Bajaj Finserv Asset Management has launched its first equity scheme – Bajaj Finserv Flexi Cap Fund. This will be an open-ended equity scheme investing across large-cap, mid-cap, and small-cap stocks. The new fund offer period for the scheme closes August 7, 2023.

Should you invest? Here is our take.

Flexicap funds

Given that markets are at new highs, a blended approach may be better to avoid mishaps with your portfolio. In this regard, flexi-cap funds may be better, given their non-rigid mandate which allows them to invest across market capitalisations. In short, flexicap funds are a good investment avenue for the long term for those with an average risk appetite.

Also read: Bajaj Finserv Money Market Fund NFO: Should you invest?

Many funds in the erstwhile multi-cap segment opted to move to the flexi-cap segment since it is a convenient space for most fund houses.

Bajaj Finserv Flexi Cap strategy

The new Bajaj Finserv Flexi Cap aims to identify the megatrends and invest in opportunities across large-cap, mid-cap, and small-cap stocks. The scheme aims to be multi-thematic, multi-cap, multi-sector, and growth-oriented in approach. Its investing approach will combine both top-down and bottom-up analysis.

The Bajaj Finserv AMC investment philosophy is based on InQuBe – an in-house framework that combines tools and processes from all the sources of alpha - Informational, Quantitative, Behavioural edges.

The fund’s megatrends filter will act as a top-down layer, while bottom-up analysis helps in identifying businesses that are suited to benefit from those trends. The fund will focus on targeting future profit pool industries and aims to have a relatively low turnover ratio.

Also read: Mirae Asset Multicap Fund NFO: Should you invest?

The scheme, which targets a 40-60 stock portfolio, will strive to have a potentially high active share component. The scheme is being managed by Chief Investment Officer Nimesh Chandan, Senior Fund Manager Sorbh Gupta (equity portion) and Siddharth Chaudhary (debt portion). The fund will be benchmarked against S&P BSE 500 TRI.

Considering the inherent characteristics of the scheme, equity positions would have to built up gradually and also sold off gradually. This would necessarily entail having a large cash position before the portfolio is fully invested and during periods when equity positions are being sold off to book profits/losses or to meet redemption needs.

Fund management team

Though Bajaj Finserv AMC is a greenhorn, its fund management team is not new. CIO Nimesh has over 22 years of experience. Prior to joining Bajaj Finserv, he worked with Canara Robeco Asset Management as Head Investments, Equities (Domestic and Offshore).

Sorbh has over 15 years of experience. Prior to joining Bajaj Finserv, he was associated with Quantum AMC.

Our take

We prefer established flexi-cap funds with a good track record such as Parag Parikh Flexi Cap, PGIM India Flexi Cap, Canara Robeco Flexi Cap, HDFC Flexi Cap etc.

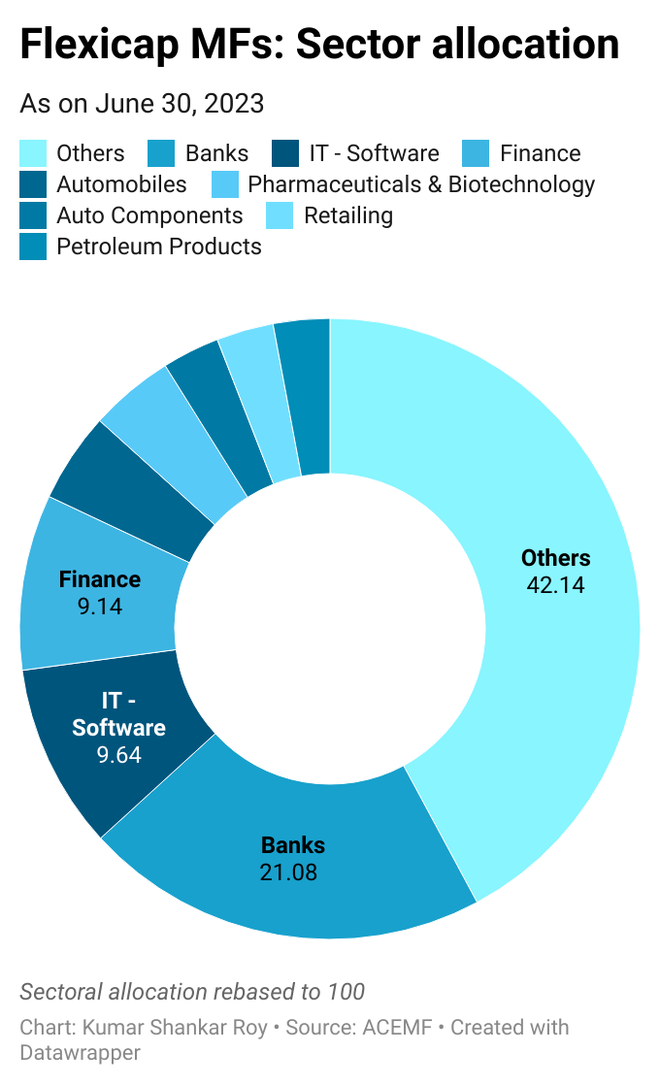

Most flexi cap funds have a large-cap bias and usually have 50 per cent or more invested in such stocks. This is one area where Bajaj Finserv Flexi Cap can be different, given its focus on future profit pools.

Also read: UTI Balanced Advantage NFO: Should you invest?

If you believe that newbie Bajaj Finserv Flexi Cap can outperform its benchmark and consistently remain in the top quartile of flexicap fund category, you can consider investing in the NFO. In the meantime, you can adopt a wait-and-watch approach to see if the fund walks the talk.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.