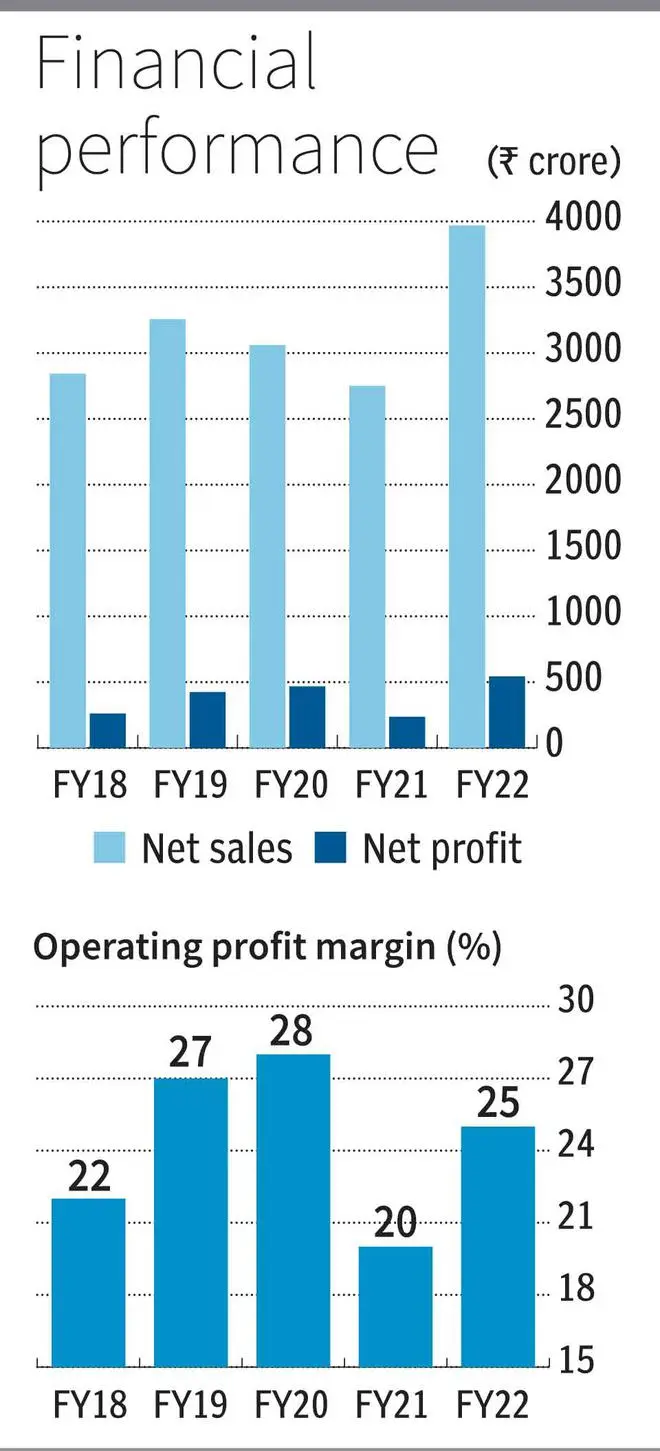

Investors with a two-year investment horizon can consider investing in the stock of paper manufacturer JK Paper. Among the worst affected sectors post Covid lockdown, the fortunes of the Indian paper industry have steadily improved in the last one year, from the FY21 lows. Demand pick-up, coupled with higher realisation, has helped the company’s strong performance over the last few quarters and the same is expected to continue over the next couple of years as well. The stock currently trades 6.4 and 5.7 times its consensus FY23 and FY24 estimated earnings. On a trailing twelve-month earnings basis, the stock trades 9.3 times, compared to 14.6 times for the industry.

We believe JK Paper to be a good diversification bet for investors with a moderate risk appetite, for five reasons.

Scale and expansion

First, JK Paper is the largest integrated paper manufacturer in the country with an annual capacity of over 7.6 lakh tonnes of paper. The product portfolio includes coated paper (used for catalogues, colour books, calendar, and brochure, amongst others), printing-writing paper and boards. The company operates three integrated pulp and paper units spread across Western, Eastern and Southern parts of the country. Its JKM unit in Rayagada (Odisha) with a capacity of 3.15 lakh tonnes is the largest in India and the company achieved utilisation of 110 per cent in FY22. CPM Unit at Songadh (Gujarat) houses the board manufacturing unit, wherein the company recently added Virgin Packaging Board unit with a capacity of 1.7 lakh tonnes per annum, resulting in a total board capacity of 2.7 lakh tonnes per annum and overall capacity (including other products) of 3.1 lakh tonnes at this facility. The total capex for this expansion was ₹1,950 crore and commercial production commenced in January 2022.

The third unit is SPM located at Kagaznagar, Telangana, wherein the company manufactures coloured paper, maplitho and copier products, and has a total capacity of 1.36 lakh tonnes.

JK Paper is also diversifying into the corrugated packaging segment, with a green field project at the Hi-Tech Cycle Valley, Ludhiana, undertaken through JKPL Packaging Products Limited, a wholly-owned subsidiary formed for this purpose. The expansion, which will cost ₹170 crore, is likely to come on stream by the end of FY23.

The new expansion in the packaging segment, coupled with full benefit of the virgin packaging board capacity expansion at CPM unit and increase in utilisation from about 85 per cent to 95 per cent at SPM unit, should drive the revenue growth for JK Paper over the next two years.

Secured raw material

Second, the company has been practising social forestry in areas surrounding its manufacturing facilities. This has enabled it to procure a significant portion of its raw material from within a 200-km radius of its manufacturing units. Every year the company ensures plantation of 30-40 per cent more than its consumption, with a view to ensuring sustainable raw material availability. For instance, in FY22, a further plantation on 44,500 acres was completed by the company, higher than the usage of 30,000-35,000 acres.

Third, the company will be deleveraging its balance sheet in the current fiscal, thanks to the strong performance in Q1FY23 and expectation of sustained performance in FY23. With no major capex planned for the next two years, JK Paper is looking to retire ₹325-350 crore annually over the next two years. As of June 2022, the company’s total debt stood at ₹3,035 crore debt and cash in the books was over ₹900 crore, translating into a net debt of ₹2,135 crore. The net debt as of March 2022 was ₹3,046 crore, implying a reduction of ₹900 crore, quarter-on-quarter. Deleveraging should further boost the company’s profitability over the next two years.

Four, the company, being a leader in the paper industry, enjoys best-in-class operating margins. In June 2022, the company’s operating margin stood at 30 per cent, which is the highest among paper manufacturers. This is thanks to its superior product mix, backward integration for raw material and ongoing cost saving initiatives. The management is confident of maintaining its operating margin at the current levels in FY23.

Five, the sector tailwinds, such as the new education policy, the strong growth in demand for packaging boards with e-commerce penetration and sustained growth in user industries such as pharma and FMCG, should help keep paper demand robust, in the near to medium term. Opening of offices and schools has already had a positive rub-off onpaper demand and price, with the wholesale price index gaining by 14 per cent in FY22. Also, the cyclicality in the business has not been there in the last few quarters, according to the management, signalling sustained demand environment.

Besides these, the new import policy for key paper products has been changed from free, to free-with-mandatory registration under the Paper Import Monitoring System.This will allay any concern over dumping of cheaper paper into India and will ensure stable pricing environment for domestic paper manufacturers.

During April-June 2022, the company reported 116 per cent increase in revenue to ₹1,430 crore, and a whopping 153 per cent increase in net profit from ₹104 crore in 1QFY22 to ₹264 crore. Demand pick-up and higher realisation aided this. While the management is confident of sustaining the current margin run rate, the only risk to the performance may be higher raw material prices, particularly of caustic soda and power and fuel costs.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.