Alkem Laboratories (Alkem) has initiated several growth platforms but has done so at a conservative pace, staying true to its company philosophy. But even so, FY23 will be a tough period for the company on margins and top line as several headwinds are expected in the upcoming fiscal. With a view on the longer-term business prospects, we recommend investors hold the shares of Alkem through the short-term headwinds.

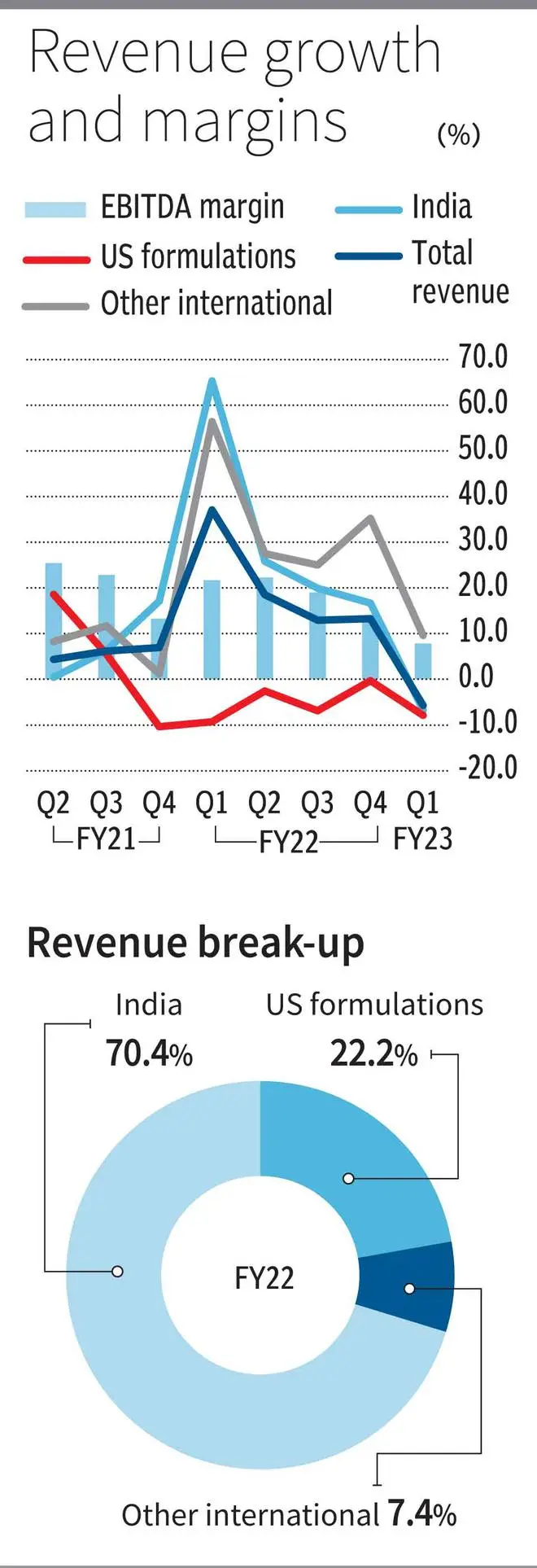

Indian formulation sales made for 70 per cent of Alkem’s revenues in FY22, while the US and other international markets accounted for 22 and 7 per cent respectively. Of the Indian sales, acute category was 85 per cent and chronic 15 per cent. Also, trade generics (unbranded generics products) account for 22 per cent of India sales, with prescription-based sales making up the remaining.

Growth platforms

India business: Alkem is a leading player (ranked 1-3) in acute categories (anti-infectives, gastro-intestinal, analgesics and VMN). The company posted 30 per cent growth in FY22 in India as zinc-based formulations and anti-infectives were leading the demand during the Covid period. On the high base (Q1FY22 sales growth of 65 per cent in peak Covid), the company reported 7 per cent sales decline in Q1FY23. The base of FY22 will be a high benchmark for yoy growth figures in FY23, even as the company is confident of beating industry growth.

Compared to acute category, Alkem lags in the highly valued chronic category where it started only recently (premium margins, higher prevalence, and comparatively higher entry barriers) and is consistently building its presence. Anti-diabetes (gained 4 ranks to 16th spot in Q1FY23), CNS, Cardiac, and Dermatology (Ranked 8/27/18) and recent addition of Pulmonary division are the larger segments where it is present. Alkem has committed large manpower to the exercise to cover specialists and doctors in the fields.

Alkem has so far outperformed chronic market growth and that is expected to continue, given the smaller base. In trade generics where manufacturing is largely outsourced and the company markets and distributes, Alkem has gained a leading position. With trade generics growing at a high pace, Alkem should gain from industry growth in trade generics.

Biotech: Alkem acquired Enzene Biosciences in 2011, engaged in biosimilar development. Enzene has now launched its 3rd product in India in Q1FY23 and Alkem expects to generate revenues of ₹250 crore (2 per cent of FY23 expected revenues from the portfolio). Apart from domestic sales, Enzene has partnered companies for launches in Europe, to begin with. The company can realise development milestones for the product, which is in global clinical trials, and expect royalties from sales on commercialisation in FY26 and beyond.

International formulations: International formulations (Australia, Chile, the Philippines and Kazakhstan) have reported sales growth of 35 per cent in FY22 and 9 per cent on the high base in Q1FY23 as well. With easing logistics cost and new product launches, similar high growth can be expected from this segment. US sales, on the other hand, have declined 5 per cent in FY22 as high price erosion continues. Alkem reported 20 per cent price erosion in legacy basket even in Q1FY23. The short term should gain as Alkem launches a limited competition product in exclusivity. But unless generic price deflation cools to at least low double digits on an eroded base in FY22, the new launches may not overcome price erosion in the US.

Margins and valuation

Alkem Labs reported its lowest EBITDA margins at 8 per cent in Q1FY23 compared to an average 20 per cent in the last two fiscals. The company faced US price erosion, higher raw material and logistics costs, higher employee, and marketing expenses in the quarter along with a few one-off forex losses (10 per cent adjusted EBITDA margin). The fiscal FY23 should witness lower EBITDA margins of 16-17 per cent as most of the factors can persist. But over the long term the margin levers available are also encouraging.

Biotech investments (₹800 crore till FY22 including ₹100 crore per year operational expense) can start revenue contribution, but will gather pace from FY25 and beyond. The company has added 30 per cent more medical representatives over the last three years. The drag caused by new additions operating below optimal productivity can also slowly turn around. One immediate lever available is adding to the chronic basket, which is gaining market share, apart from acute, which can further improve, according to the company.

A large part of the portfolio (around 25 per cent) is under price control of NLEM, but WPI itself being above 10 per cent allows the company to take similar price increases. Gross margins have declined 100 bps more than the 150-200 bps expected by the company in Q1FY23 sequentially, owing to raw material costs. While cost inflation reversal cannot be predicted, a slowdown in inflation has been witnessed in the quarter as well.

Alkem is trading at 26 times FY23 earnings estimate (21 times FY24), which is 6 per cent premium to last five year average. Bloomberg consensus expects 6 per cent EPS CAGR in FY22-24. Investors can hold the stock through the short-term volatility in margins for long term, when biotech, chronic, and better operating leverage can come into play. Easing US price erosion and strong launch portfolio can be a positive surprise.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.