Since our last buy call on Zee Entertainment Enterprises (Zee) in July 2021, the stock is up by around 18 per cent. In the interim it had rallied by as high as 80 per cent, on announcement of merger with Sony Pictures (SPNI) and progress relating to that. The stock has however cooled off since its highs in December 21. Broader market volatility, arbitrage and tactical investors possibly exiting as benefits relating to merger were getting discounted (while there were still some uncertainties on the deal then) at those high levels in December 2021, and some weakness in quarterly results may have been reasons for correction in the stock from peak levels. Weakness across the board in media stocks which are sensitive to ad revenues which will be impacted in case of any economic slowdown is also a factor.

However in our view the long term opportunity for the combined Zee-SPNI remain attractive. This combined with inexpensive valuation of ZEE presents an opportunity for investors. The stock currently trades at one year forward PE of 16.3 times and EV/EBITDA of 10.7 times, versus its 5 year average of 19.8 times and 12.5 times respectively. Its profitability is currently impacted by its streaming business which is currently loss making, adjusting for that, its valuation multiples would be even cheaper and more attractive.

Based on consensus estimates, its earnings are likely to see strong traction with a FY22-24 EPS CAGR of a solid 28 per cent. These estimates as of now are for the individual company and do not factor the prospects of the combined Zee-SPNI. Scope for growth and profitability is even better as a combined larger company benefits from revenue as well as cost synergies.

Hence investors with a long term perspective can buy the stock. The stock has good potential to outperform and yield good returns in the long term driven by a combination of valuation rerating and tapping the business opportunity in the still underpenetrated Indian media sector. Further ZEE has also had some corporate governance overhang in the past due to leverage issues pertaining to promoter group (although they are minority shareholder now with mid-single digit per cent stake). While these promoter related issues are largely behind and have been addressed well by them, markets still do not appear to be fully convinced and this has also impacted its valuation multiples. This too will get addressed conclusively with the merger as Sony comes on board and becomes the majority shareholder.

However investors must note that a minimum 3 year perspective is required before investing as rerating will happen over a period of time. While conclusion/nearing conclusion of the merger (subject to approvals) could be a catalyst for some immediate rerating, successful integration which will take time is required to tap the full potential. Further there may also be impact in the interim from slowdown in global economy, which will have spill over effects in our domestic economy and markets as well.

Zee management is hopeful of concluding the merger by October (stock exchange approval was received last week).

Prospects for combined company

On conclusion of merger, ZEE-SPI will become one of the leading entertainment company in India on par with Star/Disney. The combined entity will have 75 channels and revenue of around $1.8 billion (around 55 per cent contribution from ZEE). It will have strong presence across different categories of entertainment and sports as well as in regional presence across the country.

Besides traditional television, the combined entity will also have a strong presence in the OTT space and will be much better positioned to take on the likes of Amazon, Netflix, and Disney/Hotstar. The combined company will have a large library of content to tap from. Ever since streaming (as the way to consume entertainment) started becoming a dominant theme, the mantra for success has shifted in favour of ‘content+ scale’ is king versus the earlier ‘content is king’. This is because the streaming business model depends less on advertisement revenue, and more on having a large number of subscribers and keeping them locked-in for many years, preferably forever. The pay-off for the streaming business is more back-loaded as operating leverage kicks in once the subscriber base reaches a certain scale.

Thus, the merger besides giving a thrust to traditional business of ZEE, sets it up well for a digital future.

Recent performance

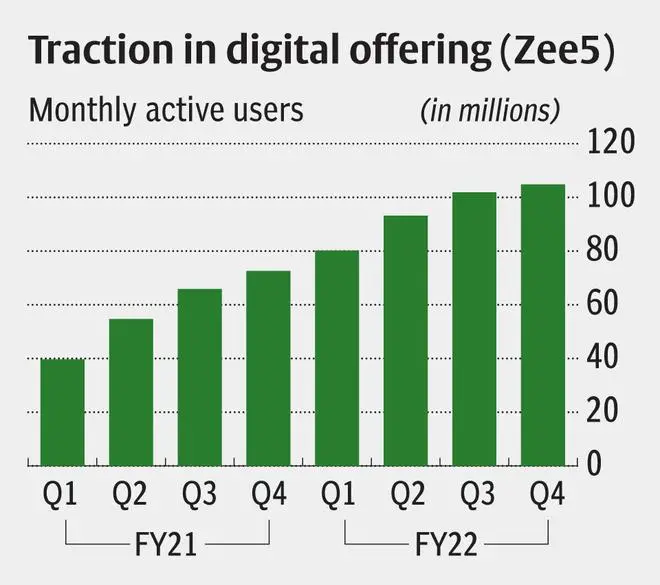

Zee’s operational performance was stable to better during FY22. While its network viewership market share was largely steady at around 17 per cent during course of the year, it has done well in its streaming business. Monthly active users for its digital offering scaled up to 105 million in Q4 of FY22 versus, 72.6 million in Q4 of FY21.

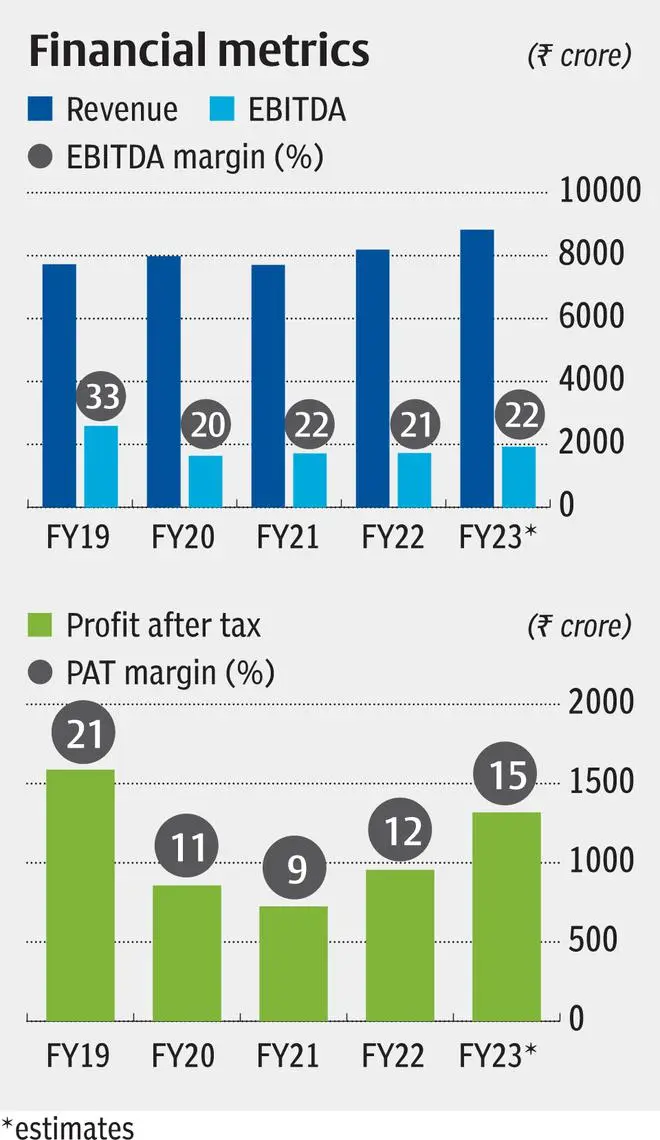

For the year, it derived around 55 per cent of revenues from advertising, 40 per cent from subscription (cable/dth/OTT) and balance from other sources like film production/distribution. For FY22 it reported revenue of ₹8,189 crore, EBITDA of ₹1,722 crore and PAT of ₹956 crore. This represented Y-o-Y growth of 14.1 per cent, 1 per cent, and 32 per cent respectively.

While revenues rebounded from covid impacted FY21, EBITDA was muted as the company focussed on investments in streaming business. The digital business reported negative EBITDA of ₹753 crore (while revenue was at ₹549 crore). This gives an idea of to what extent current earnings are getting suppressed due to investments in digital business (although exact impact may vary depending on inter-segment eliminations at a consolidated level). PAT was better mainly due to impact of few non-operating items. Consensus expectations is for performance to get better in FY23 with current estimates implying 8 per cent growth in revenue, 22 per cent in EBITDA and 38 per cent in EPS. This may of course change depending on timing of merger conclusion.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.