Despite a relatively lower IPO fund-raising amount of about ₹27,000 crore so far this year, compared to the stellar years of 2021 (₹1.18-lakh crore) and 2022 (₹59,301 crore), investors have little to complain.

The reason for their contentment could lie in the fact that nearly 92 per cent of the IPO stocks listed in 2023 are trading above their issue prices, instilling confidence and fueling the rush for public issue applications.

Few factors have contributed to the trend of lucrative IPOs in 2023, including companies offering more attractive prices for investors and an increase in funds raised for corporate purposes while reducing the share of offer-for-sale (OFS) in IPO-bound firms.

IPO scorecard

With approximately three months remaining in the calendar year, as of October 6, 2023, 36 mainboard companies have already been listed in 2023. Notably, in 2023, an impressive 91.7 per cent of the 36 IPO stocks are trading above their respective issue prices. In comparison, till date, a quarter of the IPO stocks from 2022 and over a third from 2021 are in the red.

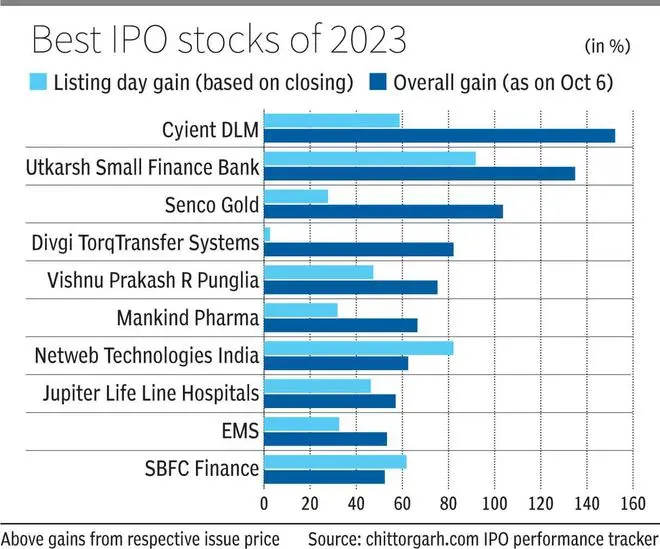

In 2023, some standout gainers, with year-to-date gains ranging from 50 to 150 percent over their issue prices, include Cyient DLM, Utkarsh SFB, Senco Gold, Divgi TorqTransfer, Vishnu Prakash R Punglia, Mankind Pharma, Netweb Tech, Jupiter Life Line, EMS, SBFC, and Concord Biotech.

Decoding IPO mantra

As the stock market reaches new highs, IPO investors are becoming more discerning about valuations. IPO-bound companies are thus likely pricing their offerings more attractively, leaving room for investor gains. For instance, the average valuation sought by IPOs in 2023 is 43 times trailing Price to Earnings, compared to 64 times for 2022 IPOs. While technology-based IPOs still command premium valuations, 2023 has witnessed more manufacturing and old-economy firms, with lower valuations, entering the public market.

Another significant factor is the reduction in the share of offer-for-sale (OFS) in 2023 IPOs. Historically, for instance in the 2016-22 period, a substantial portion (72 per cent) of IPO proceeds went to existing shareholders seeking partial or full exits, disappointing investors who wanted to see the funds used for business growth. IPOs with large OFS components are also typically more aggressively priced. According to primedatabase, in 2023 the OFS and fresh capital split is now 50:50, providing new investors with greater confidence.

Moreover, 2023 has been relatively free from negative or disappointing IPO experiences. While mega IPOs like One 97 Communications (2021) and LIC (2022) raised significant amounts, investors did not see profits. That apart, a flurry of new-age companies such as FSN E-Commerce (Nykaa), CarTrade Tech and Delhivery hit the IPO market in 2021 and 2022 but are showing negative returns from IPO price till date. In contrast, IPO stocks in 2023, even those like Updater, Yatra Online, and Radiant Cash that are in the red, have incurred minimal losses, ranging from 1 to 5 per cent from their respective IPO prices.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.