After four years of near normal monsoon rainfall, India is possibly bracing itself against a deficient monsoon this year. This is thanks to El Nino, which is caused by unusual warming of the ocean water along central and east central equatorial Pacific region. In the past, El Nino has had significant impact on the rainfall and weather pattern across countries. It typically recurs within 2-7 years, and lasts for 9-24 months, depending on the intensity of the phenomenon. For instance, the last El Nino condition began in 2014 and lasted till 2016.

India being a rain-fed country, thesouth-west monsoon — which is the predominant monsoon season contributing nearly 85 per cent of the country’s rainfall — is very critical for the country’s agriculture.

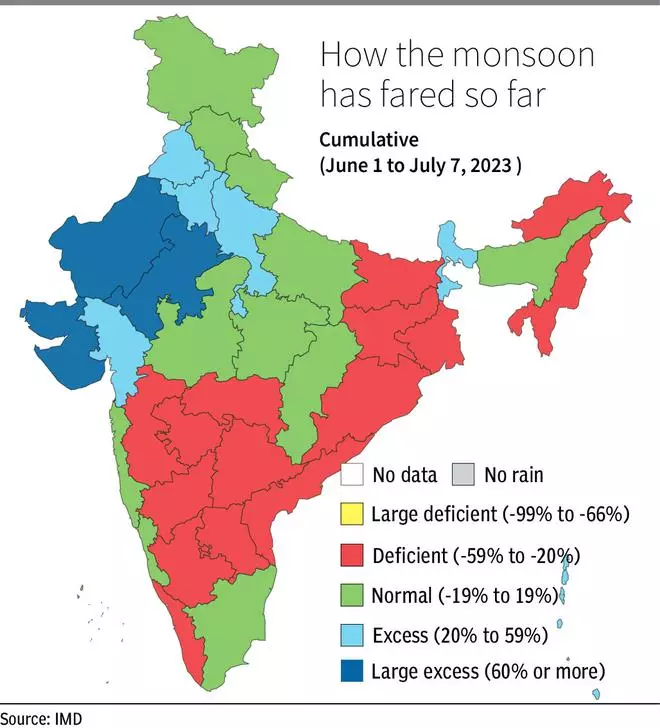

This year, while the monsoon has progressed over the last two weeks and has now covered almost the entire country, erratic distribution, coupled with progression of El Nino and a likely unfavourable Indian Ocean dipole, can disrupt the monsoon rainfall pattern over the next two months. India ocean dipole (IOD) is the difference in temperature between two poles in the western indian ocean and the eastern indian ocean. When the temperature in the western pole is higher than the eastern pole, it is called a positive IOD, which results in more rainfall in India. THe converse referred to as negative IOD typically is bad for monsoon rainfall in India.

How big a concern is this for agri and related sectors? How has India Inc fared in earlier years when faced with a similar situation? Here are some takeaways.

Impact on food grain production

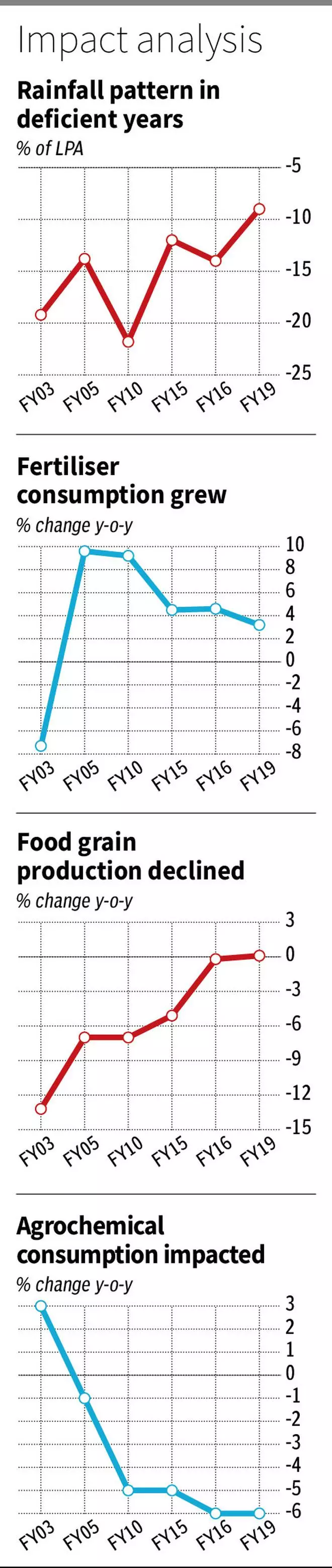

Looking at the historical data, one can conclude that deficient rainfall always does not mean lower foodgrain production. In the last 22 years, India has had surplus rainfall only during eight monsoon seasons, while the country has received rainfall lower than the long period average (LPA) in the remaining 14 years. However, the rainfall deficiency was over 10 per cent of the LPA only in five years, namely 2002, 2004, 2009, 2014 and 2015. Interestingly, foodgrain production saw a meaningful decline only in these years when the rainfall was deficient by 10 per cent or more, as compared to the LPA (see chart).

In years when the rainfall deficiency was under 10 per cent, such as in 2012 and 2018 — 8 per cent and 9 per cent below LPA — foodgrain production was only marginally lower (-0.8 per cent in 2012-13) or flat (0.1 per cent growth in 2018-19).

Howvever, history may or may not repeat itself as there are also other factors pertinent for agricultural output. For instance, it is important for the distribution of rainfall to be even for agriculture to thrive. For instance, while the rainfall over the past week has been fairly good in western parts of the country, with some regions receiving excessive rains, key rice-growing State Bihar is yet to receive adequate rainfall. Hence, the progression, coverage and distribution of the rainfall over the next few weeks and sowing progress in these areas will have to be monitored closely.

Another critical aspect is the timing of the rainfall. Excessive rainfall during flowering or harvest season may be detrimental to the crop. Hence, quantity and timing of the rains is very important for agriculture.

Fertilisers resilient

Analysis of historical fertiliser consumption data in India reveals that the consumption has not been impacted much even in years of deficient monsoon. Rather, during three of the four deficient monsoon years, fertiliser consumption has actually managed to grow over the previous year.. Except for year 2002, when consumption of fertiliser per hectare declined 7.3 per cent year-on-year, the figure grew during 2004 (9.6 per cent), 2009 (9.2 per cent) and 2015 (4.6 per cent). The rainfall was 19.2 per cent, 21.8 per cent and 14 per cent below LPA during these years.

The low sensitivity of fertiliser consumption to monsoon rainfall can be on two counts. First, fertiliser purchases happen ahead of the start of the season and the application of fertilisers continues irrespective of the rainfall trend. Even if the rainfall is delayed or is deficient during the season, farmers need to make up for the productivity loss. Hence there may not be material impact on that year’s sales. Second, availability of government subsidy on fertilisers has also helped keep the demand steady, as farmers pay only a portion of the total cost.

However, even within the fertiliser industry, the subsidy component and the structure for urea is different from that of phosphatic fertilisers. While urea continues to remain under government control —(pricing, distribution and sales,), complex fertilisers - NPK grades have been partially decontrolled. Urea has the highest subsidy proportion, with 3-4 times of the retail price of ₹5,360 a tonne being paid by the government to producers as subsidy. This insulates farmers against volatility in raw material prices. This has also made urea demand immune to the vagaries of the monsoon.

Hence, if we look at the performance of urea players, their sales have not been impacted by weak monsoon. Chambal Fertilisers, a leading private player in the urea segment with a capacity of 3.4 million tonnes, saw the operating profit of its manufactured fertiliser segment grow by 10 per cent year-on-year in FY10. This is thanks to the strong demand for the product and efficient operation of the plant, given that the industry is energy-intensive.

Likewise, in FY15 also, which was a weak monsoon year, Chambal Fertilisers reported a 14 per cent growth year-on-year. Though its own manufactured segment’s profit declined in FY14, this was due to higher energy costs as gas availability was a challenge and the company had to use expensive RLNG to produce ammonia.

Phosphatic fertiliser sales have had some impact, post the partial decontrol of the industry in 2010. Under this, the government decided to keep the subsidy fixed and allow companies to fix selling price as the difference between fully loaded cost and subsidy. Despite this, companies with superior cost structure and a strong product portfolio have managed to grow profits even in deficient rainfall years. Coromandel International, for instance, grew its revenue two out of five times, when the country experienced deficient rainfall in FY05 and FY15.

In FY10, when the company reported a decline in profits by over 10 per cent, the reason for the weakness was lower subsidies due to drastic fall in input prices and consequential inventory write-down. Even when monsoon rains were deficient by over 21 per cent, fertiliser sales volumes grew by an impressive 34 per cent year-on-year. Thus, more than monsoon, raw material costs, given that several raw materials, including gas and phosphoric acid, are imported, exchange rates and quantum of subsidy are the key determinants of performance of the fertiliser industry. Also, for Coromandel, a differentiated product portfolio with NPK grades such as 20:20:0:13, bio fertilisers and micronutrients, besides agrochemicals, has helped sustain profitability even during weak monsoon years.

Strong correlation for agrochem

While monsoon has largely been a non-event for fertilisers, agrochemicals sales’ correlation to monsoon seems strong. Historical data suggests that agrochemical sales are more vulnerable to deficiency in rainfall and the resultant fall in farm incomes. Unlike in the case of fertiliser, where significant quantity is purchased ahead of the season, for agrochemicals, only the preventive sprays are procured at the start of the season.

Typically, sales are strong for agrochemical manufacturers when there are incidents of new pest attacks or significant rise in pest (existing) incidence. Which is why we see that agrochemical usage/consumption was lower in four out of five weak monsoon years. Consider Insecticides India, a small sized company. In FY16, the company’s revenue was flat, while operating profit declined 18 per cent, on account of below-normal rainfall.

However, for PI Industries, which has a globally diversified business with significant contribution coming from export sales, the impact of weak monsoon was limited. The company grew revenue and profits over the FY15-16 period, even as India witnessed two consequent years of deficient monsoon. That said, similar to fertilisers, monsoon is not the singular determinant of the prospects of the industry. Several other factors, such as raw material prices — most of which are crude linked — currency movement for export sales, imports of raw materials and pest incidence, a impact the performance of agrochemical manufacturers.

Farm equipment

Farm equipment is another segment whose prospects are directly linked to rainfall. Tractors, tillers and other equipment such as rice transplanter are key farm equipment. For companies in this space, the impact of weak monsoon may come with a lag, as farmers typically decide on purchase of farm equipment only when their incomes are healthy. Subsequent years of weak monsoon reduce their purchasing power and, hence the demand for farm equipment.

But it is not just about monsoon. Farmers are dependent on government support by way of subsidy for farm equipment purchase. Delay in payment of subsidy or discontinuation of such funding schemes can hit the profitability and performance of farm equipment makers. TakeVST Tillers Tractors. The company, which reported a 11 per cent and 19 per cent drop in revenue and profit in FY15 due to weak monsoon, saw its profits halve in FY19 on account of receivable issues from government and lack of subsidy support/allocation from governments.

Beyond the agri inputs and agri equipment, the impact of monsoon is overarching. If monsoon rains continue to remain insufficient over the next two months, this can risk the country’s macroeconomic stability. Inflation, particularly of food items, has a direct relationship with monsoon. One cannot underestimate the importance of monsoon as it has consequences on interest rates, consumption and economic growth. Hence, it is important to watch the progress of the south-west monsoon over the next two months.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.