Torrent Pharma and Dr.Reddy’s eyeing promoter stake in Cipla might just be the start of an acquisition spree in the pharma space. We believe Indian Pharma may now flex its financial muscle for both big and small deals, with sectoral sentiments on a high, balance sheets strong and all business segments gathering momentum. Companies may now seek to complement internal development with acquisitions.

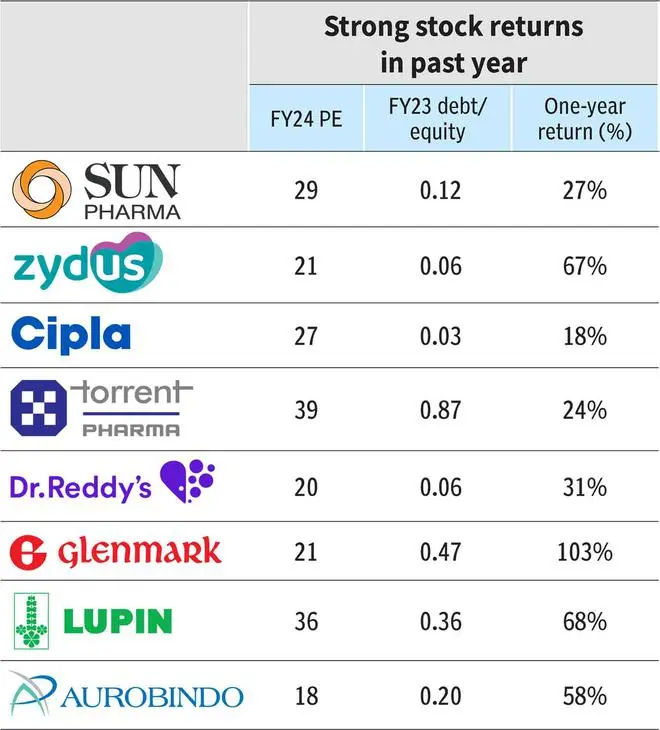

What we wrote in October 2022 on the way forward for Pharma has now played out, with Nifty Pharma outperforming Nifty by 7 percentage points. Now, focus will be on companies’ outlined areas of interest for growth.

Taking the cue from this, we analyse the financial strength of top pharma players and the likely avenue they may pursue. We also present a valuation impact to the proposed plan.

Firing on all cylinders

All markets — the US, Europe, Emerging Markets (EM) and even API operations — are reporting strong growth in Q1FY24. Only India, which has been the torchbearer for growth in the last five years, has taken a backseat in Q1FY24 results — single-digit growth with one-time NLEM price adjustments.

US markets are reporting normalised price erosion in generics after 2016. Because of this, combined with the fact that most manufacturing plants have exited FDA observations (with few exceptions), new product launches will support a higher growth. The growth story for branded products in India and EM will stay afloat with product launches. Also, companies are expecting 50-100 bps improvement in FY24 EBITDA margins from lower cost of chemicals and lower logistics costs.

Generic Revlimid, launched by most of the key players, is as much a contributor to improved financial health as operations for the outward gaze. The lucrative opportunity should add ₹500-2,000 crore in profits for each company over FY23-26.

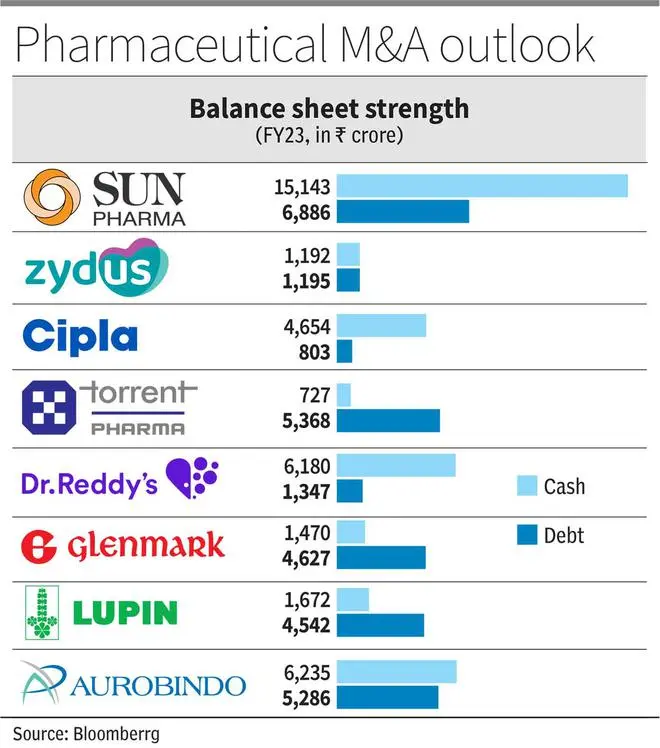

As a result, balance sheet strength will further amplify for companies. Sun, Cipla and Dr. Reddy’s have been ‘negative net debt’ companies over the last five years and have reported excess cash (net of debt) of ₹4,000-8,000 crore in Q4FY23. Amongst the others, Lupin, Aurobindo and Zydus are also expected to move to a strong cash position in the next one year.

This strong cash position might make it imperative for companies to pursue higher growth opportunities. Here’s how we expect key players to move forward:

Higher glide path

Sun Pharma, Zydus Life Sciences, Cipla, Torrent and Dr.Reddy’s fall in this category, unrestrained by debt concerns, with a clear line of development and operational strengths.

Sun Pharma may prioritise capital allocation in international ophthalmology and dermatology innovator molecules. The company built the required sales front-end in the US and will need a few more products to leverage the infrastructure developed for Ilumya, Cequa and Winlevi ( in-licensed in 2021) with acquired or developed assets.

The pipeline assets include Deuruxolitinib in Phase-III trials (lead asset of acquired Concert Pharma for $576 million) and additional indication for Ilumya, and an in-house developed anti-diabetes molecule, which should engage the R&D budget of Sun Pharma sufficiently. Sun Pharma trades at 29x times FY24 earnings and the current allocation strategy of creating high value assets for developed markets justifies the premium valuation and provides an upward bias depending on assets’ clinical trial results.

Sun also intends to fully consolidate generic derma firm Taro (78 per cent stake currently); this may initially be viewed negatively unless the company presents a comprehensive strategic gain from the acquisition in the dermatological space.

Similar to Sun’s speciality portfolio, Zydus Lifesciences has an ambitious programme in Saroglitazar and other monoclonal antibodies under investigation for US markets. But the assets have been launched in India and are developed in-house, implying a lower cost of development. The company R&D pipeline includes biosimilars and vaccines and demands higher R&D funding as they progress. The asset development from Zydus can support valuations (21 times FY24 earnings) but is coming at a cost of lower outlay in development of consumer division, which has been acquired from Heinz in 2019 for ₹4,500 crore. A strategy rethink on the division may also be expected.

With regard to Cipla, there is Cipla the asset — which is being hotly chased — and Cipla the company. Firstly, the company. Cipla, on its part, may most likely bolster its India and Soth Africa operations with big brand/complex product purchase in prescription or consumer healthcare segments. Cipla’s cash allocation in branded business supports a premium valuation of 27 times FY24 earnings. The company has a strong platform in ‘One India’, and in respiratory and peptides whose internal development is also a key investment opportunity. Trade generics led by Cipla and closely followed by Torrent, Mankind and Dr.Reddy’s, will be a tailwind for the company.

On a secondary level, the company may look for assets in the US that fit the respiratory nature of its operations or allied segments. The internal pipeline has several inhalation devices under development and may need plant clearance to realize the assets. The internal pipeline, partnered in some cases, should drive US market growth, given plant clearance.

Cipla the asset should rally its stock value in the short term while in the midst of a hot pursuit. The names of Torrent Pharma, Blackstone, Dr.Reddy’s and Bain Capital are making the rounds as a potential suitor to promoter stake (33 per cent). Only a controlling stake would allow operational synergies to be explored, which would need additional purchase from follow-on open offer, which is another short-term trigger for the stock. The additional leverage from acquisition on the eventual consolidated entity might cap the expansion plans of Cipla + “unknown”. But this remains speculative at the current stage.

Torrent Pharma is likely to continue with a predominant focus on India. Even with Dahej closing FDA issues (Indrad facility still under observations), Torrent Pharma may be doubling down on Indian markets and more specifically in complementing its top-tier therapies. Historically as well, Torrent Pharma has had a strong and successfull acquisition/integration history aimed at India. The premium multiple (31 times FY24 EPS adjusted for amortisation expenses) can sustain above average on branded business and India focus.

The net-debt to EBITDA has improved to 1.3 times as of June 2023 with further improvement expected. But the Cipla stake could imply ₹35,000 crore cash outgo (Torrent m.cap is ₹65,000 crore), not to mention the open offer. Also, core strength of synergistic integration capabilities will be stretched to the limit for Torrent. But the real synergy is from cross-selling brands, sales force optimisation in India and access to respiratory pipeline in the US.

Similar to Cipla, Dr.Reddy’s may prioritise investments in India and emerging markets via product in-licensing or acquisitions in these markets, with secondary priority to US markets. Dr.Reddy’s made a strong start to its India portfolio with the acquisition of Wockhardt’s brands in 2020 for ₹1,850 crore but has not announced domestic deals of that size since. In fact, the company has acquired Mayne portfolio of US generics for $100 million in 2023 and has constantly divested tail-end brands in India at the same time.

The company, with close to ₹5,000 crore of net cash, has been disciplined in its approach to capital allocation (has shed cash-guzzling proprietary development portfolio). Dr.Reddy’s valuation at 20 times FY24 earnings lacks the edge of branded-heavy business in India. The Cipla deal, a merger of equals with good domestic presence, can fix that if the company is able to execute and integrate.

Wishing for status quo

With debt weighing on resources, Glenmark Pharma, Aurobindo and Lupin may have to balance debt repayment and capital allocation with near-term improvement expected only in Lupin and Aurobindo.

Glenmark and Dr.Reddy’s have divested Indian assets/brands either for portfolio rebalancing or to access quick cash which, in turn, favoured Mankind Pharma and Eris Lifesciences.

Glenmark’s R&D investment into Ichnos Sciences, its innovation platform, is a bulky build-up of assets ($70-80 million per year over five to six years), but with highly lagging returns on investment. The company needs to monetise these assets or cut spending to improve margins in consolidated business. The four clinical trial read-outs expected in FY24-25 should be a key monitorable. Glenmark has to sell 7-8 per cent from Glenmark Lifesciences (going by promoter holding obligations) which, coupled with brand divestments in India and internal accruals, should reduce the significant net debt of ₹3,000 crore. Penalty of ₹700 crore to be paid in next two years (anti-trust settlement in the US) may limit the capex plans of Glenmark in the medium term.

The stock, trading at 21 times FY24 EPS, has re-rated in the current rally from an average 10-12 times 1-year forward earnings, pre-empting such changes and a turnaround in capital allocation.

Lupin has cleared three of its five plants from US FDA observations and so has Aurobindo Pharma, which will provide a large impetus to both the companies in new product launches. The net debt has also come off to ₹1,300 crore in Q1FY24 (₹2,500 crore in Q4FY23) for Lupin, which should strengthen the balance sheet as well. The company has planned to ‘restructure’ its API unit but given the positive turnaround in API industry, and Lupin as well, it may equally be likely the company may not go ahead with the plan.

The company was in a major cost restructuring effort to improve its EBITDA margins, which should end in FY24 and add 100-200 bps to margins as well. Lupin’s top shelf launch is under way with Spiriva and will add significant cash in the next one year as the lucrative product is without competition in the short term.

Lupin’s allocation objective may take shape as it rebounds, operationally and financially. Lupin now has a strong respiratory portfolio in the US and may look to add other assets to bulk up the US portfolio. Lupin spent ₹1,000 crore on acquisitions in FY23 itself, including two respiratory brands in the US. The company has announced curtailing spends on NCE development and its internal pipeline may take precedence, which includes generics: three nasal sprays in inhalation, four injectables, two complex products and two biosimilars. Spending in India may be necessary, given the heavy investment by competitors, and if not executed may have a bearing on its valuation already trading at 36 times FY24 EPS.

Aurobindo Pharma may be putting its injectable asset Eugia Pharma in value unlocking mode for the second time in two years, at a valuation of $2-2.5 billion, which is more than half of Aurobindo’s valuation. The speciality pharma and injectables unit ($122 million in Q1FY24) has only recently shown strong growth as injectables were impacted post-Covid. The company’s flagship oral solid business has been growing at a strong pace and the company may invest in smaller ANDA (new generics filing) acquisition, rather than internal development, to save on development timelines.

Aurobindo Pharma may be nearing its end of investment phase in Penicillin-G facility through PLI scheme where close to $160 million has been invested. Aurobindo also has a significant investment behind biosimilars for international market totalling $280 million so far. Dr.Reddy’s and Aurobindo plan to be in the next wave of biosimilar launches by 2027-28 while Sun Pharma is still tentative about its biosimilar initiative. Aurobindo, valued at 18 times FY24 EPS, lags peers on account of lack of branded business (India). The vaccine, peptide and complex portfolio under development, while strong, are still generics with a limited shelf life and hence can bump up earnings but not valuation outlook.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.