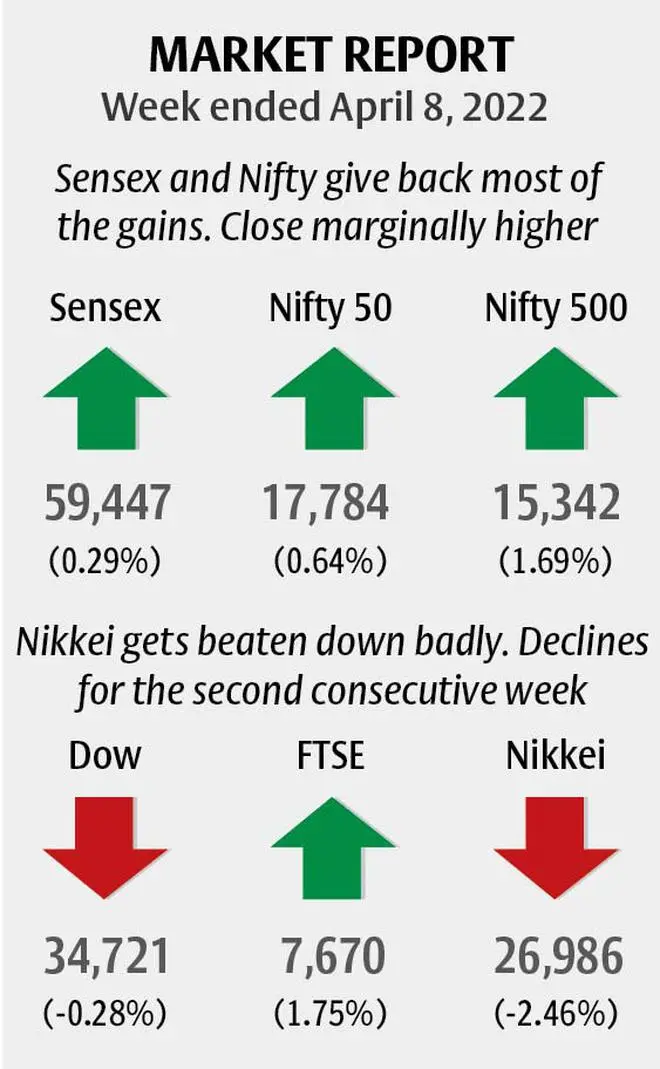

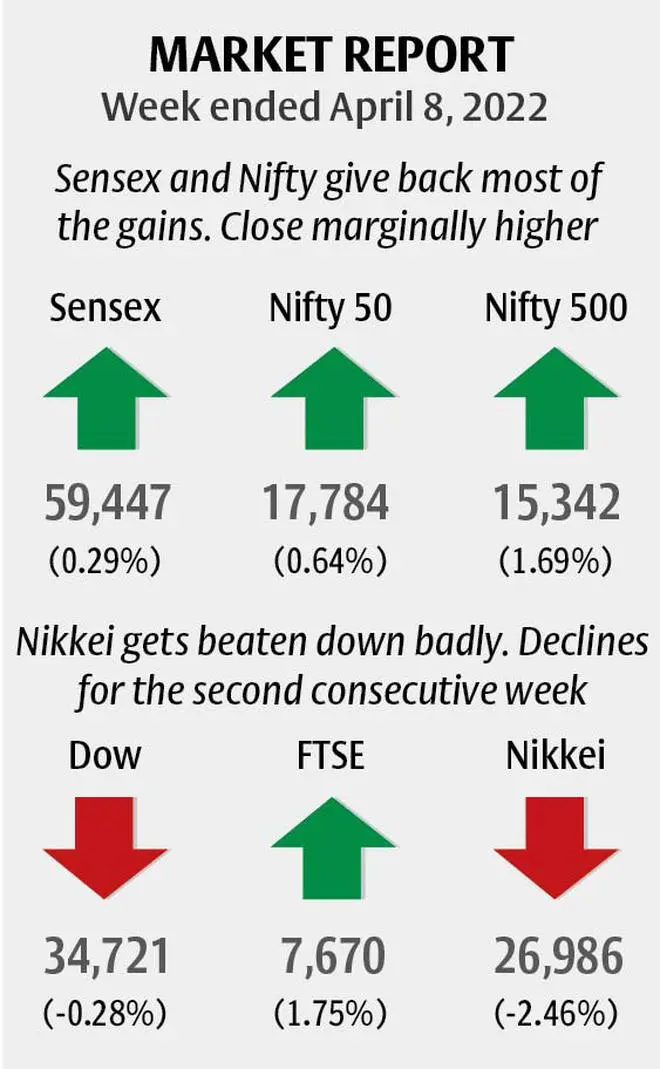

A rise to test the crucial resistances on the Nifty 50 and Sensex has happened as expected. Also, the indices have reversed lower in line with our expectation after testing their resistances. Nifty rose to a high of 18,114.65 and Sensex made a high of 60,845.1. Both the indices have come off from their respective highs. Nifty has closed the week at 17,784.35, up 0.64 per cent and Sensex at 59,447.18, up 0.29 per cent.

The mid and small-cap indices had outperformed the benchmark indices. The BSE Midcap and BSE Smallcap indices were up 3.52 and 3.72 per cent respectively. The BSE Midcap index has a crucial resistance coming up near current levels. So the chances of it reversing lower from here are high. However, the BSE Smallcap index has room to move up further from here and looks more bullish than others. Overall, it looks like a mixed picture broadly.

The coming week is truncated with just three trading days. Markets are closed on Thursday and Friday on account of public holidays. As such the chances are high for the broader indices to remain in a sideways range this week and then take a specific direction from next week.

Among the sectors, the BSE Power index outperformed by surging almost 9 per cent last week. This was followed by the BSE FMCG and BSE Metal indices, both up over 4 per cent. The BSE IT underperformed, falling 2.13 per cent.

The pace of purchase by Foreign Portfolio Investors (FPIs) seems to be gaining momentum. FPIs bought $1.019 billion in the Indian equity segment last week. For the month so far, there has been an inflow of $1.31 billion into the equity segment. If the buying momentum continues, the Sensex and Nifty can get support to rise.

Nifty 50 (17,784.35)

The resistance at 18,100-18,200 mentioned last week has held very well. Nifty made a high of 18,114.65 and has come off from there. Is the reversal from the high a beginning of a fresh leg of downmove? We will have to wait and watch to get a confirmation.

The week ahead: The immediate outlook for the coming week is unclear. Nifty has equal chances to go either up back towards 18,100-18,200 or fall to 17,300 from current levels. Overall 17,300-18,100/18,200 can be the range of trade for some time. A breakout on either side of 17,300 or 18,200 will then determine the next direction of move.

A break below 17,300 can drag the Nifty down towards the next supports at 17,000 and 16,700-16,600. On the other hand, a strong break above 18,200, though less likely, can target 18,500-18,600 on the upside.

Medium-term outlook: Inability to rise past the 18,100-18,200 resistance keeps alive our broader bearish view. As such our bias will remain inclined towards seeing a break below 17,300 in the coming days. Important support to watch will be at 16,600. A break below it will trigger a steeper fall to 15,000 over the medium term.

As mentioned last week, the rise to 18,100 last week has reduced the chances of seeing 13,500 on the downside that we were expecting earlier. For now, we would prefer the downside to be limited to 15,000-14,500. Such a fall will be a good buying opportunity from a long-term perspective.

Trading strategy: The target of 17,980 for long positions recommended last week has been achieved. Since this is going to be a very short trading week, we advise traders to stay out of the market.

Sensex (59,447.18)

The rise to 60,800 happened last week as expected. At the same time, the resistance at 61,000 has also held very well in line with our expectation. Sensex made a high of 60,845.1 and has come off from there to close the week marginally higher.

The week ahead: The near-term outlook is mixed with equal chances of moving in either way from current levels. If the Sensex manages to rise past 60,000 from here, it can revisit the 60,800-61,000 resistance zone. On the other hand, a fall from here will be bearish to see 58,000 and 57,500 on the downside. Overall, 57,500-61,000 can be a broad range of trade in the short term.

Medium-term view: The overall bearish view remains intact as long as the Sensex remains below 61,000. As such, the bias is negative to see a break below 57,500 in the coming days. Such a break can drag the Sensex down to 55,000 initially. An eventual break below 55,000 can then take the Sensex lower to 52,000 and 50,0000 over the medium term.

The current rally to 60,800 last week has reduced the danger of seeing 48,000 on the downside. The downside could be limited to 50,000 from where a fresh rally is possible. The fall to 52,000-50,000 mentioned above will be a good buying opportunity for the long term.

Nifty Bank (37,752.05)

The resistance at 38,000-38,100 was broken initially last week. However, the index failed to sustain the break and had come off from the high of 38,765.85. It made a low of 37,346.8 and has recovered slightly to close the week at 37,752.05, up 1.62 per cent.

Near-term outlook is mixed. Immediate resistance is at 38,100. A break above it can take the Nifty Bank index up to 39,150-39,200 this week. Support is at 37,350. Inability to break 38,100 from here and a subsequent fall below 37,350 can drag the index down to 36,810 and 36,760 in the near term.

From a bigger picture, 39,150-39,200 and 39,600 are crucial resistances. The Nifty Bank index will have to break above 39,600 decisively to gain bullish momentum. Such a break will pave the way for a fresh rise to 42,000-42,500 over the medium term. On the other hand, as long as the index stays below 39,200, the Nifty Bank index can fall to 36,000 in the coming weeks. In that case the index can remain vulnerable to break 36,000 and fall to 34,000 and even 32,000 over the medium term.

Trading strategy: Traders can stay out of the market this week. The stop-loss on the short positions recommended last week at an average of 38,000 has been triggered.

Global cues

The Dow Jones Industrial Average (34,721.12) fell to a low of 34,190.95 last week and then had risen back from there. The crucial support at 34,000 is holding well. However, a decisive rise past 35,000 will necessarily be needed to regain bullish momentum. Such a break above 35,000 will be very bullish to see 37,000 and even 38,000 on the upside in the coming months.

On the other hand, a break below 34,000 will be bearish to see a fall to 33,000 and even 32,000 on the downside. For now, 34,000-35,000 can be the range of trade in the near term. A breakout on either side of 34,000-35,000 will then determine whether the Dow can go up to 37,000-38,000 or fall to 33,000-32,000.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.