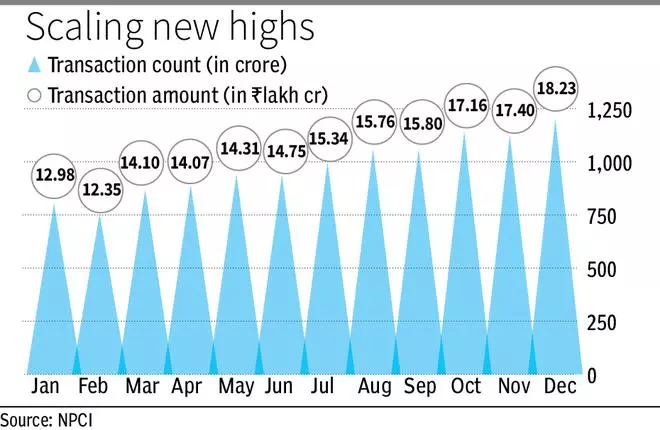

Unified Payments Interface (UPI) ended 2023 at a high, recording over 1,200 crore transactions worth more than ₹18-lakh crore in December, a peak for both the transaction count and value.

Over 11,765 UPI transactions worth ₹182.2-lakh crore were processed in 2023, up 59 per cent in terms of volume and 45 per cent in terms of value compared with 2022, as per data by the National Payments Corporation of India (NPCI).

Transactions worth ₹18.23-lakh crore were processed during December, significantly higher than the previous high of ₹17.40-lakh crore in November. In percentage terms, the value of transactions was 4.8 per cent higher on the month and 42 per cent on year.

The number of transactions on the UPI network breached the 1,200 crore mark to 1,202 crore transactions, higher by 6.9 per cent on month and 54 per cent on year.

Festival surge

While steadily growing through the year, UPI transactions have been accelerated since October on the back of a surge in consumer spending led by the onset of the festival season. The trend continued in November and December, with much of the elevated spending seen in shopping, e-commerce, and travel transactions, according to market participants.

On-year growth in UPI transactions has consistently remained over 40 per cent for the value of transactions and above 50 per cent for the volume of UPI trades in 2023 and FY24 so far. In FY23, the UPI platform processed 8,376 crore transactions, aggregating ₹139-lakh crore.

P2M trades

A shift in consumer behaviour towards moving away from traditional cash transactions, increased convenience through value-added features, digital adoption by merchants through third-party payment applications, and a rising share of P2M (person-to-merchant) transactions are driving UPI growth, according to market participants, some of whom expect UPI transactions to breach 2,000 crore in the next 18–24 months.

The share of P2M trades in overall UPI transactions rose to 57.5 per cent in June 2023 from 40.3 per cent in January 2022 and is expected to keep growing, according to Worldline India. During January-June, P2M transaction volume grew 119 per cent y-o-y to 2,915 crore, and the value rose 72 per cent to ₹19-lakh crore. On the other hand, P2P transaction volume grew 22 per cent to 2,275 crore, with the value of transactions rising 41 per cent to ₹64-lakh crore.

UPI transactions are expected to breach 100 crore transactions per day by FY27, as per a report by PwC India, which projects UPI to dominate the retail digital payments landscape, accounting for 90 per cent of total transaction volumes over the next five years.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.