No force on earth can stop an idea whose time has come – Victor Hugo.

This time, with the massive success in the launch and adoption of one famous Generative Pre-Trained Transformer or what is commonly known as ChatGPT, it does appear the idea of AI has arrived well and firm.

Every decade or so has witnessed a technological revolution that has, in many ways, upended the way the world functions. In the 1990s it was the PC and mobile telecom revolution, which made possible the internet, e-commerce and smartphone revolution in 2000s decade. This paved the way for the cloud computing, and social media revolution of the last decade. These transformations of the past have now landed us at the cusp of the AI revolution.

Each of these mega trends has accelerated the corporate life cycle, making it possible for start-ups to mushroom and grow fast, and in many a case resulting in the Davids outwitting the Goliaths. The largest tech companies dominating the landscape in 1990 were those like IBM, Xerox and Hewlett Packard. These hardware and software companies made way for the software, internet router, mobile phones and semiconductor companies like Microsoft, Cisco, Nokia and Intel in 2000. While Microsoft has managed to remain deeply relevant since, the internet and smartphone revolution catapulted companies like Alphabet and Apple to top of the tech landscape in 2010.

In the 2020s Amazon, Meta Platforms and Nvidia and Tesla (considered Tech by many, given large share of its market cap is based on prospects for its autonomous driving technology) share the top ranks along with Microsoft, Alphabet and Apple. The interesting thing is that four out of these seven companies did not exist or were minnows 25 years back. As they got catapulted, those perched earlier on the top like IBM, Hewlett Packard, Xerox etc are mere shadows of their former selves today, And this is just the amongst the big techs, not to mention the numerous other tech companies that have sprung up and displaced players across the large and mid-cap space as these mega trends played out.

With AI wave too likely to displace some and catapult some, it’s time for investors in India to consider two important things — one, how can they tap the opportunity that AI offers and two, what disruptions can this mega trend cause in the way the world functions and how can it impact current stocks in your portfolio?

But first, where are we in the AI revolution?

Innovation adoption curve

AI is not entirely new. John McCarthy, computer scientist who gave us the term Artificial Intelligence in 1955, defined it as ‘the science and engineering of making intelligent machines, especially intelligent computer programs’. In different forms, AI has existed for decades since computers were created. It got some steam in the last few decades as it gained traction and use cases across industries in the fields of automation, robotics, analytics, consumer devices, even stock trading. So why exactly the buzz this time?

It’s because of the arrival of ‘Generative AI’. The launch and adoption of ChatGPT has been quickly followed by Bard, Stable Diffusion, DALL-E, etc. With these, the field has taken a quantum leap with potential for widespread ramifications and scope for upending systems. Generative AI is different from any in the past due to its unique ability to create new content such as text, images, videos and graphics. It can write codes for developing applications and test software programs. The use cases are vast and transformative.

The productivity gains from effectively implementing it is massive. For example, a recent Mckinsey report notes that generative AI can add value in the range of $2.6 to 4.4 trillion in annual economic benefits to global economy from new use cases of generative AI. A further 3.5 trillion is possible from enhanced worker productivity across the board. A perspective on the size of the impact it can have can be gauged from the fact that current global GDP is around $100 trillion.

These are just estimates that can change either way by wide margins, but gives an idea of scope and potential. Further we are in very early days and it will take many years to get it right.

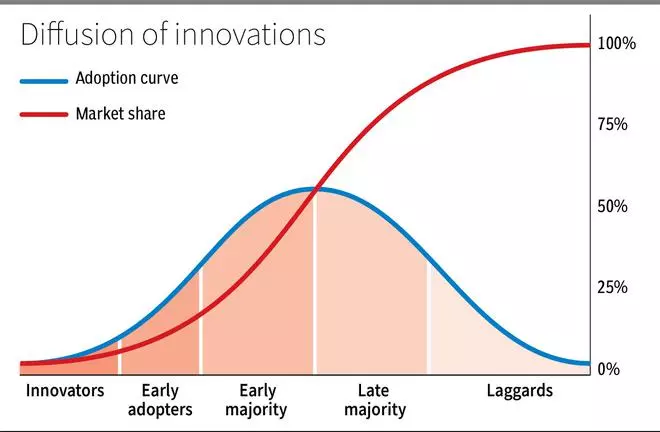

In business and management theory, there is a concept known as ‘Diffusions of Innovation’ popularised by sociologist Everett Rogers. This theory, which has been well accepted and widely referred to, explains how acceptance of new innovations follows an S pattern in five stages over a length of time. In the first stage is the innovation itself, followed by early adopters who, in turn, are followed by the early majority. They are followed by late majority and then the laggards, completing full adoption of the innovation This pattern has largely played out whether it is television or PCs or mobiles or internet. Big money starts flowing in for the innovators when scale reaches early majority levels. This pattern has played out whether it was Microsoft in the 1990s, Alphabet in 2000s or Meta Platforms in 2010s

We could say generative AI is at the innovation or early adopters stage now and few years away from early majority stage. But the important thing to note is that the innovation adoption curve is getting shorter. Consider this, for example: it took around 4 decades for radio to get to 50 million users, Television between 1 and 2 decades, Internet less than a decade, and ChatGPT – less than 2 months! Thus each innovation at a broader and subset level has witnessed more accelerated adoption than in the past. Given this we must be ready for generative AI adoption to be much faster than other tech innovations of the past.

How it can impact

Generative AI can impact the way the world functions in two ways as explained by Jensen Huang – the founder and CEO of Nvidia. One is when AI meets the digital world and other is when AI meets the physical world.

AI in the digital world can change the way we code, write, solve significantly complex and analytical problems, create content, invest etc. Consider this for example, amongst many reasons one that triggered Hollywood actors to go on strike last week which has more or less shut down the industry, was on concerns over how AI could replace actors. The point of concern – studios want to scan actors and use their ‘digital likeness’ for perpetuity. Actors worry studios can use generative AI and displace them!

AI in the physical world can change the way we manufacture, travel, transport, deliver healthcare and other services, etc. For now, though, it appears that the innovations relating to AI in the digital world will be taking the lead.

Winners, losers and investment opportunities

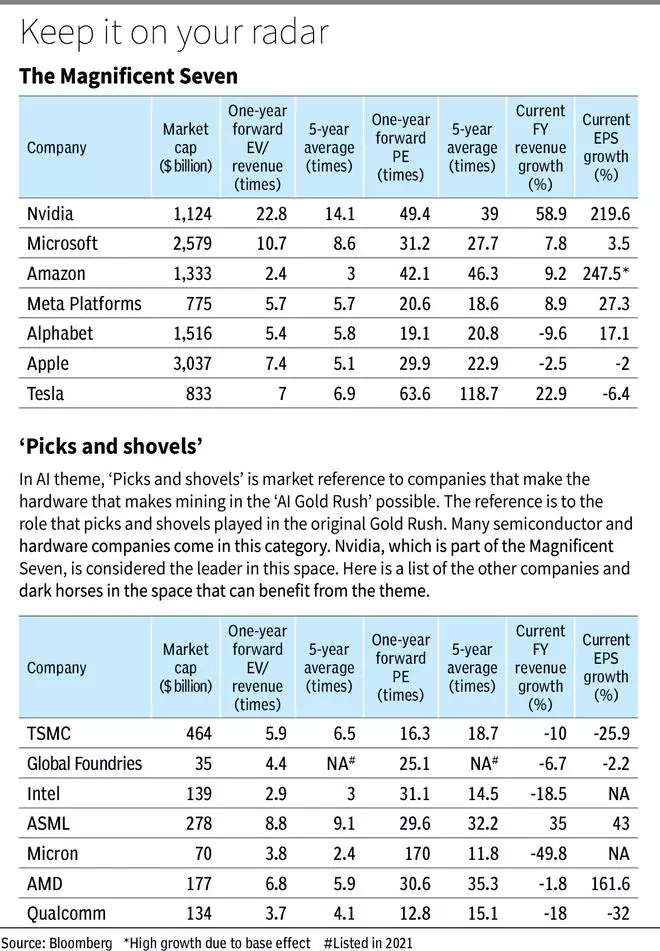

At present, the winners are companies at the epi-centre of the AI revolution – the companies which have been popularly termed as the Magnificent Seven – Nvidia, Microsoft, Alphabet, Amazon, Meta Platforms, Apple and Tesla. Companies that in one way or the other have been involved in development of generative AI for internal use or for external services. At the core of the current AI boom has been the GPU chips designed by Nvidia that has catapulted it to the trillion dollar companies league. A decade back its market cap was less than $10 billion. Its GPU chips that power AI computing by processing complex computing tasks by splitting it into smaller sub tasks each processed at GPU level has made generative AI possible. This solved they key missing link for generative AI that a centralized CPU processor could not solve. At present Nvidia literally has no competitor in this space although across the board whether it is Apple, Meta or Amazon, or semiconductor companies like AMD and Intel are trying to design competitive chips.

According to Nvidia, coming to this stage in chip development was a 10 year process starting with re-orienting its approach to chip design a decade back. Thus it may not be possible for competitors to upend Nvidia in this space anytime soon.

Beyond Nvidia, the cloud companies in the Magnificent Seven – Microsoft via Azure and Amazon via AWS are the immediate beneficiaries of AI wave. AI computing costs are prohibitive for now. It is affordable only via cloud computing platforms. Commercial users of generative AI have to directly or indirectly pay the cloud service providers. For example ChatGPT powered by OpenAI which uses Microsoft’s Azure, which will benefit as commercial adoption increases. Similarly Amazon has an generative AI offering called Bedrock running on AWS which clients can use to develop their own chatbots and generate images. Similarly for obvious reasons, Alphabet’s generative AI offerings will run on its own cloud services boosting that segment. Beyond these, the other companies in the Magnificent Seven whose shares have also rallied on the AI wave reflect market expectations of how they will monetise it. For example, markets expect Tesla to use generative AI to scale up its autonomous driving offerings and development of its Optimus robotic humanoid.

Given different stages of development of different projects, it is safe to assume that the near term beneficiaries of generative AI are the chip and cloud companies. The rest will take some more time to benefit at a significant scale.

Beyond these the winners will be companies that adapt and use AI to their advantage. These could be companies across industries that identify ways to use AI in their marketing campaigns, customer service and also in their internal functions to reduce costs. It is well-known that one of the factors that catapulted Bajaj Finance was better use of digital analytics to identify the right customers and underwrite better than peers. Similar things can play out as few companies use generative AI better than peers.

Indian IT services companies can speed up their deliveries and reduce costs by using AI to write codes. But this can also be a double-edged sword for existing players as AI makes start-ups and individuals better equipped to compete against companies. Microsoft has launched GitHub Copilot in its cloud-based platform for building software. This can further democratise coding by individuals. Further, clients too could find it cheaper to internalise some of the projects and functions they had outsourced in the past.

To summarise, the AI value chain starts with the software companies, moving on to semiconductor and cloud companies, and finally the user industries, each reinforcing the other. Each of these segments in the value chain can drive businesses for allied segments.

For example, the demand for Nvidia’s GPUs has given boost to the only foundry that can efficiently manufacture it – Taiwan Semiconductor Manufacturing Company (TSMC). The race to manufacture more AI chips by TSMC and its peers has given a boost to the fortunes of Dutch company ASML – the only provider of extreme ultraviolet lithography machines, essential for manufacturing these chips.

Thus, investors interested in benefiting from opportunities in this space must capitalise on opportunities across the value chain. The accompanying table has list of companies that investors interested in this space can keep in their radar to invest at appropriate times. For now these are not recommendations as valuations are out of comfort zone for many and success in the AI space is a matter of probability and not certainty (see box). Out of these companies bl.portfolio had in the past given an accumulate recommendation on Intel (April 2022) and Global Foundries (July 2023), and buy on Meta Platforms (November 2022) and Qualcomm (April 2023).

Dotcom lessons for enthusiasts and sceptics

Investors and sceptics alike need to pay close attention to lessons from the dotcom boom.

‘By 2005 or so, it will become clear that the Internet’s impact on economy has been no greater than the fax machine’s.’ That was economist Paul Krugman in 1998. He later on even won the Nobel prize for his work in the field of economics. A person of such high calibre was so wrong in predicting the impact of the internet. The sceptics need to keep this in mind. Technological innovations are getting more exponential with each new development as we explained earlier. Thus AI could impact you faster than you factor if you are not open to it. Sure, it will have its ups and downs in the process. To begin with, regulation can create speed bumps. Ethical considerations and concerns on whether it can cause harm to humanity if it progresses too fast for comfort too can slow down its process. But despite these, it might be hard to stem its growth.

For the enthusiasts, the dotcom bubble offers even more lessons. For one, and also probably the most important, valuation matters. You could have bought Cisco in 2000 when it was the poster boy of the dotcom boom and made negative returns in last two decades. One could say Cisco was the equivalent of Nvidia in the dotcom era – its routers were core to development of the internet. Investors were happy to buy it at 30 times EV/sales in 2000. But soon the craze faded, the dotcom bubble burst. But more importantly the routers that Cisco made got commoditised as competitors caught up, impacting its growth and profitability. Similarly you could have bought Amazon in 2000 and made no returns for 10 years, before it went to generate 3000 per cent returns in the next decade. The reason for no returns in the first decade —valuation was irrational during the dotcom boom. So investors must hold their nerve and be patient to buy only at appropriate levels.

Two, while the adoption curve can be fast in the case of AI it may not happen within any individual or groups’ expected time frame. In January 2000, the media giant Time Warner and internet giant then AOL merged in a $350-billion deal. They saw numerous synergies including purported significant benefits in streaming prime Time Warner entertainment content to consumers’ PCs in their homes via the Internet.

But what happened a couple of years later was that Time Warner booked a $100-billion loss (the largest corporate loss of all times till it was overtaken by banking sector losses in 2008) by writing off the value of AOL. The thing here is that the it was not that the idea was bad. But it was way ahead of its time. Netflix successfully executed the same idea a decade later which catapulted it to become one of the largest global stocks in value. So in your investments, you must plan for delays in the theme playing out.

Three, as the AI boom plays out it may not be possible to clearly separate the wheat from the chaff. Some genuinely might fail, while others could just be riding the bandwagon. Many email and search companies flourished for years, including Hotmail and Yahoo. But only Google managed to create substantial value. Given this, it is important for investors to place their bets on a cluster of AI companies and not just one or two.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.