FY23 was quite a turbulent year for the cement industry, mainly due to increased cost of power and fuel. This led to higher input cost and reduced margins, although demand remained steady.

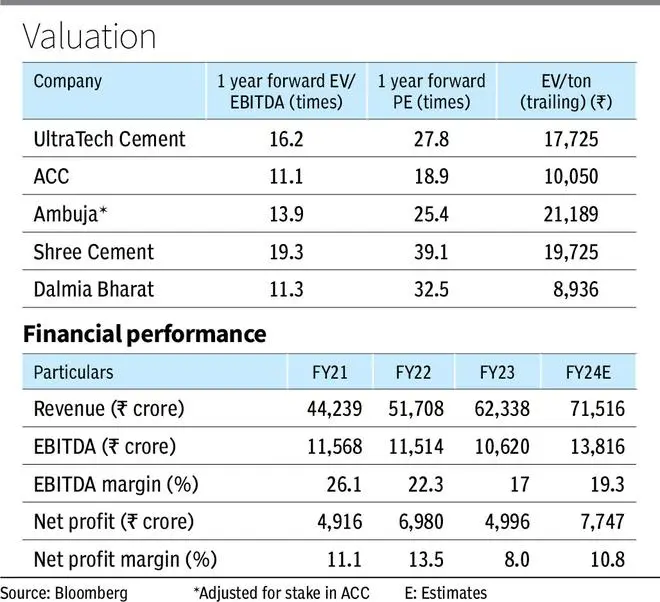

However, the stock of India’s leading cement player, Ultratech Cement, has recovered 59 per cent from its lows in FY23. This is on optimism driven by long-term demand growth and recovery in margin in recent quarters. The stock now trades at a one-year EV/EBITDA of 16.4 times against its 5-year average of 15.2 times. The one-year forward PE is 28.2 times against 5-year average of 28.8 times. Although peers such as ACC and Ambuja Cement are trading at lower multiples, the higher capacity and all-India presence are Ultratech Cement’s competitive advantages.

Long-term investors can continue to hold the stock, given balanced risk reward in terms of growth prospects and current valuation.

Business and prospects

Ultratech Cement is the largest cement producer in India, with capacity of around 138 million tonnes per annum as on September 30, 2023. The company is planning capacity expansion of 22.6 million tonnes by June 2025. . Towards this, it augmented capacity by 2.5 million tonnes in September 2023 quarter; of this 1.3 million tonnes was added in West Bengal and remaining 1.2 million tonnes by way of debottlenecking. Beyond the above mentioned 22.6 million tons, the board has also approved ₹13,000 crore for third phase of growth where it plans to add 21.9 million tons capacity. This will be funded through internal accruals.

The company has manufacturing and distribution network in all the markets of India — North, East, South, West and Central. Ultratech Cement, being located across the country, has better reach than its peers and can drive better volumes.

The consolidated volume rose 16 per cent YoY to 27 million tonnes in September 2023 quarter. The demand outlook seems robust with an expected CAGR of 8-9 per cent for FY24-FY26. In addition to the government infrastructure spending, the housing segment (both rural and urban) is expected to see a consistent demand expansion. The trade sales in September 2023 quarter were 67 per cent and remaining was non-trade sales. Trade sales are what the company sells to distributors who then sell it to consumers while the non-trade sales refer to the sales made directly by factory to the consumer. The rural sales were 63 per cent of trade sales, which is a 15 per cent growth sequentially.

Pan-India cement prices have gone up 7-8 per cent from the end of June 2023. The current prices in regions compared from June end are — Eastern markets are up 7-8 per cent, Southern market is 5-6 per cent up, Northern market is 6-7 per cent up, central market is flat compared to June end and western markets are up 7-8 per cent. The management believes that the prices should hold unless some competitors are not able to sell at a higher price and they start behaving differently in the markets.

Reducing input cost to aid profitability

The price of fuel has been coming down from second half of FY23 and at significantly lower levels now than it was in first half of FY23. EBITDA per tonne in September 2023 quarter grew 17 per cent YoY to ₹1,059 per tonne.

The cost of imported coal in October 2023 is around $136 per tonne while it was $405 per tonne in October 2022. The cost of imported petcoke in October 2023 is around $127 per tonne (35 per cent lower on YoY basis) whereas the domestic petcoke currently costs ₹13,660 per tonne, which is 25 per cent lower YoY.

The blended fuel consumption cost of the company in September 2023 quarter was $162 per tonne against $200 per tonne in September 2022 quarter. The power and fuel cost of the company decreased 10 per cent YoY to ₹1,555 per tonne during September 2023 quarter. The logistics cost also reduced 2 per cent YoY to ₹1,219. The other costs of the company were flat YoY at ₹862 per tonne.

Financials

In Q2FY24, the consolidated revenue was ₹15,735 crore, which is 16 per cent higher YoY. EBITDA in this period was ₹2,718 crore, which is 35 per cent higher YoY. EBITDA margin was 17.3 per cent, which is around 250 basis points higher YoY. Net profit during September 2023 quarter was ₹1,281 crore (69 per cent higher YoY.) Net profit margin in September 2023 was 8 per cent, which is around 258 basis points higher YoY.

The company has a strong balance sheet, with low net debt at ₹7,263.8 crore and FY24 Net debt to EBITDA estimated at a comfortable 0.52 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.