Once reckoned as a value generator, Kotak Mahindra Bank now seems to be struggling to keep that tag. In the last three years, the bank’s stock price has eroded by 5.3 per cent, while its peers ICICI Bank, Axis Bank and IndusInd Bank have generated 70–90 per cent gains during this period.

Even HDFC Bank has delivered six per cent returns in the last three years. With the Reserve Bank of India’s harsh action on Monday evening, by imposing a ban on onboarding customers digitally and issuing fresh credit cards, the question is whether Kotak Mahindra Bank can shed its underperformer tag any time soon.

For the first time in about a decade, Kotak Mahindra Bank stock witnessed the sharpest single day fall (down around 11 per cent).

There are two critical points to delve—first, the language used in the RBI circular and second, the timing of the ban.

Harsh ban

Kotak Mahindra Bank isn’t the first instance of a bank being pulled up for deficiencies in the digital banking arena. There’s precedence with HDFC Bank and Bank of Baroda (bob World app). However, the language used in Kotak Mahindra Bank’s order could have wider ramifications. To be sure, this is the first instance of a ‘cease-and-desist’ order issued on any large bank in recent times; such orders could invoke serious action from the regulator in case of non-compliance.

The order explained numerous instances (in 2022 and 2023) where the bank was asked to take remedial action but they were still inadequate. It touched upon deficiencies across almost every single aspect of digital operations ranging from user access management, IT inventory management, vendor risk management and disaster recovery to IT risk and information systems governance.

To be sure, the order issued on bob World, also invoking section 35A of the Banking Regulation Act, wasn’t as scathing and detailed as Kotak’s and restrictions placed on HDFC Bank were based on more lenient sections of the BR Act.

Business implication

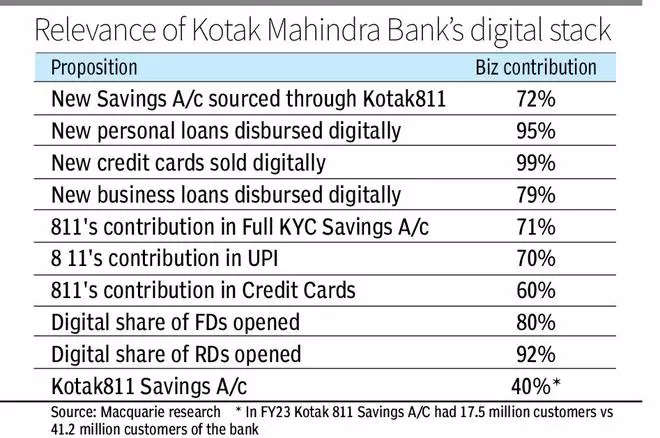

For Kotak Mahindra Bank, its digital stack seems to be a meaty customer sourcing avenue (see table).

As for credit cards, while it may be contributing only four per cent to the bank’s loan book, at 50 per cent growth so far in FY24, this along with unsecured loans (largely digitally sourced) have been the fastest growing engines for Kotak Mahindra Bank.

The bank aspires to take its unsecured loan book to 15 per cent over time from the present 11 per cent mark and the digital way of doing business would be extremely relevant to ensure costs are in place and the yield from these loans is in the top quartile. That advantage may be gone till RBI lifts the curb. While it could be argued that the bank could shift to branch banking, it could make for the costly proposition.

Cost to income ratio has already expanded by almost 200 bps year-on-year and Kotak Mahindra Bank is on a tight rope walk with respect to profitability. From Q1 FY24 to Q3 FY24, net interest margin (NIM) shrank by 35 bps to 5.22 per cent.

Timing of the ban

A new CEO is always known to bring change in the system and hence have a bearing on the financials. From Rajneesh Kumar to Sumant Kathpalia, we’ve seen many examples reiterating this.

While the Street was prepared to see some asset quality-related pain and allied changes in Kotak Mahindra Bank with Ashok Vaswani taking over from January 1, 2024, as MD & and CEO, ending the long-standing leadership of Uday Kotak, the bank’s promoter and former CEO, Monday’s development came as huge surprise.

Given how the stock market has reacted to the issue, would it give Vaswani the space to make structural changes without further hurting the Street’s sentiments? RBI’s ban also raises questions on whether the tech stack was effectively built.

Kotak 811 app is showcased as Jay Kotak’s domain. He is the co-head of the app and in November 2023, he took additional responsibility as senior VP–conglomerate relationships.

Often speculated as Uday Kotak’s successor in the long run, it would be interesting to see if the RBI’s actions impede that journey. To sum up, RBI’s ban on the bank’s digital properties has come at a time when Kotak Mahindra Bank stock has been a laggard on the Street for over three years; yet, it was among the ‘buy’ list of most stock brokers, thanks to its past legacy. That may now get challenged.

The saving grace is the comfortable capital adequacy ratio of over 24 per cent. This may reduce the need for having to tap the capital market any time soon and thus preserve valuation erosion. But from over 4x price to book (P/B) in FY22 valuations are already down to 2.5x FY25 estimated P/B. Can Kotak Mahindra Bank arrest a further compression vis-à-vis peers?

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.