Parag Parikh Mutual Fund is introducing a new member to the 27-fund arbitrage category, the ‘Parag Parikh Arbitrage Fund.’ The New Fund Offer (NFO) period closes on October 27, with the fund reopening for continuous subscription (at prevailing NAV) starting November 3. This marks the fifth addition to the Parag Parikh family of funds, which includes the well-regarded Parag Parikh Flexi Cap Fund. But should you consider investing in arbitrage funds? And how do they compare to liquid mutual funds? Here’s what you need to know.

Parag Parikh Arbitrage strategy

Arbitrage, in investment terms, involves simultaneously buying and selling securities, currencies, or commodities in different markets to profit from price differences for the same asset.

The Parag Parikh Arbitrage Fund aims to execute such arbitrage opportunities between the cash/spot market and the ‘futures’ market, a strategy known as ‘cash-futures’ arbitrage.

Arbitrage funds are designed for investors seeking income through arbitrage opportunities, primarily in the cash and derivatives segments of the equity market. Like other arbitrage funds, Parag Parikh Arbitrage primarily targets risk-averse investors looking for relatively ‘low-risk’ returns unaffected by market cycles. It’s essential to note that this fund does not guarantee a fixed monthly income.

Under current regulations, capital gains from arbitrage funds are taxed on par with equity-oriented mutual funds, providing an advantageous tax position compared to liquid or overnight debt mutual funds. Long-term gains, realized after a holding period of 12 months, are taxed at 10 percent beyond Rs 1 lakh, while short-term gains are taxed at 15 percent. In contrast, gains from debt funds are added to your income and taxed at the applicable slab rate, regardless of the holding period.

In its typical allocation, Parag Parikh Arbitrage will invest between 65-100 percent in equities and equity derivatives (hedged exposure) and the remaining 0-35 percent in debt securities and money market instruments.

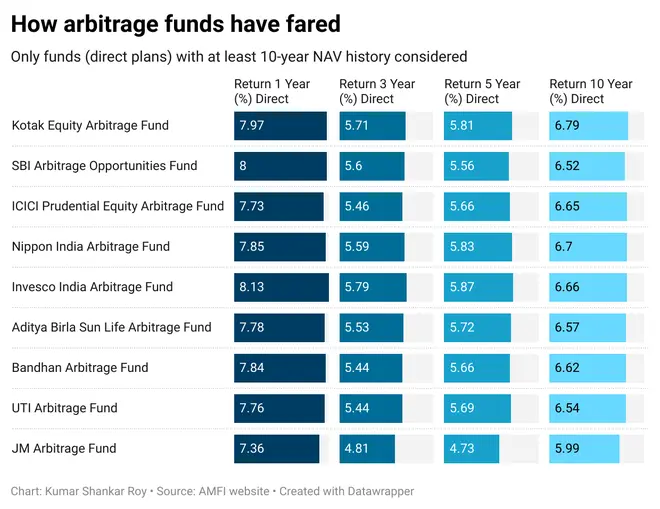

Major arbitrage funds like Kotak Equity Arbitrage, SBI Arbitrage Opportunities, ICICI Prudential Equity Arbitrage, Nippon India Arbitrage, and Invesco India Arbitrage have been consistent performers in this category. Take a look below at the returns offered by various arbitrage funds over different time periods to assess their historical performance.

What to watch out for

Around five years ago, arbitrage funds were reclassified as hybrid funds. Like the new PPFAS Arbitrage Fund, all schemes in this category can allocate up to 35 percent of their portfolio to debt securities. This means a portion of the portfolio will be exposed to interest rate and credit risks due to the presence of debt.

Arbitrage funds are often marketed as more tax-efficient alternatives to liquid funds, making them appealing to individuals in higher tax brackets. They typically deliver better returns than liquid funds. However, it’s important to note that when arbitrage opportunities in the market become scarce, returns may be lower.

Furthermore, arbitrage opportunities are not entirely risk-free, and if a particular opportunity fails to generate profits, the fund’s unitholders will bear the consequences. As a result, arbitrage funds can occasionally yield negative returns, although the likelihood of this is relatively low.

Our take

The use cases for arbitrage funds in a retail investor’s portfolio are somewhat limited. They can provide stability in a portfolio during periods of market volatility and offer a degree of diversification due to their typically low correlation with traditional equity and fixed-income assets. Investors may also use arbitrage funds for short-term cash management, such as temporarily parking funds while seeking better returns than a standard savings account.

While the returns from arbitrage funds are moderate and align more with those of debt schemes, they do stand out in terms of taxation.

If you’re considering investing in the Parag Parikh Arbitrage Fund, it might be prudent to wait for a track record of 3-6 months to assess its ability to identify and execute arbitrage opportunities and manage the debt portion of the portfolio. PPFAS Mutual Fund has maintained a conservative approach with its liquid and conservative hybrid funds, so the arbitrage fund is likely to prioritize safety when it comes to credit exposure.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.