The new fund offer of DSP Nifty Bank ETF, an open-ended scheme replicating/tracking the Nifty Bank index, opened today and shall close on December 28. Launched by DSP Investment Managers, this ETF offers investors an option to take a sectoral exposure to the banking sector. Here is a review.

Banking funds performance

Banking funds have done well in flattish markets this year. In terms of sector perspective, banking stocks have not gone up that much in the longer time periods. In fact, banking funds over the 3, 5 and 10-year time periods have lagged overall markets.

Banking funds have emerged as the second best equity category with 16.62 per cent returns year to date. In the 3-year return timeframe, the category has given 8.66 per cent. In the 5-year, the category average stands 7.72 per cent. In the 10-year timeframe, the category average is 10.02 per cent. However, S&P BSE Bankex TRI (total return index) has beaten the category average across time periods, which probably shows that passive index may be a better way to play this sector.

In terms of 3 and 5 year returns, Sundaram Financial Services Opportunities Fund is a good performer among actively managed funds.

Do note that while PSU bank ETFs or index funds have done well in 1 and 3 year timeframes, they have been pedestrian in the 5-year period.

Banking stocks currently contribute the highest share of profits among all sectors in the major indices. The top 5 banks are also seeing strong credit growth and an improvement in asset quality. Banks have also benefited from an expansion in net interest margins post Covid. Robust credit growth and improvement in operating margins and return on equity for banks are other positives that indicate a healthy outlook for banking as a theme.

Detailed look at Bank Nifty

Nifty Bank index is diversified with a composition of 78 per cent in private banks and 22 per cent in public banks. Nifty Bank Index is composed of a maximum of 12 liquid and large banking stocks, with no single stock having an exposure of over 33 per cent and the maximum exposure to the top 3 stocks being lesser than or equal to 62 per cent. At this time, the Bank Nifty top holdings are HDFC Bank, ICICI Bank, Axis Bank, SBI, Kotak Mahindra Bank, IndusInd Bank, Bank of Baroda, AU Small Finance Bank, Federal Bank and IDFC First Bank.

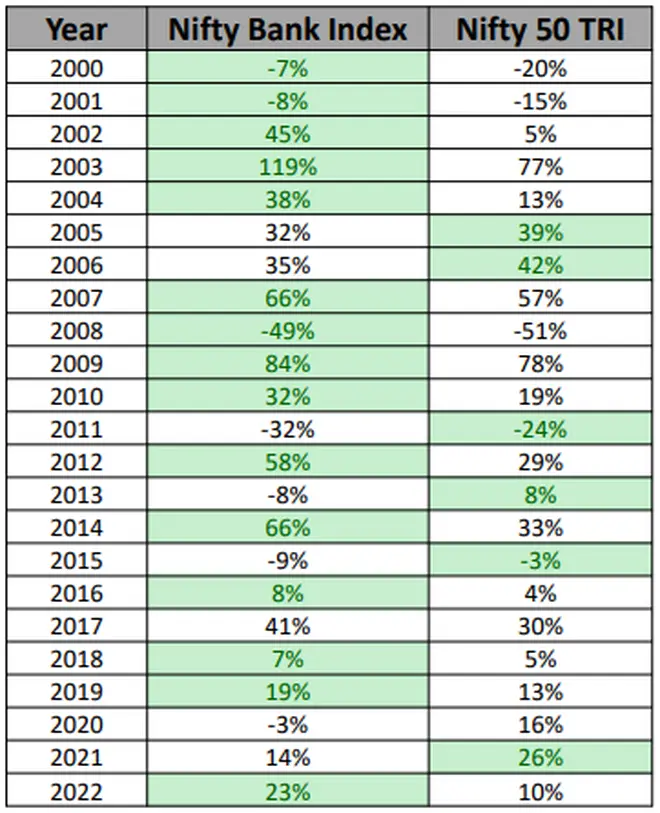

Historical data since 2000 shows that Nifty Bank index has outperformed the broad Nifty 50 index in 15 out of 23 years. On a 10-year basis, Nifty Bank Index has outperformed Nifty 50 Index a whopping 98 per cent of times.

However, investors should note some risks arising from concentration risk arising from the index having exposure only to 12 stocks in the banking sector and the possibility of higher volatility and drawdown as compared to a diversified equity fund which can result in comparative short-term underperformance.

Our take

The banking system acts as the heart and lifeblood of a good economy. The banking sector is expected to see further value unlocking on account of fundamentals factors and that coupled with attractive valuations, presents an interesting opportunity for investors. Existing ETFs in the banking space include Nippon India ETF Nifty Bank BeES, Kotak Nifty Bank ETF, SBI Nifty Bank ETF, ICICI Prudential Nifty Bank ETF, ICICI Prudential Nifty Private Bank ETF and Kotak Nifty PSU Bank ETF.

However, do note that the high weight of banking sector in diversified equity funds means that most investors are already exposed to banking sector in a good way. So, any incremental exposure to the sector has to be weighed against risk and reward, and individual portfolio preferences.

For opportunistic investors, extra exposure to banking may work if the entry and exit points in the investment are well-timed. At this point in time, the Bank Nifty trades at 2.85 times price to book and price to earnings of 18.06 times (as on November 30, 2022). This is at a discount to Nifty 50 trading at 4.4 times price to book and at 22.54 times price to earnings.

Lastly, do remember the ETF investment strategy has to revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, considering the change in weights of stocks in the index as well as the incremental collections/redemptions in the scheme.

If you want to take passive exposure to financial services excluding banking, you can consider investing in ICICI Pru Nifty Financial Services Ex-Bank ETF.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.