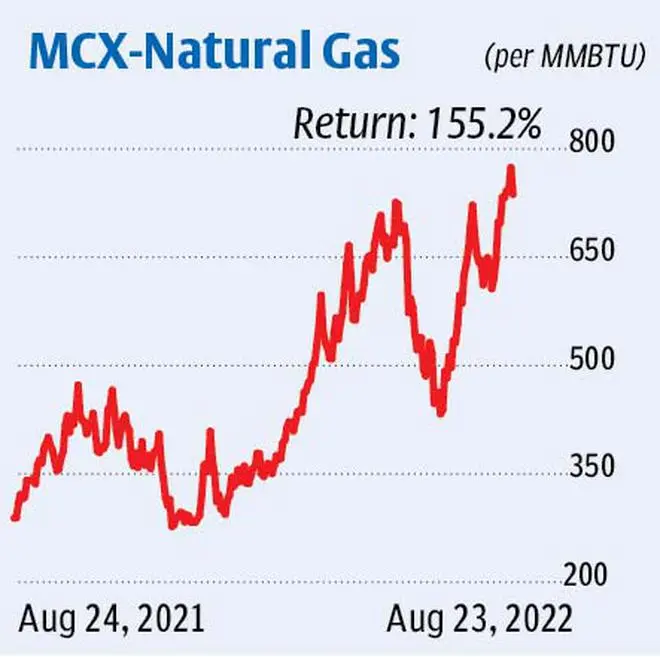

The natural gas futures (continuous contract) on the MCX (Multi Commodity Exchange), after testing resistance at ₹760 for about a week, broke out of this level and closed at ₹774 on Monday. Although the price has now moderated to the current level of ₹742, the breakout has opened the door for a further strengthening.

But note that there could be a price decline to ₹715 or even to ₹680, before hitting fresh highs from here. If the contract resumes its rally, either from ₹715 or from ₹680, it could move up to ₹900 in the short-term.

Supporting the bullish bias, the cumulative Open Interest (OI) of natural gas futures on the MCX increased to 8,579 contracts on Tuesday i.e., August 23, compared to 5,091 contracts on August 5. During this period, the price has risen from about ₹640 to ₹737. The increase in price along with increase in OI indicates a fresh long build-up. Also, the 20-day moving average coincides with a rising trendline at around ₹680, making it a strong support.

Strategy: Given these factors, traders can consider buying MCX natural gas futures. But we suggest splitting the entries to three legs i.e., go long for one-third of the total intended amount at the current level of ₹740, add another one-third of longs when the price dips to ₹715, and accumulate for the remaining when the contract declines to ₹680. Place the initial stop-loss at ₹615.

When the contract crosses ₹800, tighten the stop-loss to ₹700. Revise it up to ₹775 when the price touches ₹850. Liquidate all the longs at ₹900.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.