The Indian benchmark indices are set for a fresh round of sell-off this week. Two factors warrant a sharp fall from the current levels. First, the indices, the Sensex and Nifty 50, are not showing strength. The bounce-back move from the lows last week lacks strength. The price action on Thursday and Friday clearly shows the absence of strong follow-through buyers in the market to take the indices up. Second, the strong 1,000-point fall in the Dow Jones Industrial Average on Friday is likely to have an immediate impact in the form of a wide gap-down open in the Sensex and the Nifty 50 on Monday.

The coming week is a truncated week as the markets are closed on Wednesday on account of a public holiday.

The Nifty’s bounce-back move lacks strength and is not getting a strong follow-through buying

Recap

As cautioned, the Sensex and Nifty 50 fell initially last week thereby confirming a reversal. Sensex made a low of 58,172.48 and Nifty touched 17,345.20 on the downside. Though both recovered from their lows, the bounce-back move lacked strength. Sensex and Nifty closed down over a per cent each last week, thereby snapping the five-week rally.

The sectoral indices remained mixed. The BSE Consumer Durables index rose the most by 2.12 per cent. The BSE IT index, down 4.15 per cent was beaten down the most.

FPI flows

The pace of inflows from the Foreign Portfolio Investors (FPIs) into the Indian equities slowed last week. The FPIs bought $597.81 million in the equity segment. The Indian equity segment has seen a net inflow of $6 billion so far in August.

Nifty 50 (17,558.90)

The fall to 17,450 mentioned last week happened as expected. Indeed, the Nifty fell well beyond it to make a low of 17,345.20 on Tuesday. The recovery move from this low lacked strength and failed to see a sustained break above 17,700. Nifty has closed the week at 17,558.20, down 1.12 per cent.

Graph Source: MetaStock

The week ahead: The outlook is negative. A fresh fall can be seen this week. Strong resistances are at 17,745 and 17,775 which can cap the upside. The 21-Day Moving Average (DMA) support, which has held very well last week, is a key level to watch. It is currently at 17,488. Below that, 17,380 – a trend-line support on the weekly chart is the next important support. These supports can be very well tested in the first half of the coming week.

A break below 17,380 will intensify the sell-off. Such a break can drag the Nifty down to 17,100 initially and then to 16,980-16,900. The level of 16,980 is the 200-DMA support.

Nifty has to breach 17,775 in order to negate the above-mentioned fall and revisit 18,000 levels. But that looks unlikely.

Medium-term outlook: As mentioned last week, Nifty has to see a strong weekly close above 18,000 to turn the outlook bullish. But that looks less probable. As such, the medium-term outlook remains weak for the Nifty.

A fall to 16,500-16,300 is more likely to be seen in September. That would be a strong bearish sign to see an extended fall to 15,000-14,500, going forward.

Trading strategy: Hold the short positions taken at 17,800 with the same strategy. Retain the stop-loss at 18,220. Move the stop-loss down to 17,600 as soon as the index moves down to 17,300. Exit 30 per cent of the holdings at 16,600 and move the stop-loss for the rest of the holdings up to 17,100.

Sensex (58,833.87)

Sensex extended the fall last week well beyond our expected level of 58,500. It made a low of 58,172.45 and then managed to bounce back from there. The index has closed the week at 58,833.87, down 1.36 per cent.

Graph Source: MetaStock

The week ahead: The outlook is bearish. Strong resistances are 59,350, 59,620 and 59,935. Immediate support is at 58,692 – the 21-Day Moving Average (DMA). A break below it can drag the Sensex down to 57,900 – an important trend-line support for the week.

The fall can gather momentum on a break below 57,900, which will then pave the way to test 57,000-56,900 over the next few weeks.

Medium-term outlook: The medium-term outlook will remain negative as long as the Sensex remains below 60,000-60,350 resistance zone.

The region around 57,000 will be a crucial intermediate support. A break below it can drag the Sensex down to 55,000 and even 53,000 initially. It will also increase the danger of seeing 50,000-49,000 on the downside.

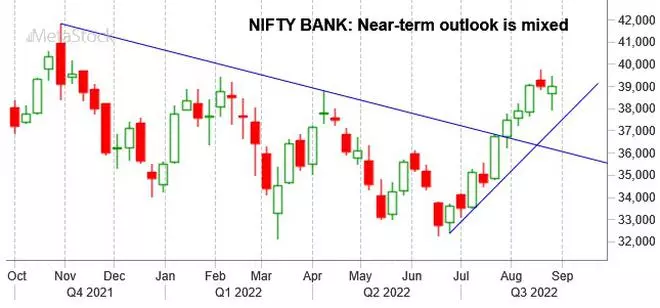

Nifty Bank (38,987.15)

The Nifty Bank index tumbled to a low of 37,950.85 last week. However, it managed to recover all the loss and close the week on a flat note at 38,987.15.

Graph Source: MetaStock

The immediate outlook is mixed. The candle for last week indicates indecisiveness. There could be a possibility of seeing broad sideways movement for some time. We can expect the index to oscillate between 37,500 and 40,150 in the short term.

Within this range, an intermediate support is at 38,400. A break below it can drag the index down to 37,500 in the near term.

Overall, the price action this week will need a close watch to get clarity.

Trading strategy: We prefer continuing to stay out of the market.

Global cues

The Dow Jones Industrial Average tumbled over 4 per cent last week. The sell-off intensified on Friday after the US Federal Reserve Chairman Jerome Powell’s speech at the Jackson Hole symposium. Powell said that the central bank will continue with its aggressive rate hikes to bring down the inflation. The Dow tumbled over 1,000 points on Friday to close the week at 32,283.40.

Last week we had warned for a fall up to 32,350 on a break below 33,000. The outlook is bearish. Strong resistance will now be in the 33,000-33,250 region. The Dow can fall to 30,000-29,500 in the coming weeks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.