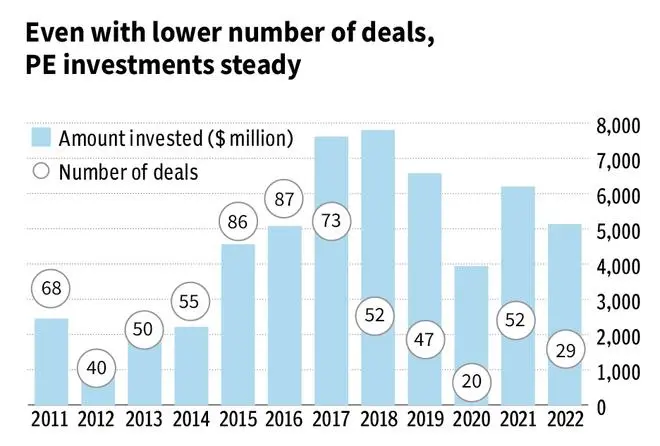

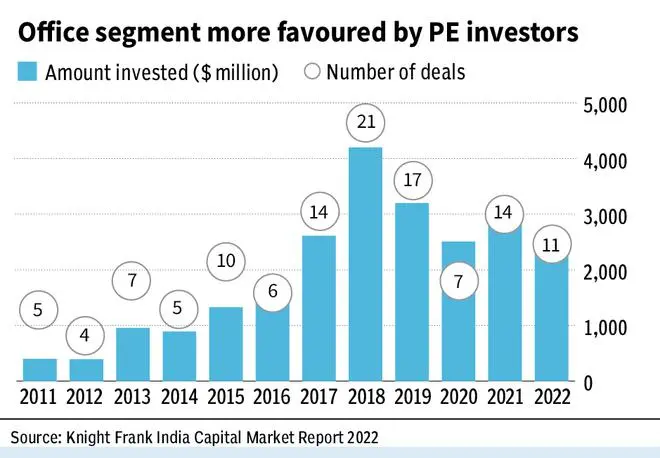

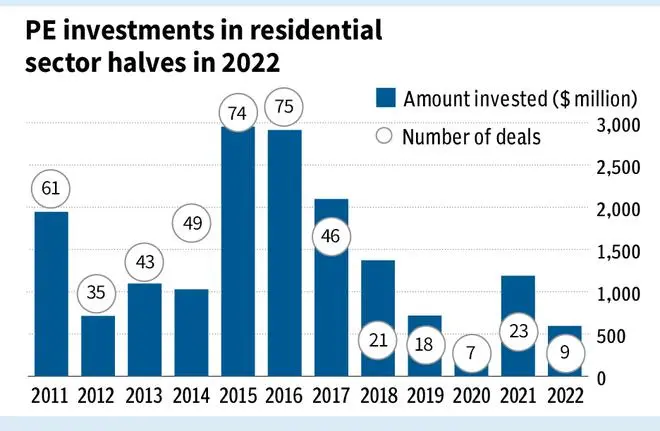

With the Indian real estate sector slowly reviving, 2022 has seen private equity (PE) investments amounting to $5,134 million ($5.1 billion) through 29 deals across office, warehousing, residential and retail sectors, as per a Knight Frank report. Equity is the dominant route, accounting for 95 per cent, while the share of debt is only 5 per cent. Office sector continued to remain the favoured asset class, while the residential space saw investments halving possibly due to rising inflation and higher interest rates.

Here are 4 charts that reflect the realities.

Holding steady

Though PE investments in the sector in 2022 witnessed a decline of 17 per cent YoY from $6.2 billion registered in 2021, the numbers are steady in the face of rising inflation, higher interest rates, and a cautious sentiment prevailing this year.

Preference for equity deals

Private equity investors have showed high preference for equity. This trend has been broadly held in the last 6 years. Debt deals had gained traction till 2016, but then equity route started becoming dominant. In 2022, equity share of PE investments in realty sector grew to 95 per cent.

Office sector

Office sector continued to remain the preferred asset class constituting 45 per cent of the total PE investments during 2022. The share of warehousing segment stood at 37 per cent, second highest after office. The sector recorded investments worth $2.3 billion in 2022 witnessing a decline of 19 per cent YoY.

Mumbai and Bengaluru recorded maximum PE investments in the office segment due to development stage transactions. Ready assets gained maximum share of investment with 66 per cent of investments, while 34 per cent of the investments were made in new and under-construction developments as investors remained cautious in 2022.

Slump in residential sector

The residential sector accounted for 12 per cent of the total PE investment recorded across asset classes in 2022. Investors preferred debt as they exercised caution due to rising interest rates. 87 per cent of private equity investment in the residential sector was received via foreign PE players. Mumbai and NCR led the PE investment in residential asset class due to development stage transactions by leading global players.

Exit trends

According to the Knight Frank report, the Indian real estate sector observed exits amounting to $9.8 billion from 250 deals across office, residential, warehousing and retail segments, generating an average IRR (internal rate of return) of 23.2 per cent.

Amongst the leading eight Indian markets, Mumbai, Bengaluru, and NCR jointly contributed 86 per cent to total exits observed from 2011 to 2022. PE exits in 2022 stood at $822 million, declining 41 per cent YoY from the peak exits of $1,392 million observed in 2021. The average deal size of exits grew significantly faster than the exit volumes, indicating higher valuations and growing appetite of investors to absorb higher value deals.

Exits via public market sale also observed an appetite for large exits, with an average size of exit reaching $155 million and $164 million in 2021 and 2022, respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.