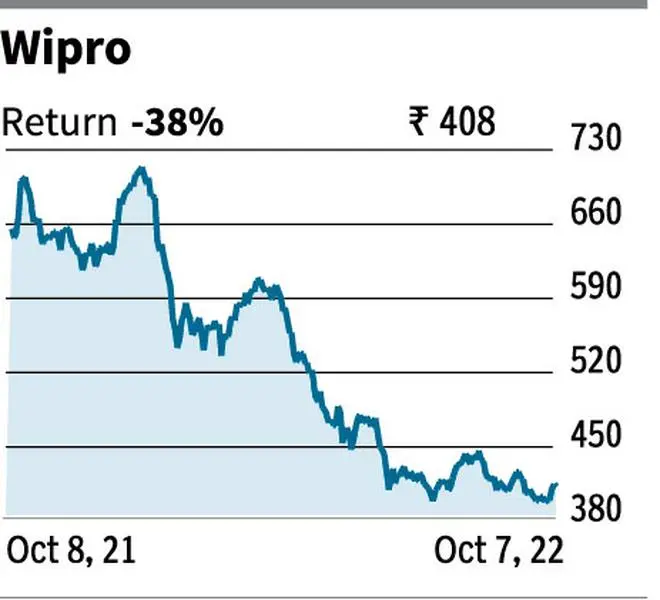

The downtrend in the stock of Wipro (₹408.10) that has been in place since January this year could be approaching a bottom. Investors with a medium-term perspective can consider buying this stock at current levels.

In February this year, we had given a sell on this stock in this column when the price was at ₹561.61. In the same call we had said that Wipro will become a good buy when it comes down to ₹380-₹360. This fall has almost happened. A low of ₹384.60 has been made so far and the stock has been oscillating around ₹400. The 200-Week Moving Average, currently at ₹386 has been giving good support for the stock. Even if Wipro breaks below these supports, next strong supports are at ₹365 and ₹350. A fall beyond ₹350 is unlikely.

Resistances are at ₹425 and ₹440. A strong break above ₹440 can take Wipro up to ₹525-₹535 by the second quarter of 2023. Thereafter a corrective fall to ₹500-₹480 cannot be ruled out. From a long-term perspective, Wipro has to breach ₹535 decisively to revisit ₹700 levels.

Medium-term investors can buy the stock at current levels. Accumulate more on dips at ₹375 and ₹360. Stop-loss can be kept at ₹310. Trail the stop-loss up to ₹450 as soon as the stock moves up to ₹490. Move the stop-loss further up to ₹485 when the stock touches ₹505 on the upside. Exit the stock at ₹520.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.