The prospect of their licences getting cancelled seems to have prompted some of the financially weak urban co-operative banks (UCBs) to walk down the aisle with stronger counterparts, going by the approvals for amalgamation that the Reserve Bank of India (RBI) has given over the last two decades.

Since 2004-05, when the central bank first issued guidelines for merger / amalgamation of UCBs and followed it up 16 years later with a ‘Master Direction on Amalgamation of UCBs,’ 152 UCBs have merged with financially sound and well-managed UCBs till October 2023.

In other words, roughly 8 per cent of the 1,926 UCBs that existed as on March-end 2004, have amalgamated with healthier peers so far. There may be more to come. The RBI, in its latest ‘Report on Trend and Progress of Banking in India’ noted that the liberal licensing policy adopted in the 1990s led to a surge in the number of UCBs.

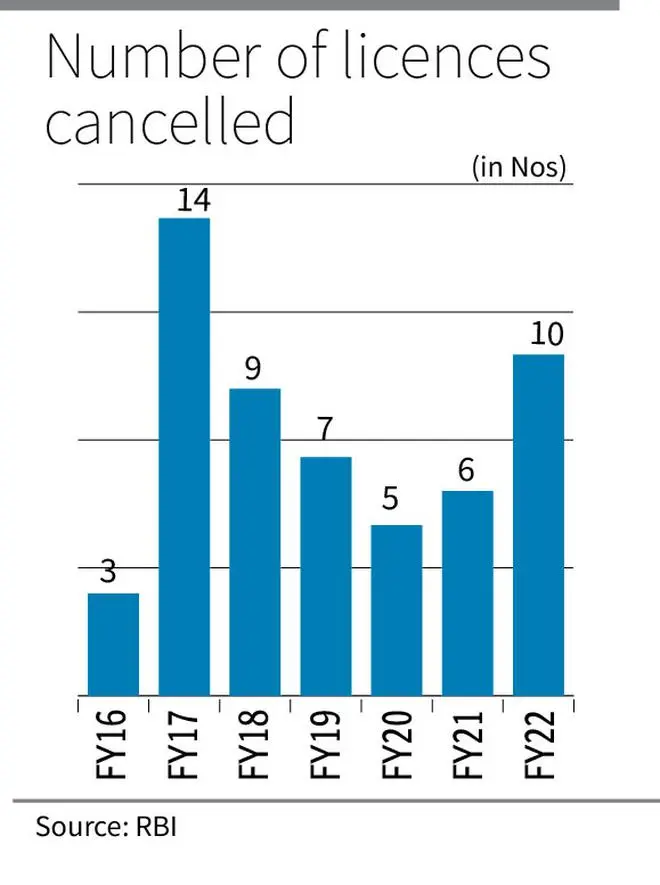

“Over the years the inherent fragility in their structures, coupled with financial weaknesses, resulted in nearly one-third of the newly licensed UCBs becoming unsound. Since 2004-05, the Reserve Bank initiated a process of consolidation in the sector, including amalgamation of unviable UCBs with their viable counterparts, closure of non-viable entities, and suspension of issuance of new licences. As a result, the number of UCBs progressively declined (coming down from 1,926 as of March-end 2004 to 1,514 as of March-end 2022),” the report noted.

String of pearls

For the stronger UCBs, this consolidation fits in with their string of pearls strategy. They have grabbed acquisition opportunities with both hands as it has given them an established branch network in geographies where they either didn’t have a presence or want to deepen it and expand customer base — depositors and borrowers.

For example, Mumbai-headquartered Saraswat Co-operative Bank, India’s largest UCB, acquired seven stressed UCBs since 2006 — Maratha Mandir Co-operative Bank, Mandvi Co-operative Bank, South Indian Co-operative Bank, Nashik Peoples Co-operative Bank, Annasaheb Karale Janata Sahakari Bank, Murgharajendra Sahakari Bank, and Kolhapur Maratha Co-operative Bank. The move followed the RBI decision to not issue fresh licences for branch opening to co-operative banks.

Pune-headquartered Cosmos Co-operative Bank snapped up three UCBs — Shree Sharada Sahakari Bank, Maratha Sahakari Bank and Sahebrao Deshmukh Co-operative Bank — in the year gone by, and is now eyeing Mumbai’s The City Co-operative Bank.

Not all success

Not all amalgamation attempts have been successful. Financially weak Kapol Co-operative Bank’s efforts to merge with Cosmos Co-operative Bank came a cropper. The Reserve Bank cancelled Kapol Bank’s licence in September 2023 due to inadequate capital and earning prospects and inability to pay its depositors in full, given its financial position.

Cosmos Bank, in its annual report, has identified increasing competition in the banking sector, the need for adopting latest technology, cost outlay required for technological upgradation, and enhancing skill sets of human assets through continuous training, as the challenges faced by small co-operative banks.

But what happens when a UCB licensed is cancelled? Experts underscored that when a UCB’s licence gets cancelled, depositors holding balances over and above the maximum deposit insurance amount of ₹5 lakh lose money. If a depositor has ₹10 lakh deposit with such a bank, only the insured ₹5 lakh is received.

This is why even the regulator prefers amalgamation of a weak UCB with their stronger counterparts, instead of cancelling licences, so that depositors with cash balance of over ₹5 lakh are protected.

“RBI cancels licence only when it becomes impossible to revive a bank. So, instead of exploring merger after becoming sick, UCBs should do so prior to reaching such a stage,” says Jyotindra Mehta, President, National Federation of Urban Cooperative Banks and Credit Societies (NAFCUB).

Mehta believes that smaller UCBs have understood that they will not be able to bring in technology as it is very expensive. Further, referring to the RBI’s stipulation that UCBs with deposit size of ₹100 crore and above should constitute Board of Management (BoM), comprising persons with special knowledge and practical experience in banking, for allowing them to expand their area of operation and open new branches, he said such expertise is hard to come by in certain locations..

That said, Mehta expects the number of amalgamations to come down once the Umbrella Organisation (UO) for the UCB sector — the National Urban Co-operative Finance and Development Corporation — gets in the groove.

UO, apart from extending liquidity and capital support to its member UCBs, is expected to set up Information and Technology (IT) infrastructure for shared use of members to enable them to widen their range of services in the wake of advances in information and communication technology at a relatively lower cost. It can also offer fund management and other consultancy services.

Govt, RBI to the rescue

Understanding that there is a genuine problem and depositors of UCBs need to be protected, the government and RBI have put in place some critical measures after the PMC Bank debacle. First is increasing the deposit insurance cover five-fold to ₹5 lakh to protect depositors.

The government enacted the Banking Regulation (Amendment) Act, 2020, to protect the interests of depositors and strengthen co-operative banks by improving governance and oversight by the RBI, while enabling them better access to capital.

A significant feature of this measure is that it enables the RBI to reconstruct or amalgamate a bank, with or without implementing a moratorium, provided there is approval of the Central government. This enabled the merger of fraud-hit PMC Bank with Unity Small Finance Bank.

Clearly, in the interest of ultimate stakeholder (depositor), the wind is in favour of more consolidation among UCBs. This could be the silver bullet to ensure they become stronger, especially when without scale facing stiff competition from nifty rivals such as small finance banks and NBFCs could be a tall ask.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.