Assets managed by the Indian mutual fund industry reached the ₹40 trillion milestone in December 2022. For individual investors, mutual funds have emerged as a preferred route for taking exposure to equities. It is reflected in the growth of the assets under management (AUM) of equity-oriented schemes that is now over 50 per cent of the industry assets.

Close to 90 per cent of the equity AUM is owned by individual investors. In other words, mutual funds hold over ₹20 trillion of the free float capitalisation of the companies in the country, and individual investors have taken close to ₹18 trillion exposure to equities through mutual funds.

One of the less highlighted functions provided by mutual funds to their investors is their involvement in corporate governance of investee companies, given the significant rights attached to the ownership of equities.

As the size of the mutual fund industry and the equity holding is increasing, mutual funds are expected to play a pivotal role in corporate governance. Shareholder voting on companies’ resolutions is the most important aspect of corporate governance. The act of voting is a critical part of mutual funds’ fiduciary obligations.

Voting rights

SEBI had, way back in 2010, prescribed the guidelines requiring mutual funds to disclose their general policies and procedures for exercising the voting rights in respect of the shares held by them on their respective website as well as in the annual report distributed to the unit holders.

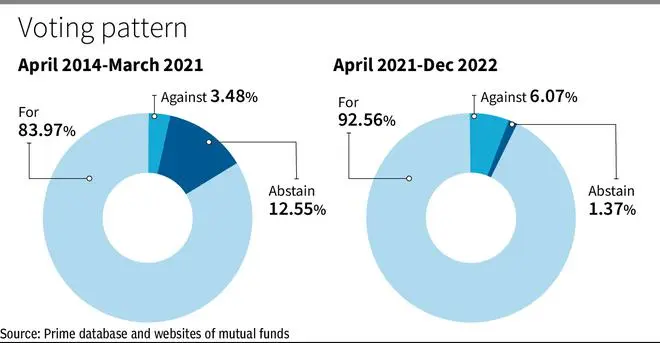

In 2014, mutual funds were mandated to disclose their voting patterns every quarter. This resulted in an increase in the percentage of resolutions on which the mutual funds voted. However, an analysis of the voting pattern for the period April 2014- March 2021 shows that at the industry level, most of the voting by mutual funds supported the investee companies’ resolutions.

SEBI, in March 2021, made voting on corporate resolutions compulsory for mutual funds. The expectation is that this would make the mutual funds more transparent and responsible in casting their votes.

Though these instructions are of a recent origin, with a view to ascertaining their impact, an analysis was done for the March 2021-December 2022 period of the voting behaviour of 25 mutual funds along with a comparison with the position obtaining during April 2014- March 2021.

As can be seen from the chart, the proportion of ‘abstain’ voting has reduced significantly and the mutual funds appear to be more assertive in voting ‘against’ the resolutions. Another observation is that more than 90 per cent of the time, the mutual funds support investee companies’ resolutions — either the mutual funds buy the shares of the companies where they trust the management or they do not want to be in the forefront of shareholder activism.

Mutual funds have two options when they are in disagreement with the investee company’s policies — vote against the management (“voice”) or vote with their feet (“exit”). Intuitively, one would feel that the larger funds, given their sizeable ownership block, may face greater liquidity constraints and thus have relatively lesser likelihood of ‘exit’.

Further, they may have a stronger incentive to engage in ‘voice’ for the sheer reason of scale economies.

However, the analysis finds not much difference in the way the top 10 large funds managing close to 80 per cent of AUM have been voting versus the rest 15 mutual funds. The ‘voice’ of the larger mutual funds against the companies’ management in comparison to the smaller ones is only slightly higher. It is possible that, in general, the mutual funds prefer ‘exit’ when dissatisfied with the management.

Also, the analysis shows that all the mutual funds have voted in lockstep, though SEBI’s regulations do provide for voting at the scheme level.

Bank-affiliated MFs

Generally, it is believed that the mutual funds affiliated with the banks have a stronger proclivity than independent funds to vote in accordance with the management recommendations. However, the analysis done for a sample of nine bank-affiliated mutual funds versus 16 others finds no evidence of it.

The bank-affiliated funds, though, have abstained from voting on more number of resolutions than other mutual funds (3.25 per cent versus 1.11 per cent). This may be, to some extent, due to their policy of voting on group companies, mainly the banks they are affiliated to.

As for the comparison in the voting pattern of mutual funds sponsored by the domestic companies versus the ones having foreign sponsors, there is a strong evidence of heterogeneity in the voting behaviour of the latter than the former.

Going forward, as the mutual fund industry in India further matures and gains in size, there would be increased expectations of their meaningful stewardship role in improving corporate governance. Their success is likely to inspire the other institutional investors to follow suit.

Baid is a professor at NISM, and Tyagi is a former chairman of SEBI

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.