In the last two years alone, over $32 billion flowed into ESG-focussed US ETFs, signifying how the trend has picked up pace.

Given the obvious FOMO (fear of missing out) regarding ESG theme, some global funds have been stretching the original definitions of ESG and sustainable investing to get money. And, they have a strong motive to do so. A 2021 analysis by Morningstar found that Millennials, Gen X and Boomers all had similar preferences for owning sustainable investments.

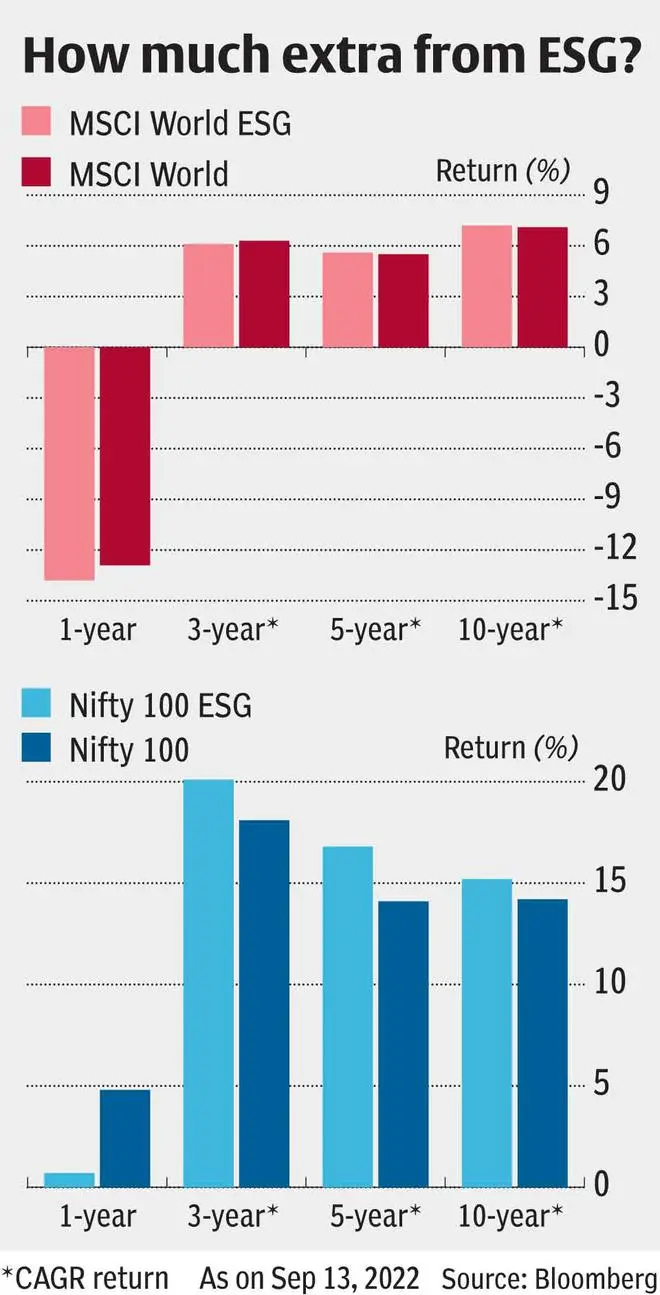

Yet, returns have been pedestrian. The MSCI World ESG index in last 10 years has doubled but this is barely 100 basis points more than the plain Jane MSCI World index. Besides, there are no universally agreed norms and standards. Standard-setting bodies such as IOSCO, FSB, etc. are working in this area, including development of standardised disclosures for funds in the ESG space. Until then, regulators around the world will continue to grapple with the issue of determining whether an ESG label on a fund is warranted. In the US, the Securities and Exchange Commission may soon require additional disclosures about how ESG principles fit into managers’ investment strategies. Europe is said to be developing some of the most rigid criteria. Indian market regulator SEBI has floated an exhaustive consultation paper on introducing disclosure norms for ESG MF schemes.

Convenient definitions and the use of negative/positive screening have led to ESG/sustainability funds globally building portfolios from companies that would ideally not fit in ESG baskets. For example, some ESG equity funds have been increasing their investments in firms such as Shell and Repsol since Russia’s invasion of Ukraine boosted the energy markets. One of this year’s top-performing managers of sustainable funds holds ConocoPhillips and Exxon. To global investors, China’s authoritarian regime should be an automatic disqualifier and ‘un-investible’ from any ESG perspective, yet ESG funds hold about $130 billion in Chinese assets.

Domestic landscape nascent

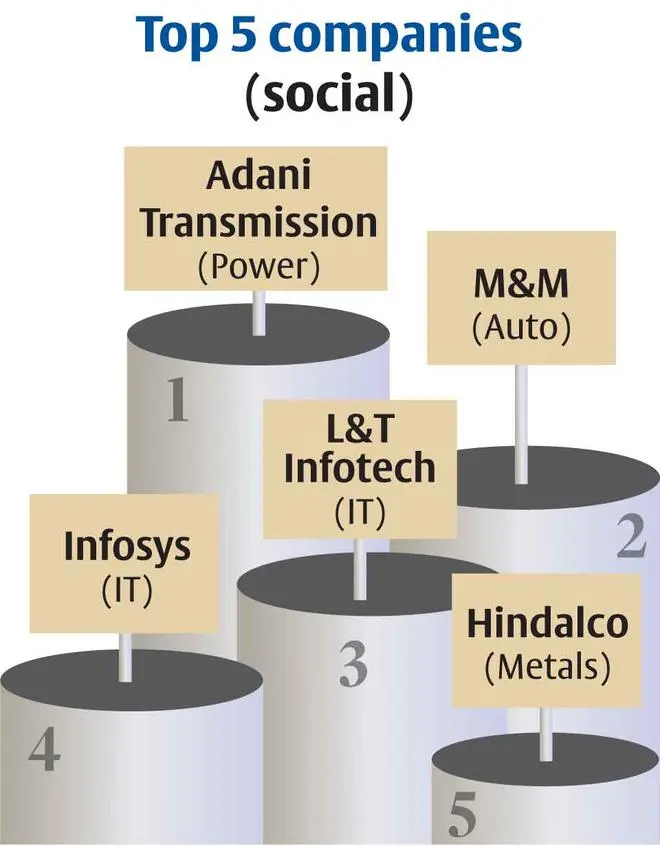

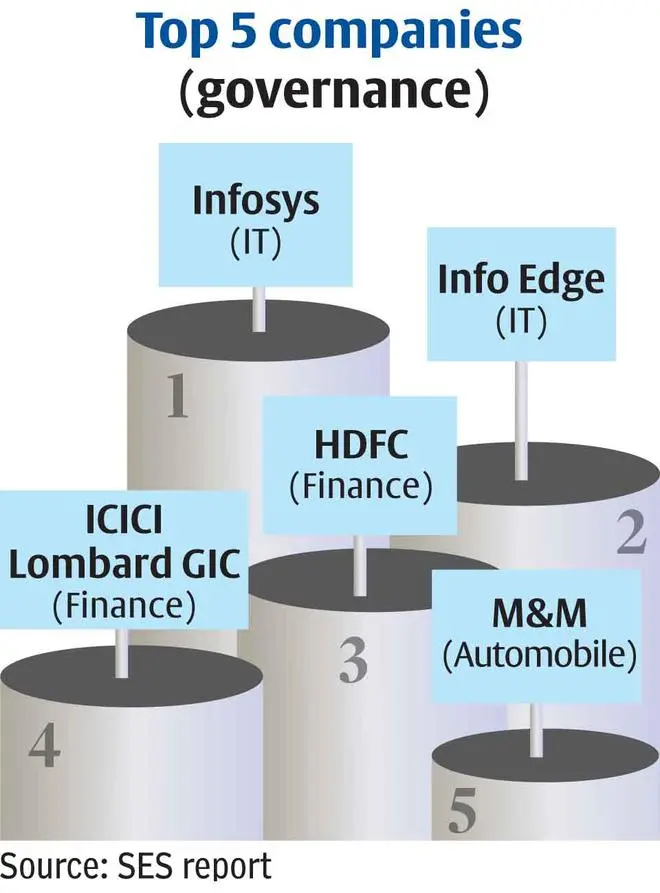

An increasing number of investors want to do their own research and pick stocks, which could be daunting enough; and this could be even more challenging if they extend their filtering criteria to ESG goals. There are a few free resources such as SES Governance which make available the ESG ranks for specific Indian companies, but they are few and far between. For others, you will have to pay up. You can, of course, access the top 10 holdings from the latest factsheets of ESG stock indices such as Nifty 100 ESG or S&P BSE 100 ESG. The weight of each stock in Nifty100 ESG index is tweaked based on ESG risk score assigned to the company.

Compared to this, domestic mutual funds offer readymade ESG portfolios. At present, there are 10 ESG-focussed thematic equity mutual fund offerings. These funds, put together, manage assets over ₹11,400 crore ($1.4 billion). Eight of the ten have been launched in the last two years. Two of the products are passive in nature. Only one fund has a long history, but it didn’t begin as an ESG fund at inception and changed track only in 2018.

Given the absence of water-tight definition for ESG, what is the investment strategy that mutual funds follow?

ESG-focussed mutual funds invest in a basket of securities based on combining existing traditional fundamental, bottom-up financial analysis with an analysis on the ESG aspects of the company. Most of them claim they have a ‘proprietary investment framework’. The ESG analysis is part of the investment framework, which may use data shared by external service providers. For instance, CRISIL, in June last year, launched its ESG scores for 225 companies across 18 sectors in India.

To shortlist ESG-compliant companies, funds usually do sector-level screening and stock-level screening. While ESG scores/risk scores are an integral part of the investment research process, some funds are not restrained by them and can use discretion to decide on companies which are long-term sustainable businesses with good ESG practices. Schemes may specify selected no-go sectors which are deemed as harmful or unfavourable from the societal perspective.

Companies are also considered in ESG portfolio owing to their ‘strength’ in any one or two of the ESG parameters and not necessarily all three in combination and vice versa. The portfolios are reviewed and rebalanced on periodic basis due to change in ESG score/risk score. Funds are allowed to invest only in equity securities that have Business Responsibility and Sustainability Report (BRSR) disclosures from October 1, 2022. The existing investments in the scheme for which there are no BRSR disclosures would be grandfathered till September 30, 2023.

On the portfolio management services (PMS) side (minimum ₹50 lakh investment), a handful of products exist in the form of SBI ESG Portfolio, Avendus ESG Fund PMS and White Oak India Pioneers Equity ESG Portfolio.

ESG has also made its way into curated stocks baskets, with offerings such as Green Energy (managed by Niveshaay), Omni Belief Compliant Strategy (Omniscience Capital), Socially Responsible Investing (Rupeeting), MWG ESG (My Wealth Guide) and Shariah ESG (SenSage) incorporating ESG principles fully or partially.

Insipid returns so far

Does ESG investing work in India? For all the big teeth, there is not much of a bite. This is borne out by index-level movements. For instance, Nifty 100 ESG index has delivered 15.25 per cent CAGR in last 10 years, which is barely 100 basis points more than 14.2 per cent CAGR given by Nifty 100. This alpha is small, especially given the fact that ESG index statistically prevailed against the regular index in 8 out of 10 instances in terms of calendar year returns.

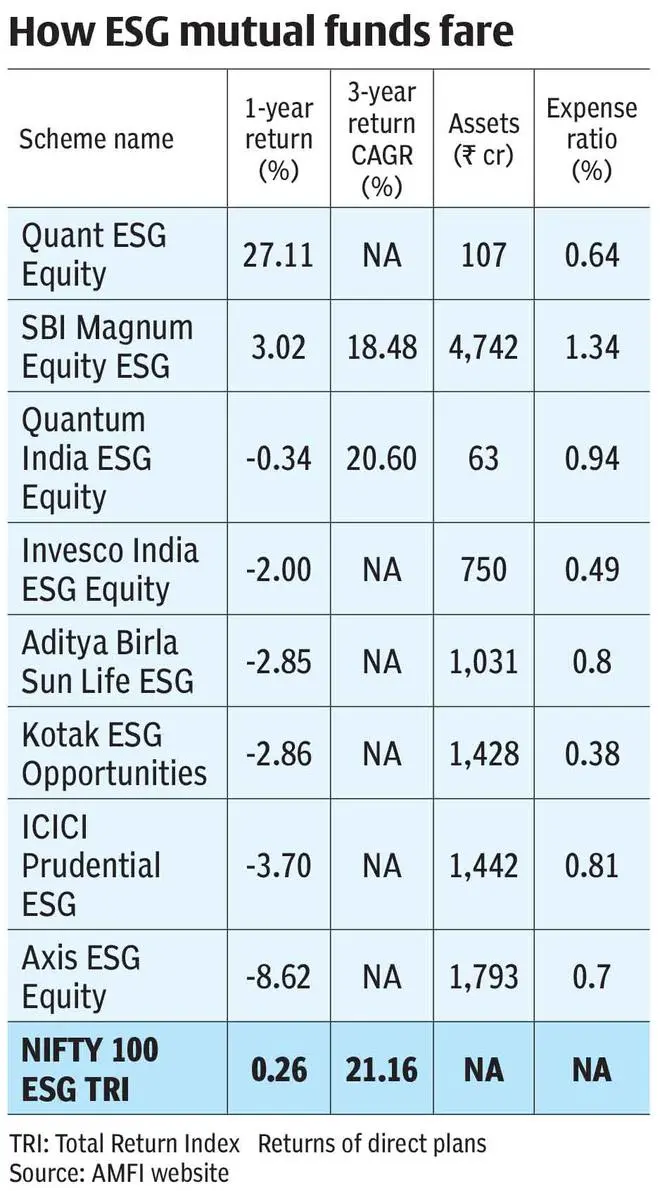

For all the hullabaloo, ESG-focussed mutual funds have not shown any great financial returns either. The individual one-year fund returns range from -9 per cent to +27 per cent, bringing the category average to a forgettable -0.15 per cent amid flattish markets. Negative returns by seven funds don’t lend to them any risk-adjusted return analysis. The paltry returns place the ESG thematic category among the worst out of the 20 broad buckets tracked by the industry. However, ESG funds seemed to have outscored sectoral funds betting on pharma (down 12 per cent) and IT (down 15 per cent), and international equity funds (down 17 per cent) in one-year period. On risk ratios (1-year and monthly), 30 per cent of the ESG funds sport higher-than-average upside capture and that has translated into their outperforming.

However, one may argue that investors need to give more time for ESG funds to deliver performance given their young age.

Portfolios not unique

A close look at the latest portfolios of ESG funds throws up interesting insights.

One, there are broadly 200-odd domestic stocks and 40 international stocks that find place in ESG fund portfolios. As per regulations, these schemes fall under the category of thematic funds and so a minimum of 80 per cent of total assets are invested in securities following ESG theme. SEBI’s consultation paper proposes that the residual portion of the investment should not be starkly in contrast to the philosophy of the scheme from the theme. Some funds select stocks if they have ESG orientation “in the opinion of the fund manager”.

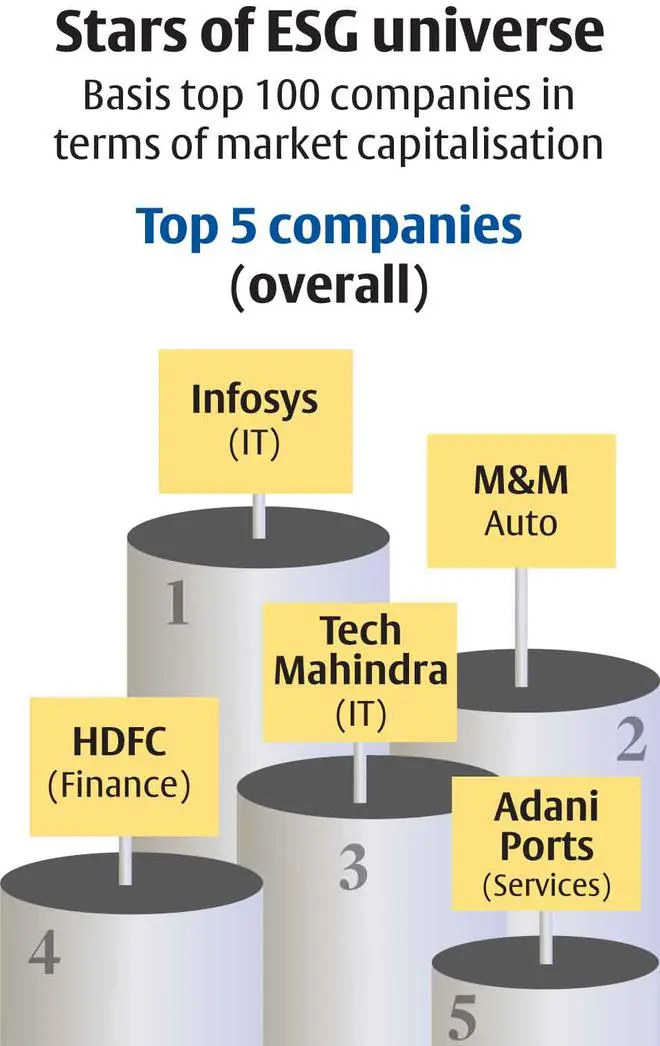

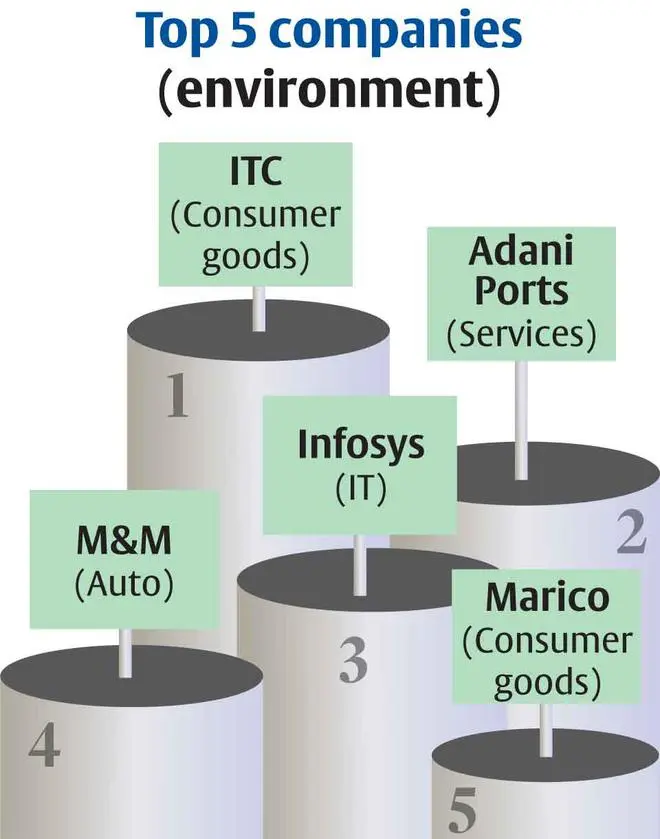

Two, BFSI and IT stocks are the dominant sectors in most funds (they were never doing something awful to the planet or to the people in the first place!) Infosys is a top-3 holding in 80 per cent of the funds. Similarly, ICICI Bank, TCS, HDFC Bank and HDFC are top 3 holdings in many ESG funds. However, many of these stock names are widely owned in the fund universe in as many as 330-520 schemes. So, how different will the experience of investors be with ESG funds if they are allocating money to the same household stocks? This is further brought out if you look at the top 10 holdings (40-60 per cent weight) of ESG funds.

Every fund has an overlap of 4 to 9 stocks of top 10 holdings with another peer. Presence of stocks from Adani group and others has helped boost returns of some ESG funds.

Most popular top ESG stocks across PMS and MF portfolios also tell the same story. They include Infosys, TCS, HDFC, Bajaj Finance, Titan, HCL Tech., Tech Mahindra, Wipro, HDFC Bank and HUL. So, no real surprises here.

Beware greenwashing

Since companies get better market valuation (Nifty 100 ESG enjoys a 13 per cent premium valuation), given the elevated demand from investors, many corporate aspirants have started greenwashing. This is a process of conveying a false impression or providing misleading information about how a company’s products are more environmentally sound.

In a bid to avoid this peculiar problem, India, for instance, has framed new environmental rules that will require companies to submit detailed emissions data starting next fiscal year. Under the rules, corporates will have to provide data on more than 120 metrics, including from the past two years.

While ESG depends upon third-party rating organisations to assess companies on their credentials, there is no unified benchmark or methodology behind ESG ratings. Inconsistencies have muddled what qualifies as adhering to ESG principles. This leaves the door ajar on ESG malpractices.

Clear, concise, and relevant rules can put an end to such occurrences, so that only the good apples of the ESG landscape get the investments and investors draw returns from them. On the other hand, if ESG companies and ESG investment vehicles such as funds become true-to-label, that will also lead to less wiggle room for stakeholders involved. Standardisation can make it difficult for certain funds to tweak their investment policies for alpha chase. Some can argue that ESG investors must look beyond mere financial return. SEBI’s consultation paper proposes that investments by mutual funds should be designed to generate a beneficial ESG/sustainability impact alongside a financial return and the asset management company should clearly state the intended ‘real world’ outcome in qualitative terms.

Given all this, as of today, ESG investing is not yet a hands down winner.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.