The Power Ministry has scheduled tenders of around 50 GW annually of renewable energy for the next five years, to achieve the target of 500 GW of non-fossil fuel capacity. Alongside the government’s thrust on ramping up renewable energy capacity, building incremental thermal capacity has also been a priority. This is because energy security has become an important issue with consistent increase in demand in recent years; power demand is now at all-time high/peak levels.

PSU thermal major NTPC appears to be well-placed to capture both themes — energy transition and energy security.

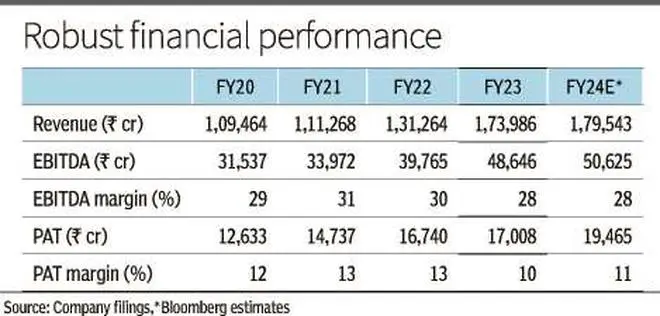

Since our accumulate rating on NTPC in bl.portfolio dated August 13, 2023, the stock has gained around 48 per cent. This has been majorly on account of growth in earnings as well as re-rating in the stock from the trailing P/E of around 10 times then, to 12 times now. During FY23, the company’s revenue increased by around 32 per cent. While there was flattish growth in PAT during the period on account of increase in fuel cost, the same grew nearly 30 per cent YoY in H1FY24. NTPC is now trading at a one-year forward P/E of around 11 times, which is around 35 per cent higher than its historical five-year average P/E of around 8.2 times.

The re-rating in the stock has happened mainly due to company-specific and industry-level structural positives (which justify current premium to historical average) and the company’s aggressive capacity addition plans. We maintain our postive stance on NTPC and investors can continue to accumulate the stock on account of growth plans in place, along with the strong revenue and earnings visibility due to assured return model. Further, it is offering a decent dividend yield of around 3 per cent.

Business

NTPC earns majority of revenue from sale of power generated from thermal-based generating stations. More than 90 per cent of its revenue is tied to long-term power purchase agreement (PPA) under cost-plus based tariff regime, which ensures pass-through of costs such as plant capacity charge, supplementary capacity charge (emission control system cost), interest on loan, interest on working capital and energy cost (fuel) and allows ROE (Return on equity) of 15.5 per cent over and above these costs.

The complete recovery of capacity charges is allowed when the plant shows technical availability (plant availability factor) over and above the normative level i.e. typically 85 per cent wherein the plant should be technically available to generate power with sufficient coal in place. However, do note that pass-through is allowed subject to normative parameters and provisions defined in the PPA.

NTPC has assured coal supply, given its long-term fuel supply agreements (FSAs) with Coal India Limited (CIL) and Singareni Collieries Company Limited (SCCL) for supply of coal for 20 years for total Annual Contracted Quantity (ACQ) of 183 MTPA. Further, the company has captive coal mining with capacity of 71 MMT.

Recent performance

During H1FY24, the company reported PAF (plant availability factor) in its coal-based generation stations to the tune of 93.32 per cent as against 92.05 per cent in H1FY23. Further, PLF (Plant Load Factor) i.e. capacity utilisation for the period has been 76.62 per cent against 77.27 per cent in the last year and national average of 68.75 per cent. The company reported a YoY increase in generation of around 4 per cent, reaching 212 billion units (BUs) in H1FY24. Coal supply during H1FY24 was 113 MMT, including 4 MMT of imported coal. The coal consumption during the corresponding previous period was 112 MMT, including 10 MMT of imported coal.

The company has reported flattish revenue growth in H1FY24 reaching close to ₹88,058.44 crore. This has been on account of shutdown in certain plants due to repair work and grid restrictions, which is expected to improve, going forward, in the upcoming quarters, as per the management. The company saw a YoY growth of around 18 per cent in EBITDA reaching ₹25,091 crore and thereby EBITDA margins expanded from 25 per cent to 29 per cent on a YoY basis. This has been mainly on account of lower fuel cost due to reduced share of imported coal. The imported coal price rose steeply in FY23, the pass-through of which might not have been allowed completely, which resulted in decline in margins in FY23.

Growth triggers in place

NTPC plans to have 130 GW of installed power generation capacity comprising 60 GW of renewable energy from the current level of 3.3 GW. While this is quite a long-term target, in the near term, NTPC plans to add 15-16 GW of renewable energy by FY26. Currently, around 7.7 GW of RE capacity is under construction and 11 GW under different stages. Further, as all-time high peak power demand makes the case for having thermal-based capacity as an energy security, NTPC plans to add 10-11 GW of thermal-based capacity by FY26. The target for the same has been raised from 7 GW earlier. This will imply capacity growth during FY23-26 to the tune of 10-11 per cent CAGR from the current levels.

The management has given the guidance of capex to the tune of around ₹28,373 crore for FY24. For FY25 and FY26 it will be on similar lines while capex will shoot up on account on growth in renewable-related capex post then as per the management.

During our previous call, we highlighted that NTPC was attempting to monetise its stake in its renewable energy arm NTPC Green Energy Ltd (NGEL) by way of selling stake to a strategic partner. However, during Q1FY24 earnings call, management highlighted that the company is now looking to unlock value by way of IPO rather than onboarding strategic investor. However, the timeline is not yet certain as it will depend on market-based factors and within how much time substantial RE capacity is there on the ground.

The company has a D/E of around 1.24 times as on H1FY24 and can, on account of its stable business model, access debt at a cheaper rate as compared to private power generation companies. The reasonable D/E gives NTPC scope for further debt financing to fund its capex requirements.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.