In the past week the benchmark indices, Sensex and Nifty 50 inched down about 0.2 per cent each respectively. Sectoral indices report card was mixed with, Auto, Healthcare and Oil & Gas down 0.6 per cent each while Capital Goods (1.9 per cent), Power (1.5 per cent), Teck (1.4 per cent), IT (1.2 per cent), and Bankex (1.1 per cent) ended in the green.

Among the BSE 500 stocks, winners dominated (311 scrips). The top gainers with fundamental news driving the shares were Linde India, GMR Airports and Suzlon Energy.

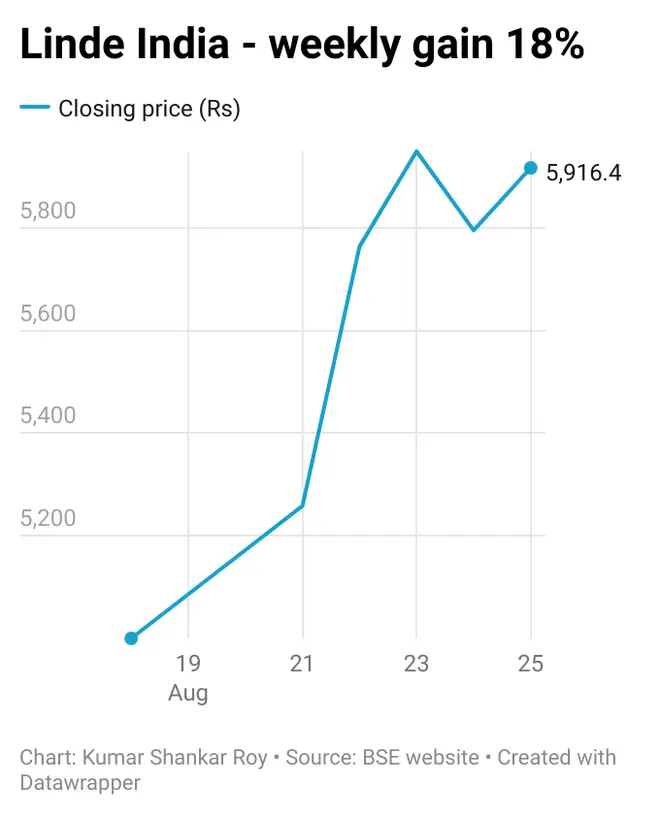

Linde India

The stock of industrial gases company, Linde India returned 18 per cent for the week ending on August 25, 2023. The highest single day gain of the stock (9.6 per cent) was on August 22, 2023 amidst key order wins. On that day, the company announced it has been awarded a ‘Letter of Acceptance’ by Indian Oil Corporation Limited (IOCL) in connection with the job-work contract for setting-up of Air Separation Unit (ASU) on a site licensed by IOCL within its Panipat Refinery Complex. This was for production and supply of Instrument Air, Plant Air and Cryogenic Nitrogen to IOCL Panipat Refinery Expansion Project (P25). Linde India is also expected to enter into requisite agreements with IOCL for operating and maintaining the facility for a period of 20 years from the first delivery date.

Then, on August 25, the company announced it has been awarded a ‘Letter of Acceptance’ by Steel Authority of India (SAIL) for installation of 1000 tonnes per day Cryogenic Oxygen Plant on Construct, Operate and Maintain (COM) basis for a period of 20 years from the date of commissioning of the plant and ancillary facilities with provision of renewal for a further period of 5 years on mutual agreement basis at the SAIL’s plant situated at Rourkela. For both orders (IOCL and SAIL), no financial details are available.

The trailing 12 months PE of Linde India, with a m-cap of Rs 50,451 crore, is 126.1 times whereas the price to book ratio of the company is 16.1 times. The stock has gained nearly 77 per cent in last one year, outperforming smaller industrial gas peers such as Gagan Gases, Bhagwati Oxygen, Bombay Oxygen Investments and National Oxygen.

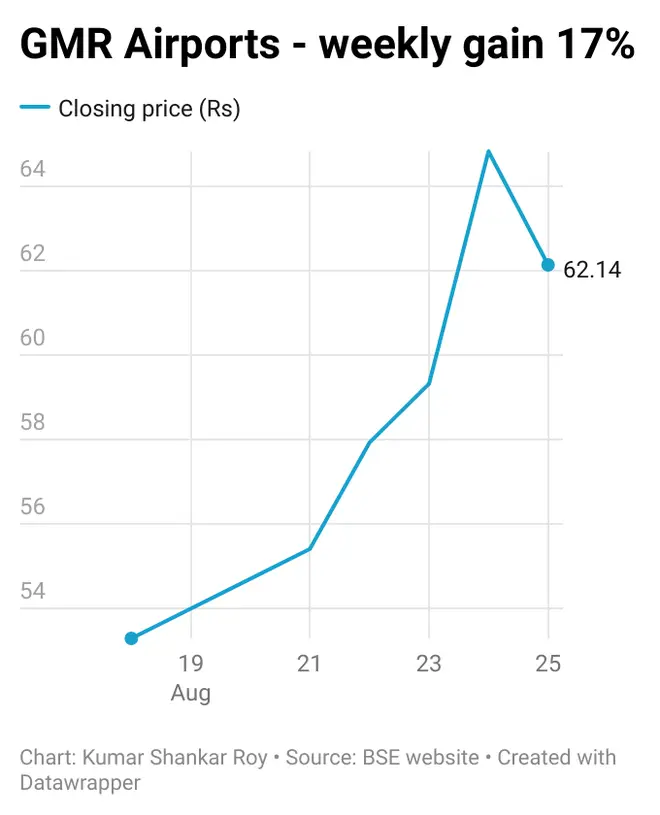

GMR Airports Infrastructure

Formerly GMR Infrastructure, private airport operator GMR Airports Infrastructure gave nearly 17 per cent return for the week ending on August 25, 2023, reaching 13-year highs. The highest single day gain of the stock (9.3 per cent) was on August 24, 2023. The main reason for the rally in the stock was the improved June 2023 quarter results and positive sentiment around July-2023 monthly traffic data.

The company had reported robust performance at Hyderabad & Delhi airports in Q1FY24, with Hyderabad airport handling highest-ever quarterly passenger traffic. Gross revenue for the company increased 40% YoY to Rs 2,018 crore in Q1FY24 and EBITDA rose 77% YoY to Rs 753 crore in Q1FY24. Profit after tax from continuing operations was Rs 15 crore, from Rs 623 crore loss in Q4FY23 and Rs 115 crore loss in Q1FY23. Besides, the company communicated steady progress on the merger of its subsidiary GMR Airports Ltd (GAL) with GMR Airports Infrastructure Ltd (GIL), commencement of international operations at Mopa (Goa) airport, receipt of Rs 631 crore from NIIF partnership in Mopa airport, divestment of 8,18,000 sq. ft. warehouse facility located at Hyderabad airport, etc.

Further July-2023 traffic data showed 30% rise in passenger traffic at airports and 17% jump in aircraft movements, which enthused investors.

The trailing 12 months PE of the company, with a m-cap of Rs 37,543 crore, is in negative due to quarterly losses but the price to book ratio of GMR Airports is 38.8 times (high in the industry). The stock has gained nearly 85 per cent in last 1-year period, outperforming BSE Infrastructure index (up 20.2 per cent).

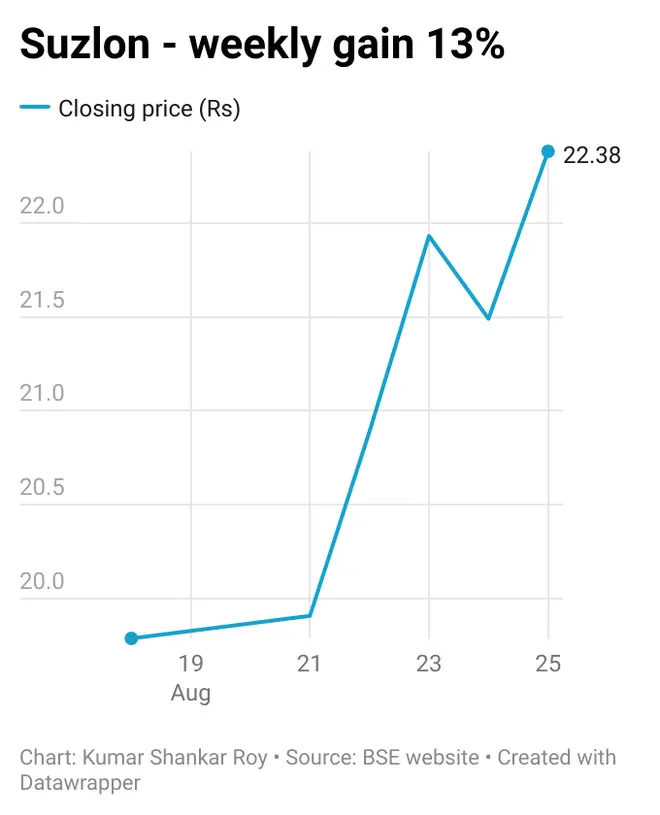

Suzlon Energy

The stock of Suzlon Energy returned 13 per cent for the week ending on August 25, 2023, carrying the momentum after the renewable energy solutions provider raised Rs 2000-crore via QIP route. The highest daily gain of the stock (nearly 5 per cent) happened twice viz. August 22 and 23, 2023. The main reason for the rally in the stock seems to be order wins (financial details not disclosed).

On August 24, Suzlon announced a new order win for the development of a 31.5-MW wind power project for Integrum Energy Infrastructure, wherein Suzlon will install 15 units of their S120 – 140m wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 2.1 MW each in Maharashtra and Karnataka. The project is expected to be commissioned in May 2024. Suzlon will execute the project with a scope of supply, installation, and commissioning. Additionally, Suzlon will offer post‐commissioning operation and maintenance services.

On August 25, Suzlon informed exchanges that it has bagged a significantly large new order acquisition for its 3 MW series of wind turbines from Teq Green Power XI Private Limited, part of O2 Power Private Limited. Suzlon will install 64 of its largest wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 3.15 MW each for the 201.6-MW wind power project. The project is expected to be commissioned in 2025. Here too, Suzlon will supply the wind turbines (equipment supply) and execute the project including erection and commissioning, and also provide operation and maintenance services post‐commissioning.

The trailing 12 months PE of the company, with a m-cap of Rs 30,465 crore, is 54 times (below industry median) whereas the price to book ratio of the company is 25.4 times (high in industry). The Suzlon stock has sharply risen by 179 per cent in last 1-year period.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.