A rising tide may lift all boats, but that maxim falls flat if you look at the Indian market’s ongoing record-breaking run. As the Sensex roared to a new all-time high by zooming past Mount 63K, in the process widening the outperformance gap over global peers, only a handful i.e., 63 stocks such as L&T, Axis Bank, ICICI Bank, SBI and Adani Enterprises are trading near their respective lifetime peaks (up to 5 per cent away).

This could explain why your portfolio may not be sparkling at a time when markets are pulling out all the stops in their gravity-defying performance. This is also a reflection of the extremely narrow nature of the rally since mid-June this year, chiefly on the back of select large-cap legs, while mid- and small-cap stocks are quite a distance away from getting high in this bull party.

Getting narrower

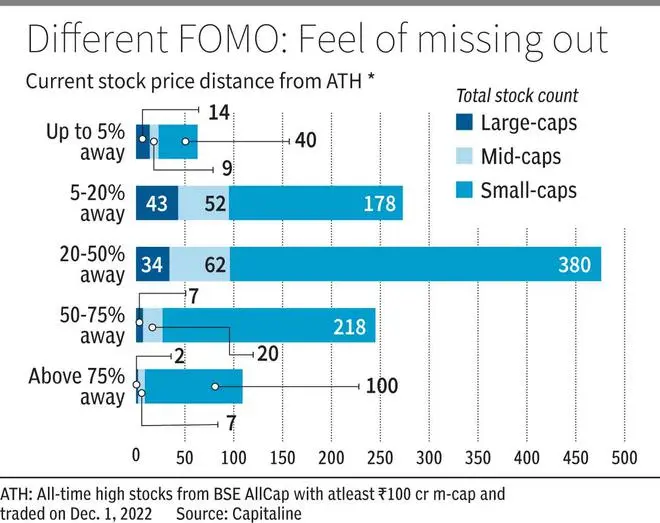

Considering BSE AllCap index stocks that have traded on December 1, 2022 and have a market capitalisation of at least ₹100 crore, the study considered 1,166 scrips.

At a time when Sensex is hitting new peaks almost every day, just about five dozen stocks, including the likes of Cummins, Britannia, Escorts Kubota and HAL, are close to their all-time highs. About a year ago when Indian benchmark indices had hit the then lifetime high, a higher 18 per cent of stocks were close to all-time highs compared to 5 per cent now.

Missing the bus

Currently, as many as 273 stocks (23 per cent) are 5-20 per cent away from their apex levels. The largest component of 41 per cent (476 stocks) of BSE AllCap constituents are at a good 20-50 per cent distance from their lifetime crown levels.

The most ironic is the case of 354 stocks, i.e., 30 per cent of this universe, which are more than 50 per cent distant from their respective all-time highs. Darlings of the 2000 and 2007 epic rallies, such as MTNL, 63 Moons, HFCL, Reliance Power, Subex and MMTC, are in fact 90 per cent away from those peaks.

Large-caps a tad better

Going by market capitalisation indices, the large-cap (Sensex) and the mid-cap (BSE MidCap) and the small-cap (BSE SmallCap) benchmarks are all trading at respective peaks. But dig a bit deeper and you can find, the stock level situation is vastly different.

Only 14 per cent of large-caps near their lifetime highs. As much as 43 per cent of large-caps are 5-20 per cent away from highs, while another one-third of stocks are 20-50 per cent lower than their peaks. About 9 per cent of large-caps, such as Zomato, DLF and Indus Towers, are trading more than 50 per cent away from all-time highs. Many PSU energy stocks like IOC, ONGC, Coal India, BPCL are also 30-55 per cent away from all-time highs.

Many small-cap and mid-cap stocks are still to play catch up. Just 4 and 6 per cent respectively of them are near record highs. Two-third of small-caps and over half of mid-caps are 20-75 per cent away from their peaks. The correction in Indian markets till June 2022 was brutal for smaller stocks, many of whom traded at frothy valuations. New-age firms have found the climb from lows a challenging task. Examples include PB Fintech, FSN E-Commerce, Delhivery.

Less-loved sectors

While most sectoral indices have soared to fresh highs during the year, a few such as real estate and IT are yet to surpass their lifetime highs. While the BSE Realty index soared to an all-time high level in the 2008 bull run, it is currently trading over 70 per cent lower. IT sector index, after a sharp correction post Covid rally, is 19 per cent below its peak.

Some exceptions to the trends exist in sectors. For instance, TCS and Infosys are down 10-15 per cent from peaks when Wipro’s distance from all-time high is over 40 per cent.

BSE Power, Healthcare and Utilities are all about 10 per cent away from their respective heights. Domestic-economy oriented sectors such as FMCG, Industrials, Auto and Banking are all trading at or near lifetime highs. But there is a whole bunch of PSU and private sector banks that are quite the distance from lifetime highs. This shows that as markets keep reaching for new highs, its only the exceptional stock pickers would have made merry.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.