PAN or Permanent Account Number is a form of identification issued by the Income Tax Department of India. The Central Board of Direct Taxes (CBDT) has issued a deadline to link Aadhaar with PAN card. The last date for linking Aadhaar with PAN is set on March 31, 2023. Post the deadline, the PAN card will account for deactivation. The Government has made the linking compulsory to carry out financial transactions.

Before the deadline pass, you can link the PAN-Aadhaar by visiting Income Tax Department official site and paying ₹1000 to initiate the linkage. However, individuals can also check if their PAN card is valid or not in few simple steps, even after the deadline pass.

Also read: How to change PAN address using Aadhaar?

Check PAN card validity

- Visit Income Tax Department website.

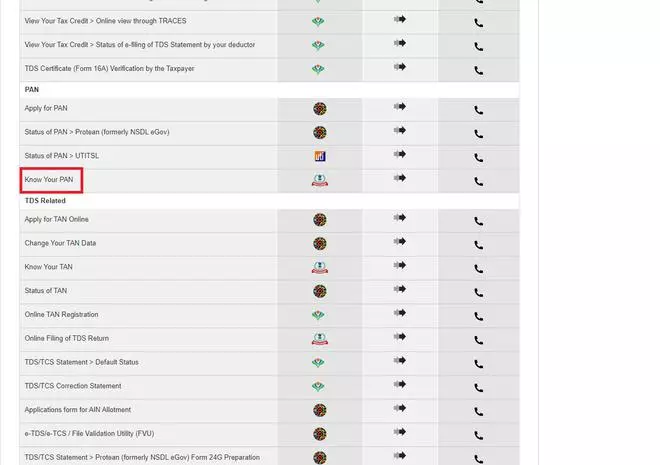

- Click on Tax e-Services on the homepage.

- Scroll down to ‘Know your PAN’ under PAN subcategory.

- Tap on the two arrows as shown in the screenshot.

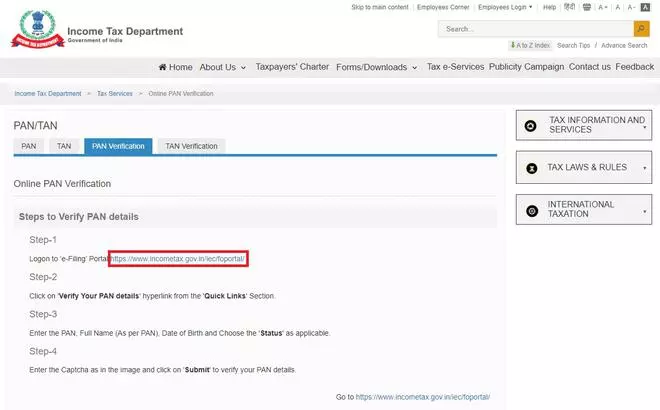

- Click on the e-filing link on the portal, as shown in the screenshot.

- Under the Quick Links on the left side, scroll down to Verify your PAN.

- Go on to fill the required details on the next page.

- Once the verification is done, the page will show you your PAN status as per given details.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.