Domestic benchmarks NSE Nifty and BSE Sensex rose nearly 1.36 per cent and 1.02 per cent, respectively on the back of FII net inflows for five straight sessions last week.

All the sectoral indices closed the week in green. BSE IT (3.69 per cent), BSE Healthcare (3.28 per cent) and BSE FMCG (3.10 per cent) were best performing sectoral indices last week.

Among BSE 500 stocks, Adani Enterprises, Dixon Technologies and Suzlon Energy were the best performers during the week.

Adani Enterprises

The stock of Adani Enterprises gained the most at around 30 per cent due to two reasons.

One, the shares of the company jumped around 19 per cent on Monday as the Supreme Court appointed expert committee has concluded that it would be difficult to point to a regulatory failure on the part of SEBI, providing some relief to investors. The committee was appointed by the apex court following the Hinderberg Research allegations against the Adani Group.

Two, the stock further moved around 13 per cent on Tuesday after the US-based global investment firm GQG Partners increased its stake in the Adani Group to 10 per cent. According to Rajiv Jain, CIO, GQG Partners, the asset management firm made the move on account of comfortable valuations, healthy growth potential and faith in the company’s management.

The stock is currently trading at a trailing EV/EBITDA of 37.38 times.

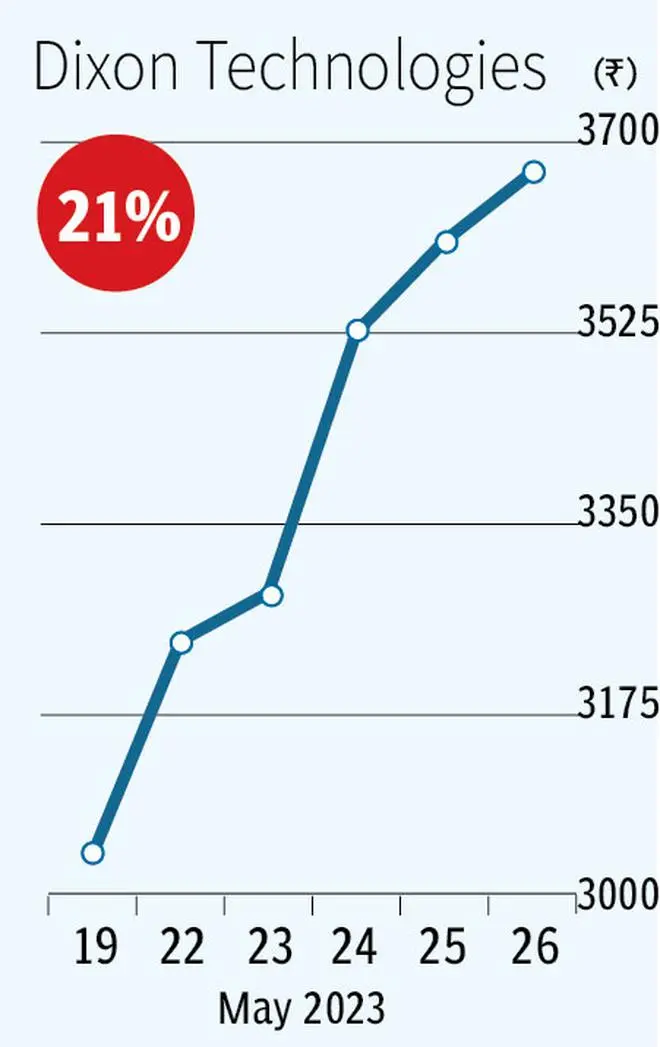

Dixon Technologies

The stock of Dixon Technologies rallied close to 21 per cent on account of its robust quarterly results.

Dixon Technologies is a contract manufacturer of consumer durables, lighting products, and mobile phones.

Dixon Technologies announced its Q4 FY23 results on May 23, 2023. The results have beaten the Bloomberg consensus estimates on all fronts. The company’s Q4 FY23 revenue grew 4 per cent, while the EBITDA margin expanded to 5.1 per cent from 4 per cent y-o-y. Management has mentioned that price hikes, cost optimisation and easing of commodity prices aided growth in margins.

The stock of Dixon Technlogies is currently trading at an EV/EBITDA of 42.91 times.

Suzlon Energy

The stock of wind turbine manufacturer Suzlon Energy gained around 18 per cent on the back of a major order win from Torrent Power Ltd for development of a 300MW wind power project.

Suzlon group on May 24, 2023 announced that it bagged a significantly large order for its new 3 MW series of wind turbine. Suzlon will install 100 wind turbine generators with a hybrid lattice tubular tower and a rated capacity of 3 MW each.

The project is located in Karnataka and is expected to be commissioned in 2025.

The stock of Suzlon is currently trading at an EV/EBITDA of 17.63 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.