UltraTech Cement announced its latest quarterly results on Wednesday.

In the September ended quarter, the cement major managed to beat the consensus on revenue front but failed to meet the EBITDA estimates by a small margin.

Revenue grew by 16 per cent to ₹13,596 crore, beating consensus (Bloomberg) expectation by 1.83 per cent, while the EBITDA was pegged at ₹2,013 crore, missing the consensus estimate by around one per cent. The PAT of the company was ₹756 crore.

Margins under pressure

During the reporting period, the volumes grew seven per cent year-on-year to 23.10 million tons.

The capacity utilisation in Q2 FY23 was 76 per cent. Premium products contributed to 18.8 per cent of total sales and the RMC business grew 29 per cent year-on-year.

Despite a growth in volume and revenue, the company failed to maintain profitability due to a rise in the prices of energy that grew 58 per cent year-on-year.

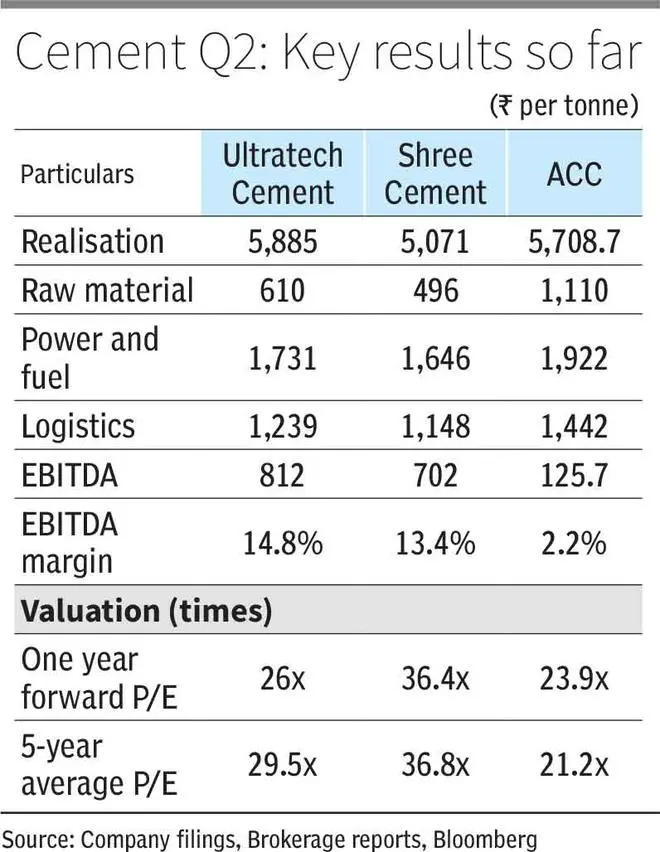

The EBITDA margin declined around 10 percentage points to settle at 14.8 per cent in the reporting period against 24.3 per cent in Q2 FY22.

The cost of energy was a spoilsport and dented the profitability of the company. The data show that power and fuel accounted for 32 per cent of the total sales in the last quarter against 21 per cent in Q2 FY22, a steep rise of 11 percentage points.

Valuation and outlook

The stock price of UltraTech Cement has corrected by around 22 per cent since its peak recorded in November 2021. It ended the previous trading session (October 19, 2022) on a positive note as it recovered from a low after the announcement of results.

Ultratech is trading at a one year forward P/E of 26x (5-year average 29.5x).

High energy prices will continue to affect the profitability of the company in the coming quarters. However, on the positive side, the demand growth prospects in the coming months look relatively good.

The growth is expected to be led by the infra segment which accounts for nearly 25 per cent of demand and the increased government capex is also expected to drive demand for cement companies.

Besides, retail housing projects, including rural housing, are expected to pick up.

bl.portfolio’s verdict

While demand prospects are good, overhang of cost pressures and concerns on spill over effects of global slowdown on Indian economy will remain headwinds for the company.

We maintain our hold recommendation given in our bl.portfolio edition dated March 06, 2022.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.