Paytm recently became the first platform to launch UPI LITE payments, to enable quick and seamless transactions of up to ₹200 without having to enter a PIN to make a payment.

A maximum of ₹2,000 can be added twice in a day to UPI LITE, making the cumulative daily usage up to ₹4,000.

The new platform, however, only supports select banks (including Canara Bank, Central Bank of India, HDFC Bank, Indian Bank, Kotak Mahindra Bank, and State Bank of India).

The success rate of transactions via Paytm UPI LITE is improved further as it is designed to reduce the load on bank systems for small-value payments.

Also read: UPI Lite: How to set it up on BHIM app

How to set up UPI Lite on Paytm?

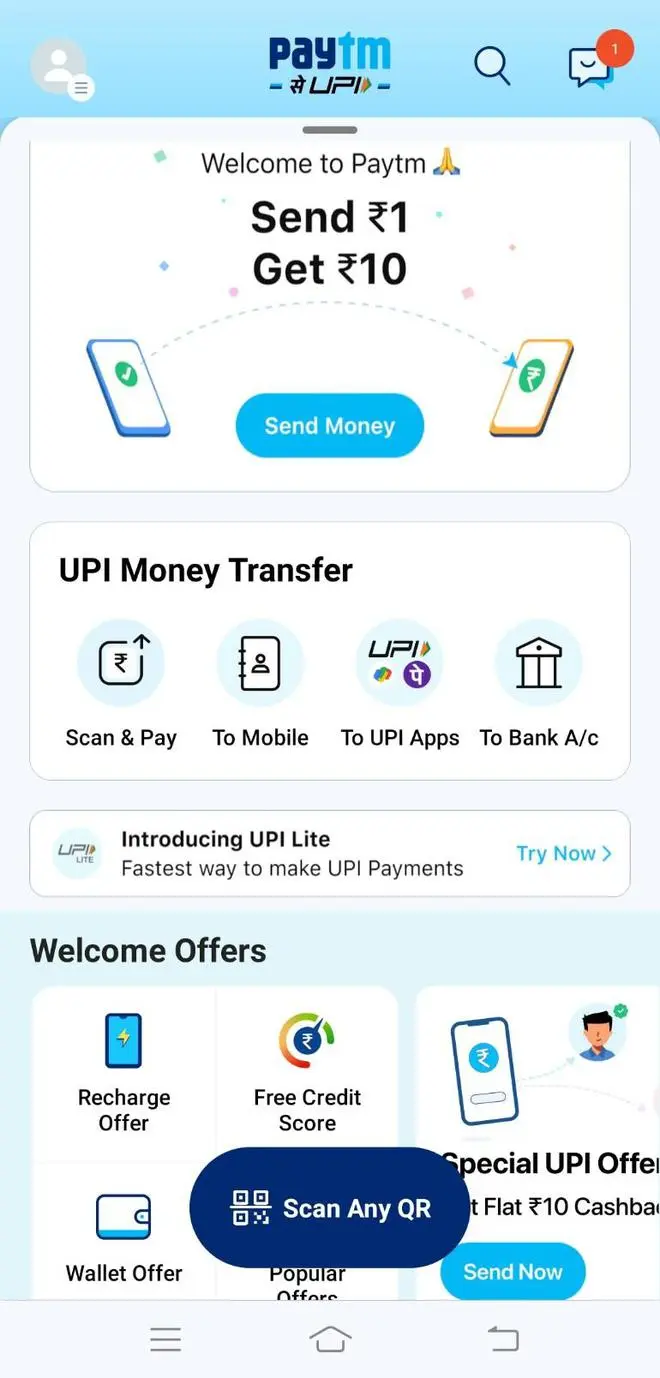

- Step 1: Open the Paytm app

- Step 2: On the Home page, find the ‘Introducing UPI Lite’ panel and click on it

- Step 3: Tap on a linked bank account that is supported by Paytm UPI Lite

- Step 4: Add some money to UPI lite (between ₹1 and ₹2,000)

- Step 5: Once the money has been added, Paytm UPI Lite is ready for use

How to pay using Paytm UPI Lite

- Step 1: Select a contact, or scan a QR code, to make payment

- Step 2: Enter the amount

- Step 3: Tap ‘Pay Securely’

- Step 4: The payment will be made without the need to enter UPI pin

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.