After the meteoric rise in 2022, oil prices have been on a downward trend in 2023. Global crude oil prices have been on a falling spree over the last few weeks. The global financial crisis spurred by the Silicon Valley Bank collapse and trouble at Credit Suisse and First Republic Bank, among others, has dampened the energy outlook globally. Since March 2023 beginning, Brent Crude has declined by over 13 per cent to about $74 a barrel. Interestingly, the last time oil touched these levels was back in December 2021.

What does this mean for India and the Indian energy sector? Well, falling crude oil prices are certainly good news for India, given that the country imports over 88 per cent of its crude oil requirement. A fall in crude prices should ease the burden on the Indian government by way of lower spending on crude imports and foreign exchange reserves, which are depleting and also provide some comfort to the widening current account deficit.

Also read: Russian oil imports to India to hit a plateau

Oil producers

For Indian oil-producing companies – ONGC and Oil India – lower crude prices though will mean lower realisation on one end, however, a moderation in the windfall tax should also cushion against the decline in profits. Indian Government, this week announced a further reduction in the windfall tax to ₹3500 a tonne from ₹4400 a tonne (March 4). This has been reduced from ₹23250 a tonne on July 1, when the Government first introduced it; crude then was at about $110 a barrel.

Also read: ONGC identifies 70 sites for exploration

Historically, crude oil price above $60 per barrel has remained a healthy level for oil exploration and production companies.

OMCs and refiners

For refiners, historically, bumper years in terms of revenues and profits have been the years in which crude oil prices have been on an upswing. The reason is that the realisation on downstream products, such as petrol, diesel, etc., tends to increase in line with crude prices and thus helps companies clock higher refining and retail margins. Also, companies benefit from lower-cost inventories held by them – which translates into a one-time margin benefit.

Typically, during down cycles in energy prices, the refining margins tends to be lower, this in addition to inventory losses. Price correction phases has historically had an impact on the profitability of refiners and oil marketing companies. However, in addition to the crude prices and refining margins, the other key variable to monitor is the sale price of petrol and diesel.

Also read: India’s petroleum product exports at over $86 billion in April-February of FY23

Falling refining margins, along with moderation in the sale price of petrol and diesel, will be incrementally negative for oil marketing companies. While Brent prices have fallen from over $80 levels to $70 levels now, the petrol and diesel sale price in India has remained unchanged over the last few quarters. Interestingly, prices were not hiked even in Q1FY23, when crude prices soared to $120 plus levels, and thus a crude price of $60-70 a barrel should be quite comfortable for OMCs.

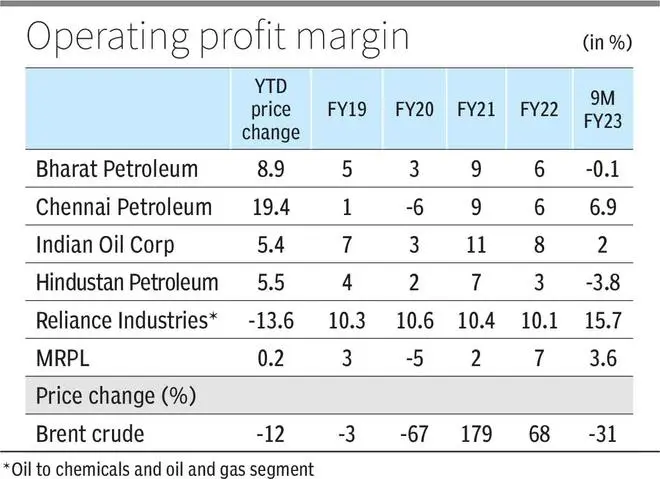

However, should the Government decide to pass on the benefit of lower crude prices to end customers, this will mean more trouble for oil marketers. Indian Oil Corporation accounts for 28 per cent share in the market, making it the largest in terms of refining capacity. In addition to size, IOCL’s margins traditionally have been higher than HPCL and BPCL. For instance, in FY21, the company’s operating profit margin was higher at 11 per cent and interestingly crude trebled that year from $22 a barrel to $62 a barrel. The operating margins for BPCL and HPCL was at 9 per cent and 7 per cent, respectively. In a falling oil price regime, IOCL’s margins also witnessed significant reduction.

Also read: Indian Oil Corporation floats new unit for clean energy business

Earlier in 2020, when crude oil prices (Brent) crashed by 67 per cent over covid-19 fears, IOCL’s operating profit margin fell to 3 per cent, from 7 per cent in FY19. However, operating margins have still been better than peers, such as Hindustan Petrochemicals. That said, Bharat Petroleum’s performance has been comparable to that of IOCL, in years when crude has corrected. The company has managed to contain the downside better during bad times.

For Chennai Petroleum, the sensitivity of the operating margin to crude price fall has been higher in the past, given that the company is a pure-play refiner. In the last nine months, the company enjoyed margins better than that of IOCL, BPCL and HPCL, given the higher prices prior to the recent decline, as well as it did not have any marketing losses. Now, with a fall in crude prices, margins are bound to moderate.

For Reliance Industries, the refining margins have been impacted largely on account of special duty (windfall) given that their exports are significant. Also, given that the company has a negligible retail presence (petrol/diesel retail outlets), the margin impact is not as significant as that of OMCs.

Also read: Reliance Industries to re-auction gas in line with new government rules

That said, the game-changer for OMCs would be to see if the Government will budge to inflationary pressure and reduce fuel prices. This, if happens, can lead to further decline in profits and also add to the pressure on OMC stocks. However, should the Government decide to hold retail prices for now, that will ease the pressure on profitability and partly compensate for lower refining margins. However, for pure-play refiners, such as Reliance Industries and CPCL, the impact of falling crude will be visible in their Q4 FY23 and Q1 FY24 performance.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.