Domestic speciality chemical stocks are among those that have capitalised on China+1 theme over the years. Have the recent disruptions further accelerated their positive momentum?

Read on to know the complete analysis.

Indications from quarterly results

The latest quarterly results of domestic speciality chemical companies indicate that their volume growth has been continuing on the back of on-going capex cycle, despite a slowdown in some major economies. This indicates that they are able to increase their share in the global market (albeit on a low base), and remain well positioned to further tap the China+1 strategy of global companies.

Growth momentum intact

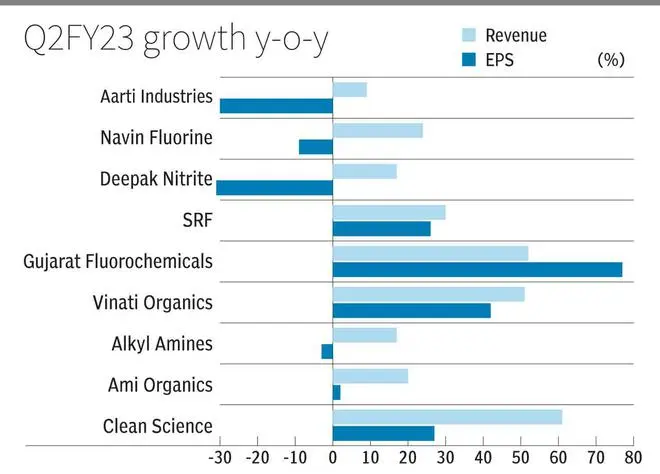

For our analysis, we have considered the top 9 companies (by market cap) in analysing the growth trends.

In line with its high growth label, the sector reported an average revenue growth of 30 per cent YoY (range of 8-60 per cent) in Q2 FY23. The sector passed on the increase in raw material costs (albeit partially) in the quarter. But growth continues to be driven by volume uptick, including capacities added by previous rounds of capex.

Their plans related to capital expenditure, including backward integration, downstream products and line extensions are seem to be in line with earlier commentaries, despite emerging recessionary fears in developed markets.

The cost pass through failed to fully protect margins though, as margin compression across most companies resulted in earnings growth (average of 11 per cent) lagging top-line growth.

For instnace, Navin’s HFO segment (hydrofluoroolefins) with high revenue visibility has started contributions in the second quarter. New generation refrigerant capacity (R32) will be expanded along with a dedicated plant for agrochemicals. The company expects to add further pharma customers with its fluorine-based APIs.

Speciality chemical major SRF’s planned capex of ₹3,000 crore per annum has been reiterated this quarter as well, which includes a new plant for agrochemicals and expansion in refrigerant capacities.

Vinati Organics’ one of two important products (ATBS) is expected to register a 50 per cent capacity addition along with improvement in utilisation from recently added capacity in the other segment (IBB).

Similarly, Clean Science, Deepak Nitrites and Gujarat Fluorochemicals are expected to add significant capacities with a view on either import substitution or high demand from export markets.

The supply diversification helps global companies in reducing their dependence on China, while it is also likely to result in supply bottlenecks for domestic companies too in sourcing reliable raw materials.

Navin Fluorine was impacted from supply disruption in Q2FY23, while SRF had only recently indicated lower costs of raw materials. Solvent and key intermediaries’ costs across different chemicals are only beginning to cool off when new round of Chinese disruption has emerged in late November. But this disruption may be transitory and impact margins (through high spot market costs), but will strengthen domestic speciality chemicals top-line outlook in the long run.

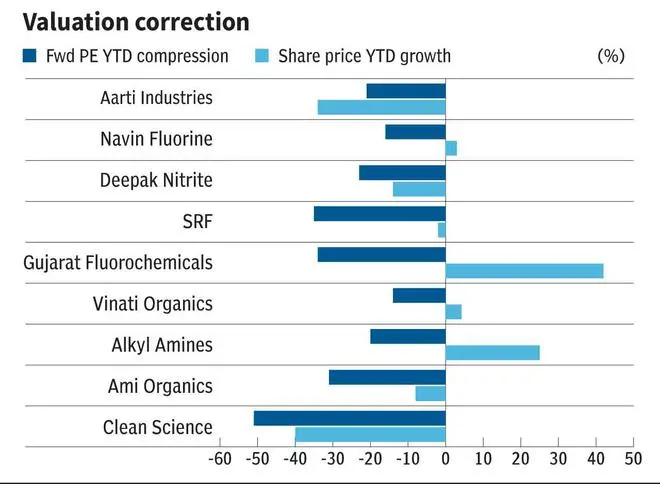

While Year-to-date valuations (measured as one year forward PE ratio) have corrected between 15-50 per cent, stock returns (between -40 to 42 per cent) have been flat on an average basis for the sector as a whole.

This may imply that volume driven FY23 earnings growth (and possible roll-over impact to FY24 estimates) is driving the growth in stocks, rather than multiple expansion.

Based on this, we reiterate our positive stance on companies scaling up the value chain (Navin Fluorine, SRF and Vinati Organics) with CDMO operations and strong relationship with end-users. From a long-term perspective, reasonable valuations in SRF, Aarti Industries and Gujarat Fluorochemicals that are trading at 25 times forward earnings, compared to 40-50 times earlier, offer a good entry point to the high growth sector.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.